Nigeria Could Benefit from 'Virtual Pipelines' [NGW Magazine]

Gas pipelines in Nigeria are notoriously prone to damage, meaning flows across states are often interrupted. Age is another problem affecting its 5,000-km network.

According to an April 2018 paper published by the Petroleum Training Institute Nigeria, the cause of pipeline integrity failure in Nigeria’s pipeline networks, can be traced to three factors: excavation damage; corrosion; and ‘all other causes’.

In context, all other causes are related to pipeline vandalism, which in the recent past, have been carried out by Niger Delta militants in response to a succession of governments’ neglect of their concerns and by the international oil companies operating in the south of the country. These account for 24% of the total causes, according to data from the National Bureau of Statistics at end-2016.

Owing to the inadequacies of physical pipelines in Nigeria, international oil companies (IOCs) are making use of small-scale LNG distribution which in Nigeria is often referred to as ‘virtual pipelines’.

Small-scale LNG distribution could benefit Nigeria as it avoids disruptions duch as pipeline vandalism, says a 2016 paper by Ikpeka Princewill of the Society of Petroleum Engineers. He explains how upstream firms deliver unprocessed gas to plants that clean it up and transport it through via Nigeria’s high-pressure transmission system to domestic and industrial consumers through local distribution systems.

“However, there have been a lot of issues arising from the construction of new transmission lines, as existing gas pipelines don’t have enough capacity to fill gas demands from various sectors. Virtual pipelines are an alternative method of transporting natural gas to places where there are no physical pipeline networks available,” writes Princewill.

Small-scale LNG distribution is already common in many parts of the world including northeast Asia, western Europe and Turkey, with a surprisingly large 10.2mn metric tons of LNG loaded on to trucks in China alone in 2017, according to the most recent International Group of LNG Importers (GIIGNL annual report.

Although the federal government has in 2018 come up with plans to add seven pipelines to the already existing distribution network, as of November 2018 it is unclear whether any of them will be built, owing to the forthcoming 2019 presidential elections.

Even if they are, there is little guarantee that these new projects will bridge the current gaps in Nigeria’s gas pipeline system. In October 2018 officials at state-owned Nigerian National Petroleum Corporation (NNPC), said it will use mini-LNG plants, to distribute about 84mn ft³/d of gas from producing fields, using customised cryogenic LNG trucks to areas that are not easily accessible by pipeline.

Nigeria LNG - the joint venture of NNPC, Shell, Total and Eni – has told NGW that it is not collaborating with the government in its guest to start supplying LNG to various parts of the country.

NLNG’s public affairs manager said the reason for this is because the company does not supply LNG to the Nigerian domestic market; only for exports. However, it does supply liquid petroleum gas (LPG), known as cooking gas, to the Nigerian market under a scheme using NLNG-dedicated vessels chartered to ensure a steady supply.

In a 2017 interview with Thisday newspaper, the Nigerian Gas Association’s vice president Audrey Joe-Ezigbo said using virtual pipelines was an option to get gas to remotely located plants. However, she cited the expensive nature of the technology.

"Virtual pipeline technology is expensive, from the point of view of the equipment itself and then also the added costs of compression and/or regasification as in the case of mini-LNG, security, logistics and so on.

"It is thus better suited to bulk off-takers such as power plants and heavy industrial consumers, or in cases where there are industrial clusters that can absorb shared portions of the fixed costs.

"There are limitations as to where and how efficiently you can deploy this technology and remain cost-effective, particularly considering the state of our current road network and building patterns, and other challenges we face in the environment," she stated at the time.

Despite these challenges, Greenville LNG, a privately held company, came in to invest in Nigeria’s gas sector, with plans to bring LNG-fuelled trucks into Nigeria and provide over the full stretch of the pipeline LNG stations with cryogenic storage and full re-gasification on site. Additionally it will deliver LNG to customers with a fleet of 750 specially designed cryogenic tank trucks (see box).

NGW has this year reported that activities are still not at 100% capacity owing to bureaucratic bottlenecks. Although officials are keeping their cards close to their chest where the details of their agreements with government are concerned, there is an indication that Greenville will collaborate with the government through NNPC for its interest in virtual pipelines.

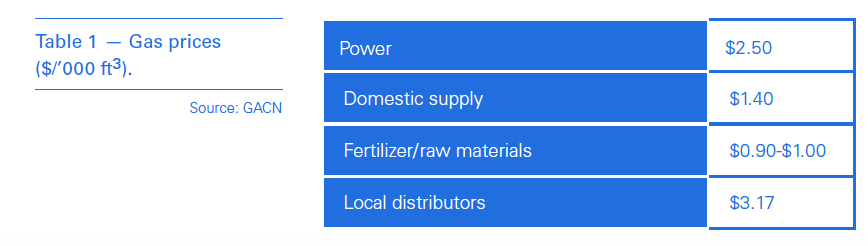

Asked if the government has agreed to higher gas prices for virtual pipelines, officials at the Gas Aggregation Company of Nigeria, GACN, told NGW that all gas suppliers negotiate with their customers on a ‘willing buyer, willing seller’ basis, while the government ensures gas suppliers adhere to the domestic supply obligation.

The typical approach is to offer customers a discount against diesel. This can be as much as 30% lower.

According to GACN, the pricing usually changes every year based on factors such as global gas prices.

Greenville opens LNG plant in Nigeria

Greenville LNG inaugurated the first phase of its $500mn liquefied natural gas plant in Rumuji, Port Harcourt, Rivers State November 22.

During the inauguration, Greenville LNG Chairman, Eddy van den Broeke, said the LNG plant will have an initial daily production capacity of 2,250 metric tons (mt).

The Greenville LNG project will be focusing on supply to power plants and other end users in the West, North and Eastern parts of the country. For now, Greenville has about 100 trucks which will deliver LNG to customers across the country. The trucks travel a distance of more than 1000 km at a time without refuelling and are fitted with GPS tracking devices to monitor movement.

Greenville LNG told NGW, November 26, that the second phase of the project will include two additional liquefaction trains, which will increase the total capacity produced to 5,250 mt/day, and, that the company has a capacity to supply LNG for industries with capacities from 1MW to 250MW.

Department of Petroleum Resources (DPR) told NGW, November 26, that the government is interested in attracting foreign direct investment in the sector, so as to move the sector forward. This, they say, remains a goal for the department despite the current president's refusal to sign the petroleum industry governance bill. According to DPR, the Greenville project is an indicator of opportunities that await global LNG investors in Nigeria.

The company had since 2017, signed a memorandum of understanding (MoU) with the government to supply LNG to customers using LNG trucks. However, they are just now taking official steps to begin operations, owing to bureaucratic bottlenecks as well as unclear policies. During the inauguration of the Rumuji plant, the company said that being an investor in Nigeria was no easy feat, as the government agencies lose interest in its investors.