[NGW Magazine] Interview: Andrei Belyi

Oil prices are disengaging from gas once more, with benefits for gas. Andrei Belyi comments also on Yamal LNG, EU pipeline regulations and the problems with Nord Stream 2.

The oil price could go above $70/barrel and indeed many expect it to; but, given how unexpected was the end-2015 commodity crisis, nothing is certain, according to Andrei Belyi, adjunct professor at the University of Eastern Finland. The weaker dollar and the commitments from Russia and Saudi Arabia to limit output have led to stockpiles decreasing and prices going up, he told NGW, even though the global demand for oil is weakening relative to demand for other fossil fuels. There is a rebound and the overall sentiment is bullish,” he said. “But we should not be overoptimistic, there is a mismatch between the oil price and the decreasing share of oil in energy markets."

He said the oil price is not linked arithmetically to imbalances in resources: it is inherent to the political stability in a large part of the world and stimulates dynamics in stock exchanges. It also remains highly correlated to an assessment of companies' resources. Hence, there is always a demand for a high price in addition to a demand for oil itself.

A high oil price not only benefits producers: as long as the oversupply in gas remains, it will benefit LNG too, as customers will find it easier to switch from diesel if there is an arbitrage. The price of gas had been tightly linked to oil, he said, as the dynamics were pretty similar; but since the December 2015 slump, the oil price has rebounded faster than the gas price, where the oversupply persists, perhaps until 2022.

However, as Cedigas pointed out in a report in late January, the fact that so little LNG has arrived in Europe reflects the unexpected strength of demand in Asia, casting doubt on the extent of the oversupply, at least in winter.

The dynamics of the oil and gas sectors are less correlated than before, he says. Since the price collapse of 2015, the oil price has trebled, while gas price has not gone up so much. Still,the gas price in Asia is trending up, and there are grounds for hopes in China’s and India’s long term demand for hydrocarbons. Hence, long-term investors are betting mostly on these two economies.

Prices at European gas hubs have also begun to move upwards. New volumes from Gazprom have also been purchased by European companies, stimulating the upstream sector. The US gas price has not evolved much as domestic over-supply remains important. But small shale producers can function even at this price.

This will lead to projects being postponed until after that date, except for the low-cost gas, such as the second Yamal LNG project, which was more a political project than anything. Total, the western partner, needed to show its technological expertise to show it can build a competitive project in those conditions, and Russia needed to show it could host such a project, Belyi said, even though a lot of the equipment was built in South Korea.

This story reached its climax with the molecules of methane ending up in the US, poised to enter Engie’s Everett LNG terminal after resting briefly in the Isle of Grain, UK, terminal, brought there by Petronas which bought the commissioning cargo. “What matters is the Russian image, the portrayal of success,” he said. But nobody will know what the Yamal LNG payback period will be or when it will be profitable; there are a lot of unknowns, including the cost of building the port at Sabetta which the Russian government bore; and the terms required by the Chinese for their involvement.

Credit: Yamal LNG

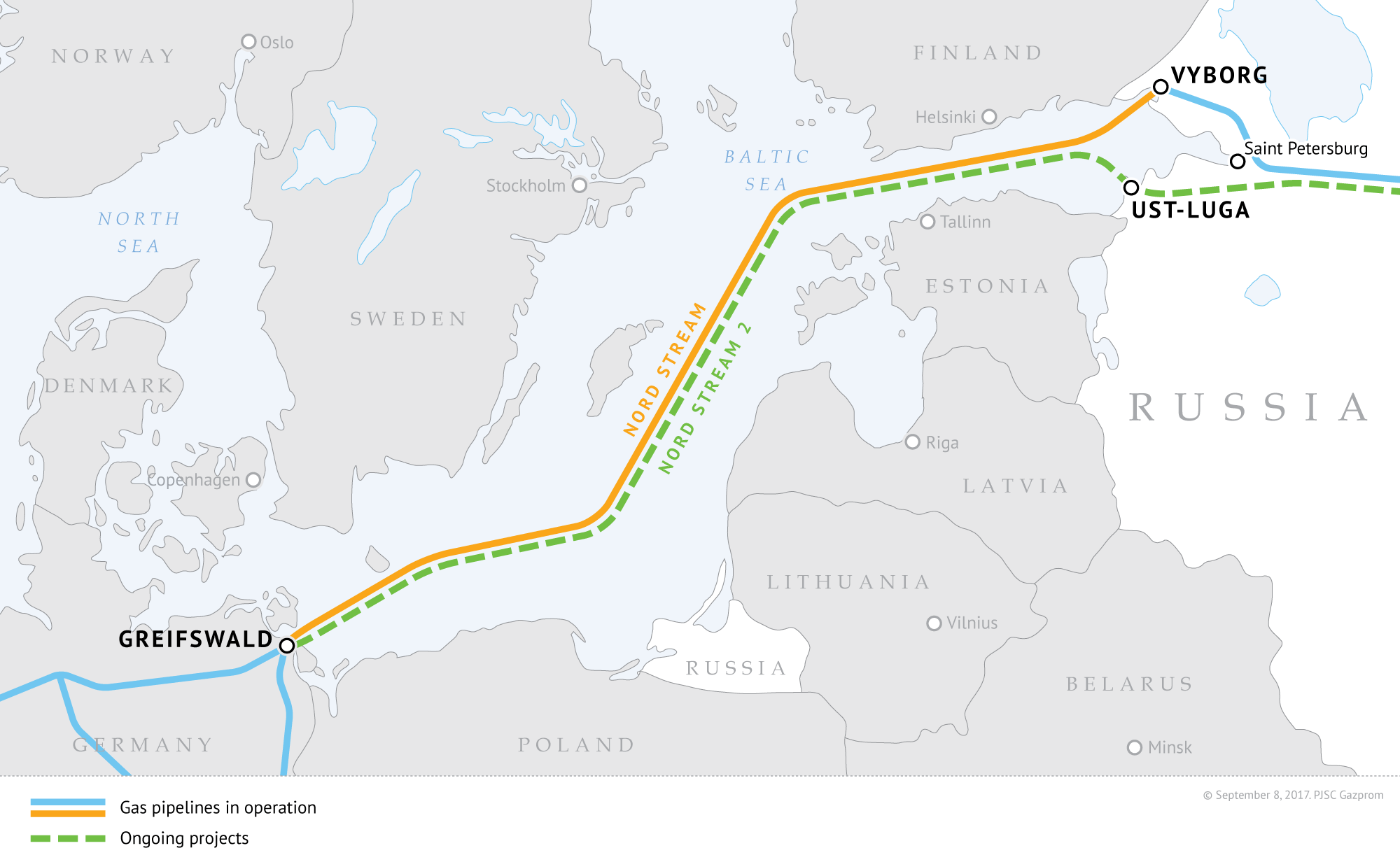

Nord Stream 2 is an anachronism that goes against the tide: when the focus is on small and nimble projects such as LNG, a 55bn m³/yr fixed pipeline is old fashioned, Belyi said. "It seems that new long-distance pipeline projects are from the past in Europe. There is no room for long-term incremental demand. Nord Stream 2 does not add much in economic terms. I would even doubt that it will ever be built. And if so, it will not challenge the current competitive structures that have emerged in European gas markets, including eastern Europe. In the mid-term perspective, container-based shipment of either compressed natural gas or LNG will facilitate cross-border supplies without need for interconnectors. Hence, the number of suppliers will increase regardless of Nord Stream 2.

I would agree that some central and eastern European countries are lobbying heavily against NS2. In this context, we do not understand whether the NS2 is a danger in itself (security); or is solely a problem of how to introduce third-party access (TPA). For example, if Gazprom agrees to introduce the TPA, will the critique of NS2 disappear? Probably not. Finally, even if NS2 is built, central and eastern Europe would become less dependent on Russian supplies because they can get gas from the west. The argument about transit fees is strange: in the competitive market, transportation tariffs are matter of capacity market and booking platforms.

Credit: Gazprom

Rosneft can scent an opportunity: if the EC demands half the line’s capacity be opened up to TPA, then Rosneft could offer to fill the other half of the line and achieve a key objective of marketing its gas in the European Union. Gazprom would like competitors such as Novatek and Rosneft to sell more gas at home, but they are aiming instead at ending Gazprom's export monopoly.

The EC, under pressure from central and eastern European countries particularly Poland, has entered its request for third party access for NS2. This makes no legal sense. Offshore pipelines are not under its control, but under the UN Convention of the Law of the Sea; and the European Union cannot expand its legislation. This view was even backed up by the EC’s own legal service, which rejected the EC's request for a mandate to negotiate terms with Russia in autumn.

The EC in December came up with a plan to change the gas directive, extending it to all pipelines entering the EU, and that is a blow for legal logic. It would be impossible to ask Algeria, an external state, to introduce third-party access. The EC would have to make exemptions for all, except for NS2.

But the technological shift towards small-scale supplies keeps surprising us. Among others, new LNG deliveries from Rotterdam to China started at the end of the last year, priced at around €13/mn Btu delivered to the end-user in China. Beerensgas, the seller, specialises in the LNG supply chain, serving “stranded demand,” where off-grid customers lack access to LNG pipelines. It says it was "the first in the world to ship LNG ISO tanks from Europe to China."

So, imagine the distance: Long-distance delivery costs by containers may get close to the traditional LNG shipment. And without investment either into regasification infrastructure or pipeline connections. We may see the use of LNG containers in the Balkans and in northern parts of Europe as well.

(Credit: Beerensgas)

Many things that made no economic sense before now do so. Look at the change in the telecoms sector: why should something similar not happen in energy as well?

William Powell