AG&P Wins Indian Licences [NGW Magazine]

As India’s gas demand rises and the south Asian nation works towards attracting investment in the requisite infrastructure, the industry seems to be warming up to the potential the sector offers.

For instance, the ninth city gas distribution (CGD) licensing round, which wound up in August this year, saw extremely strong responses. Indian downstream regulator Petroleum and Natural Gas Regulatory Board (PNGRB) received a total of 406 bids for the 86 geographical areas up for grabs; and 35 entities participated in the process. According to PNGRB, the ninth round is likely to attract investments of rupees 700bn ($10bn). Before the start of the ninth round, the regulator made significant changes to the rules, making them a lot simpler.

Encouraged by the response to the ninth round, India opened 50 more areas for bidding under the 10th round in early November. Similarly, a lot of investment is expected to flow into India’s LNG import infrastructure as multiple terminals come up over the next four to five years on both its east and west coasts. India at present has four fully operational LNG receiving terminals. The fifth, operated by Gujarat state-owned GSPC, has been inaugurated but is yet to get a commissioning cargo. All five of the terminals are on India’s west coast.

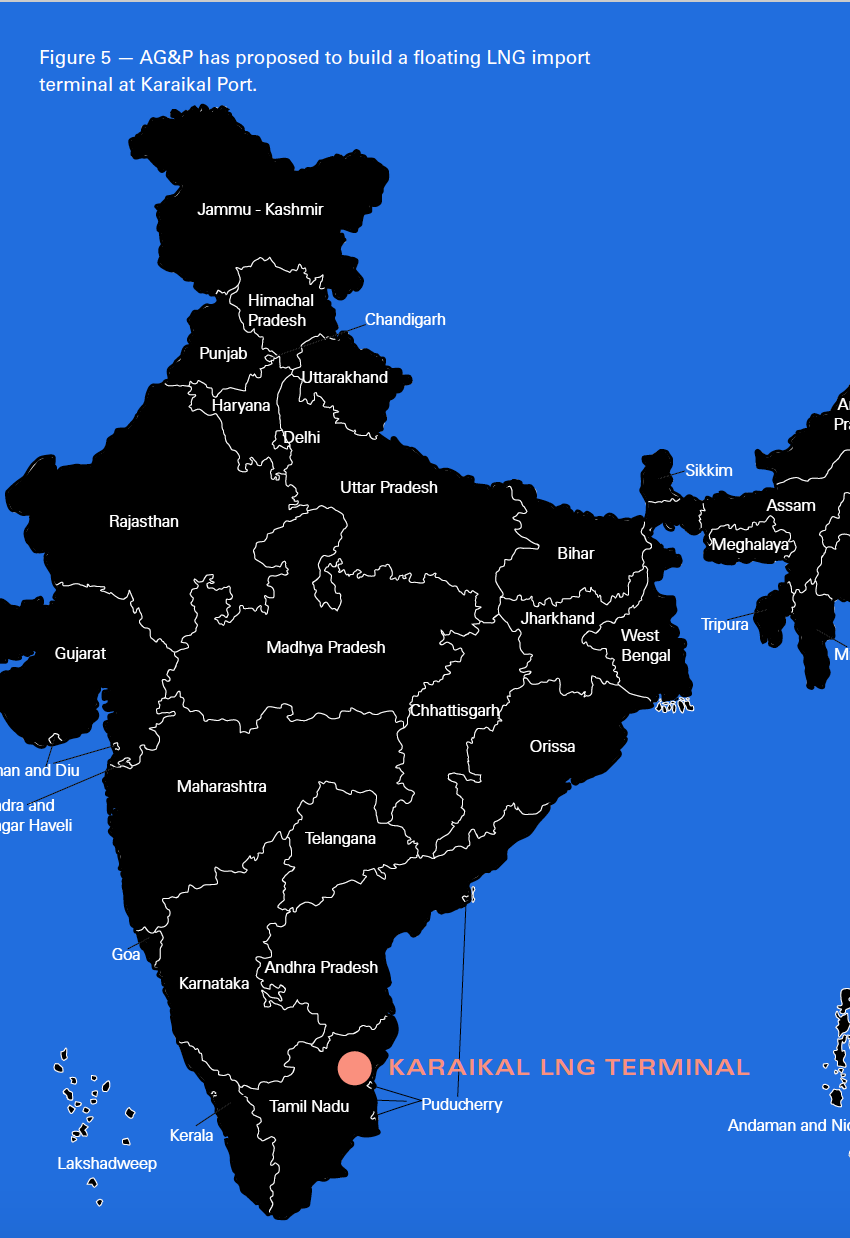

Indian gas distribution and infrastructure space is dominated by local public and private companies, so AG&P is among the few foreign players aggressively expanding in the space. In the ninth CGD round, the Manila-based company was awarded three concessions to develop infrastructure and supply natural gas to households, industry and vehicles. AG&P has also proposed developing a floating LNG terminal at Karaikal Port in the southern Indian state of Tamil Nadu.

Maiden foray into local gas

With the award of the three CGD licences in India, AG&P has ventured for the first time into the CGD business overseas. AG&P will develop infrastructure and supply natural gas exclusively to all residential, commercial, industrial and transport users in the districts of Kanchipuram and Ramanathapuram in Tamil Nadu and districts of Jodhpur, Jaisalmer and Barmer (under single licence) in the western Indian state of Rajasthan, with a total population of 13mn. These licences give AG&P the rights to own the gas infrastructure and supply natural gas to households, in addition to the commercial, industrial and transport sectors.

The exclusivity rights cover natural gas pipelines to residential areas (PNG), supply for commercial establishments and CNG stations for cars, buses and trucks.

“CGD is India’s fastest growing end-user sector of natural gas, with a 5.6% compound annual growth rate over the last five years. While India’s CGD sector accounts for 11% of the country’s natural gas demand, only three states – Gujarat, Maharashtra and Delhi NCR – have extensive CGD networks; thus, the sector is expected to continue its rapid growth. With over half of India’s population yet to be covered by a CGD concession, incumbent Indian CGD players are forecasting a two-fold growth in their city coverage in the next five years,” said Ryan Chua, AG&P’s director of business development, Global LNG.

Prime minister Narendra Modi gave a speech November 22 to mark the start of construction work on new CGD schemes awarded under the ninth round. With the completion of that round, gas will be available in 178 geographical areas comprising 290 districts spread over 26 states and union territories covering more than 46% of India’s population and 35% of its landmass. According to AG&P, in Tamil Nadu, more than 5mn domestic PNG connections and 806 CNG stations will be installed over the next eight years.

At present, 124 districts in India accounting for 11% of the geographical area and 19% of the population has access to natural gas through CGD networks. There are around 1,500 CNG stations in operation in India and this number is expected to reach 6,000 over the next eight years. The Indian government is looking to raise the share of natural gas from 6%-7% at present to 15% in the next ten years and it believes the CGD sector is expected to play a very important role in driving the demand for gas in the country.

“As AG&P’s CGD networks come into operation in India, this will create local employment opportunities for thousands of Indians. For example, in the districts of Kanchipuram and Ramanathapuram, AG&P will be hiring up to 2,000 local people to build and operate its CGD network. AG&P is investing heavily in gas infrastructure to support the nation’s commitment to switch to natural gas as a clean and affordable source of fuel,” added Chua.

Since CGD infrastructure requirements of each geographical area differ, AG&P plans to go public with the roll-out plans for each area once the plans are finalised and construction is underway. Meanwhile, it has appointed PPG Sarma as managing director for the CGD and logistics business in India. Sarma is former CEO of Torrent Gas Private, which has won licences to develop CGD networks in ten different regions, including some in the ninth round.

Karikal floating LNG import terminal FID next year

Karikal floating LNG import terminal FID next year

The plans for AG&P’s LNG terminal within the breakwater at Karaikal Port are progressing well. Front-end engineering design (Feed) is complete and the final investment decision (FID) is expected in 1H 2019, by which point there might be a schedule for first gas. The LNG import terminal will have an initial regasification capacity of 1mn metric tons/year provided by one single regasification train. However, it is expected that capacity will double in less than three years. A total of three trains and multiple loading bays are planned to allow the facility to expand.

“Modular construction of the regasification trains (modules) will commence at AG&P’s heavy fabrication yards in the Philippines in parallel with onsite construction immediately following FID,” said Chua.

AG&P’s LNG terminal at Karaikal has been designed with a hybrid configuration integrating a standardised, scalable regasification train with floating storage. According to Chua, a key component of the terminal design is the standardised 125mn ft3/day LNG regasification train, which uses fan ambient air vaporisation (FAV), water-glycol shell and tube vaporisation (STV) or water bath vaporisation (WBV) technologies enabling it to be used onshore or offshore.

“This approach not only reduces project cost and schedule, but because the solution is easily scalable, it meets the needs of a wider range of customers, from small to large- scale, offering different delivery pressure ranges based on the needs of the facility. Fabrication is fast, and transport is easier compared to having stick-built facilities,” Chua said.

The Karaikal terminal will provide wider gas accessibility in Puducherry and Tamil Nadu through AG&P’s CGD networks, which includes a truck-based delivery chain with mother and daughter gas stations located close to end-users that regasify and compress LNG.

“AG&P’s LNG terminal, supported by its CGD networks, will establish Karaikal as a major gateway for distributing LNG quickly and efficiently to customers throughout the region,” Chua argued.

The terminal will serve the heavily industrialised region of central Tamil Nadu, which has major manufacturing bases for the fertiliser, cement, steel, textile, leather, sugar and garment industries. In addition, it will support the gas-fired power industry, including PPN’s power stations, as well as multiple demand centres via pipeline. AG&P has executed exclusivity with PPN Power to supply gas to its six nearby power stations.

AG&P has also set up an LNG marketing team in the city of Chennai in Tamil Nadu to aggregate customer demand.

Expanding beyond Asia

With an Indian LNG terminal in the works and now three CGD licences in the bag, AG&P also has plans to move beyond the Asia-Pacific region.

“While India and southeast Asia are AG&P’s priority markets, its vertically integrated approach to LNG import and distribution is being applied in other emerging markets, with several LNG projects in advanced stages of development in Latin America and the Caribbean. These markets do not have established infrastructure to bring natural gas to end-consumers, representing a significant opportunity for AG&P to introduce its integrated gas logistics platforms including its proprietary, standardised solutions for LNG terminals,” Chua said.