UK CS: Offshore numbers tighten [NGW Magazine]

Producers took out 600mn barrels of oil equivalent from the UK Continental Shelf in 2017, but booked less than that in reserves gains, with a disappointing amount found with the drill-bit.

This year, with the greater number of final investment decisions taken, the result could be different. And there are still some big fields, such as Rosebank, waiting for FID which would add to the total.

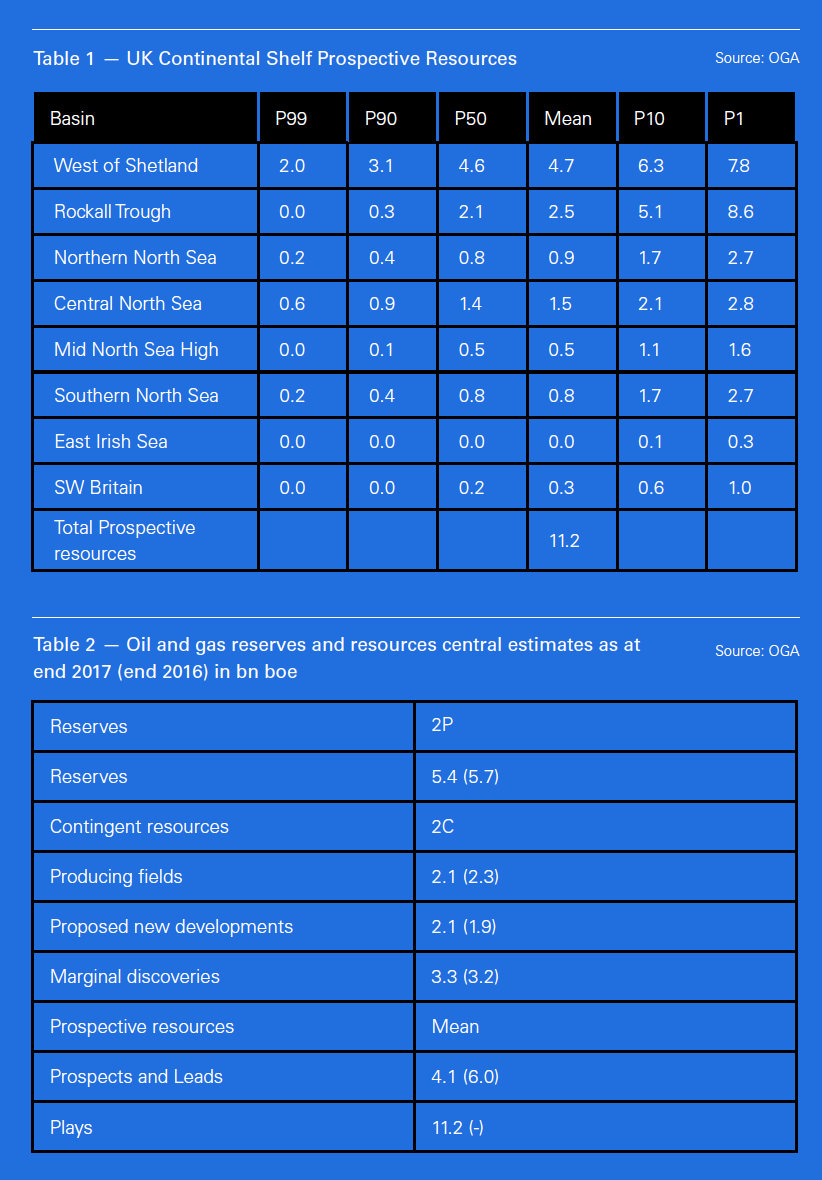

The Oil and Gas Authority’s 'UK Oil and Gas: Reserves and Resources Report' shows that overall remaining recoverable reserves and resources on the UK Continental Shelf (UKCS) are at least 10bn barrels of oil equivalent (boe) and could exceed 20bn boe. Of those, proven and probable (2P) reserves ended 2017 at 5.4bn boe.

Last year 2P reserves grew by 400mn boe but about 600mn boe were produced, giving a reserve replacement ratio of 69%, and so unsustainable in the long term. Only 100mn boe were matured from new field developments, while 80mn boe were the result of infield activities and about 220mn boe were field life extensions. OGA is worried by the low figure from “reserves maturation” – firming up an asset from remote possibility to drill-ready prospect.

It points out that it has changed the methodology from past years, so the numbers are more consistent with the rigorous reporting standards companies must observe.

The OGA’s key function is to ensure the maximum economic recovery of the UK’s oil and gas resources through a mix of carrots and sticks; the carrots including championing the offshore in its dealings with the finance ministry; and sticks including forcing companies to sell assets they have not got round to developing and to charge economic rates for third party access to infrastructure.

Other factors beyond OGA’s control but which nevertheless have the potential to extend the UKCS useful life include today’s lower operating expenses and higher oil prices; efficiency gains in production; incremental projects at producing fields; undeveloped discoveries being unlocked by technology; innovative commercial and supply chain arrangements; and a robust prospect and lead inventory.

The UKCS contingent resource level is significant with a central estimate (2C) of discovered undeveloped resources of 7.5bn boe, mainly in mature developed areas and under consideration for development. Of that total, 2.1bn boe are expected to be added through new field developments coming forward; 2.1bn boe from incremental projects in producing fields and 3.2bn boe from discoveries with no proposals yet for their development.

UKCS petroleum reserves and discovered resources are 70% oil and 30% gas, when expressed in oil equivalent terms. However the ratio is to change: working with the British Geological Survey it estimates that 11.2bn boe reside outside mapped leads and prospects and the proportion of gas there is estimated to be greater than 60%. The methodology and approach has been audited by Rose & Associates.

It says that the split of oil and gas in the total production during 2017 was 370mn boe oil and 230mn boe gas.

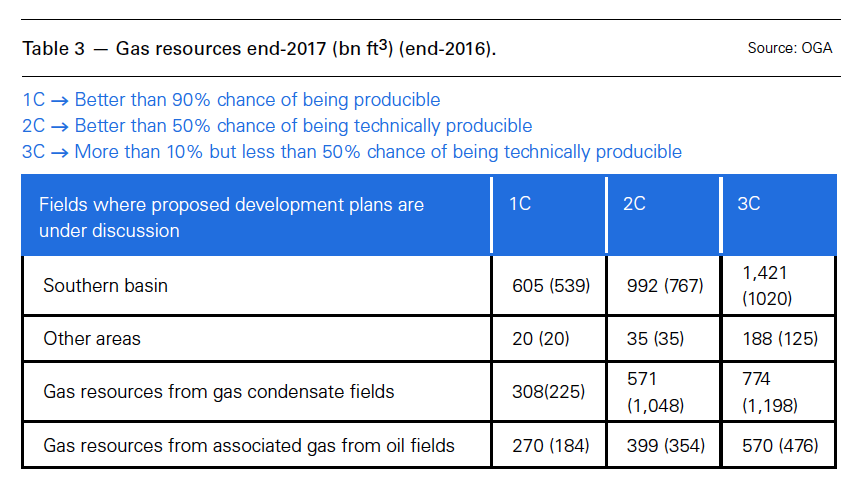

The largest contribution to future gas production is expected to come from gas condensate fields, rather than dry gas fields whose output may be varied to match seasonal demand. About three quarters of the condensate gas reserves and resources lie in the central North Sea.

Leads and prospects must meet a volume threshold of 10mn boe mean prospective resources, or a 30mn boe mean volume cut-off in the higher-cost West of Shetland; and have an estimated technical (geological) chance of success greater than 15%. These thresholds are consistent with drilling activity taking place under current market conditions, says OGA.

There is a large number of excellent exploration opportunities that are waiting to be matured by industry towards drill-ready status. Establishing which resources though will take time, co-operation and money however, it says.

It is clear from the table that the range of probabilities of material resources ranges widely from region to region.

The OGA will publish further information in the first half of next year, including a follow-on publication on the methodology, play maps, the impact of exploration and appraisal activity constraints and enablers, portfolio performance, and value.

The right assets in the right hands

A key element of maximising the economic recovery of the UKCS is ensuring assets end up in the hands of those who are ready to develop them. This year has been a good one for asset sales, with private equity to the fore; and NGW asked OGA about this.

NGW: Does the OGA think that the stable oil price is the trigger for the deals, or is it the new financing methods, or is the more creative deal structuring which allows for the price to depend on rises and falls in output over time; and production thresholds triggering subsequent payments?

OGA: All the points raised will have played a part to some extent. In addition, decommissioning and how companies view that liability, and whether they are prepared to have a “clean break” or not has also been a factor; i.e. where a company is happy to retain the decommissioning liability it is more likely that they will be able to find a buyer, especially if it is a late life asset.

NGW: Has the OGA created more value upstream or is private equity simply looking for more things to play around with and it sees energy production as new thing?

OGA: The OGA in collaboration with industry are always looking to the future, thinking about what’s next. In the past few years we witnessed assets changing hands; some deals being structured using quite innovative methods which have helped new entrants to get into the UKCS. Looking to the future, the offshore oil and gas industry can contribute up to nearly £1 trillion to the UK economy by 2035 from the production of oil and gas in the UK Continental Shelf (UKCS) and from increasing the level of exports from our supply chain. This bold ambition is captured in Vision 2035, a set of targets that look at growing the production levels through better use of technology, innovation and collaboration.

NGW: Is the short-term investment cycle – three to five years that private equity looks at – long enough to give the UKCS the value it needs? Is there a risk that in five years, the present boom in asset trades will have fizzled out and output decline falls sharply as the ‘easy’ wins have all been banked?

OGA: The OGA working with government and industry (as envisaged by Sir Ian in the Wood Review) is making the UKCS more attractive to investors. Effective asset stewardship is crucial to maximising economy recovery from the UKCS and to deliver greater value overall and we’ve worked closely with industry to deliver and embed this new way of working. It’s simple, clear and uses data from industry to help inform where we prioritise our efforts to achieve the maximum economic recovery from the UK offshore. Other achievements to increase value include – the introduction of strategic area plans, reinvigoration of license rounds with quality data. Therefore, we expect the basin to continue to be competitive in attracting further investment from a wide spectrum of exploration and production companies and investors.

NGW: Is there more the government can do to help, with regards tax incentives and seismic, for example?

OGA: The finance ministry in particular has done a lot to date, however, if there is evidence there are barriers to investing from a fiscal perspective the OGA will have that conversation with government.

‘Producers know they must do more’: OGUK

Oil & Gas UK (OGUK), which represents the offshore industry, said that the OGA had done a good job in firming up the resources and reserves over the last two years and the industry knows that it needs to do more with the drill-bit.

The OGA with other agencies has gone through the different categories of find, from plays to contingent resources, and shaken out a lot of prospects. On the other hand it has also established others with a greater degree of certainty. “It knew it was behind the curve, but it has been gradually getting its head around what is left and what to do with it,” OGUK upstream policy director Mike Tholen told NGW. “What is left might appear to be less than a few years ago, but the numbers are more accurate.” Licensing rounds and seismic surveys have firmed up a lot of vague figures, he said.

“The message from the OGA is that exploration has not been yielding enough resources for development. We need to up the game to refill the hopper,” he said.

“The game is to go out and find it and produce it. We think we have got that mastered. The challenge is to keep adding barrels as fast as we take them out.” Not everything that is found is worth producing and companies held a lot of resources on their books that, on closer inspection, are not going to make it to the production stage, either because of their small size, or their distance from infrastructure or the likely cost of production. However the production cost needs to be considerably lower than the oil price prevailing at the time of FID, as companies have seen the consequences of bullish assumptions.

“For us as a basin, there is one underlying thing: you get nowhere without drilling wells. We need to keep attracting people to drill and it needs more successful wells to get the volume through the development process. That means being competitive and boring, in terms of the fiscal regime,” he said.

It also means greater commerciality when it comes to asset trading, which Tholen says has been an order of magnitude better lately. He says the OGA has done a good job encouraging sales, putting the right assets in the right hands; but the industry knows it has to work at it – and not just in the UK, as the Faroe-Equinor asset swap in the Norwegian Sea showed in early December.

Both sides claimed a good result for their respective portfolios resulting from the cash-free and reserves-neutral transaction. Faroe gains in production from next year, improving its cash-flow and helping it fight off a hostile take-over bid. Equinor meanwhile has cut its exposure to non-operated assets and boosted its presence in key areas.