[NGW Magazine] Iran’s emissions rise despite gas boom

The best laid plans... Iran has made commitments to cut its emissions of greenhouse gases in order to meet its COP21 obligations but how it will get there has not been properly costed.

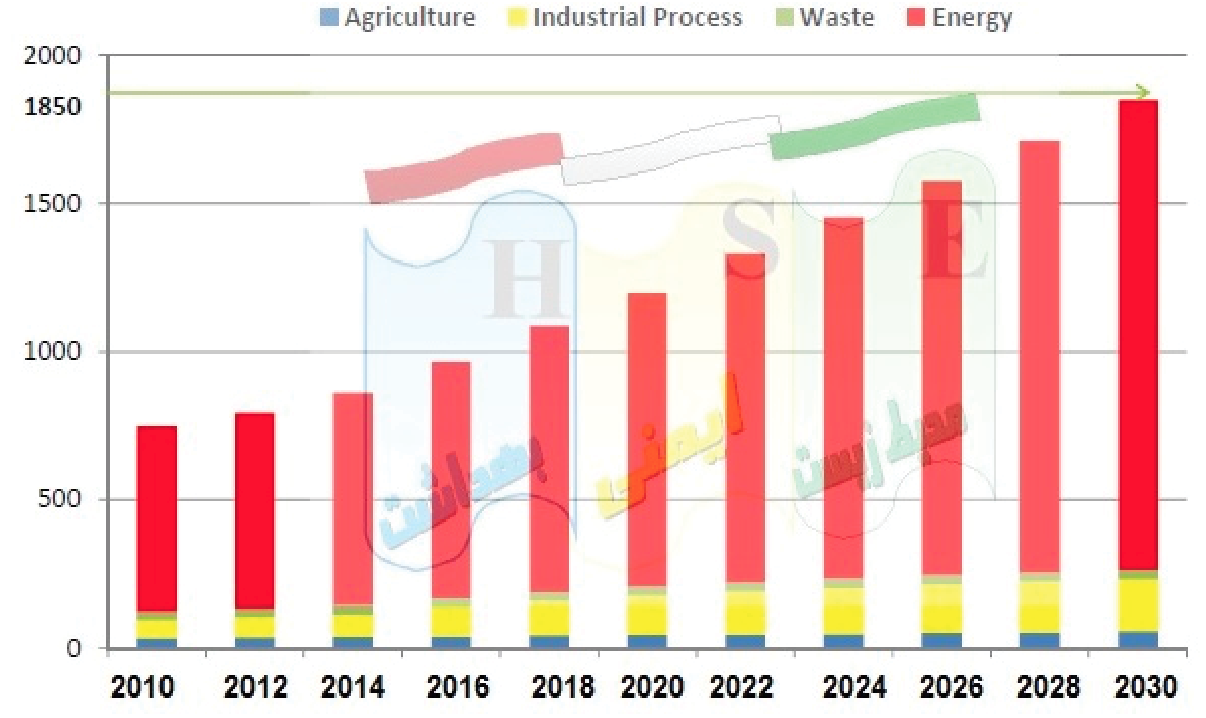

Iran clocks up 800mn mt/yr in emissions, of which 600mn mt/yr are CO2, and it remains in the top 10 global air polluters list. But now it has to cut its growth rate of emissions by 12% by 2030 to 1.689bn mt/yr, if it can find foreign funds, in order to meet government targets under the Paris climate agreement (COP21); or by 4% to 1.85bn mt/yr using domestic financing($17.5bn).

The 12% reduction in growth will cost $52.5bn, of which just a third – $17.5bn – is expected to come from domestic funds and to achieve a third of the targeted cut. Under the business‐as‐usual scenario (BAU) of COP21, Iran’s total emissions will rise to 1.92bn mt/yr by 2030.

If it spent the total $52.5bn, Iran’s emissions would fall by 230.4mn mt cumulatively (or 15.36mn mt/yr) and if it spent just $17.5bn of its own money, the figure would stand at 76.8mn mt (or 5.12 mn mt/yr) by 2030.

Iran’s total emissions growth based on COP21 obligations:

Source: Department of environment, including non-CO2 emission, mn mt/yr

The country has some measures to meet its obligations, including increasing gas production, especially in order to curb liquid fuel use in power plants, enhancing energy efficiency, installing 7.5 GW of wind and solar power plants, replacing old vehicles with new gas-fired ones, improving energy efficiency for space heating and so on.

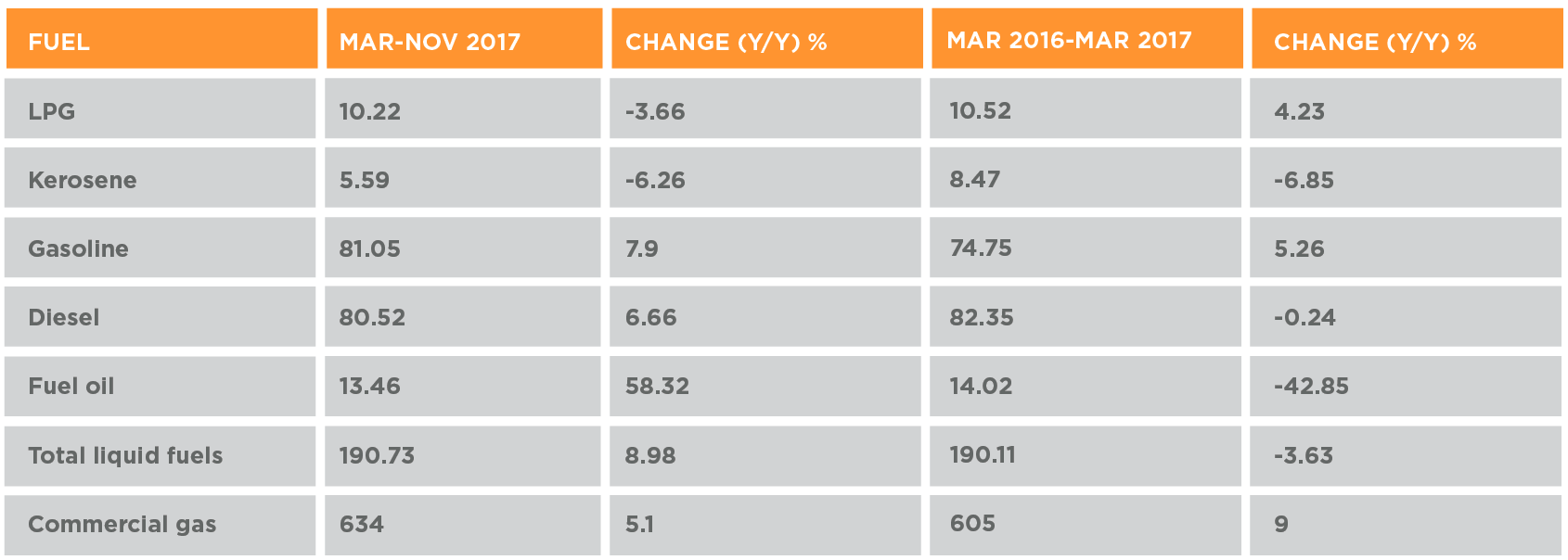

However, according to NGW analysis, the country has only succeeded partly in replacing gas with liquid fuels in power sector. This had the effect of cutting diesel and fuel-oil use in 2015 and 2016, but the use of both recovered in March-November 2017.

Iran's energy consumption by fuel type

Source: oil ministry. Based on Iran’s fiscal year (liquid fuels: mn litres/d; gas: mn m³/d)

According to two official documents, prepared by oil ministry and seen by NGW, Iran cut its liquid fuels' use, especially fuel oil and diesel, which led to a cut in liquid fuels-related CO2 emissions of 33.4% in 2017 compared with 2014.

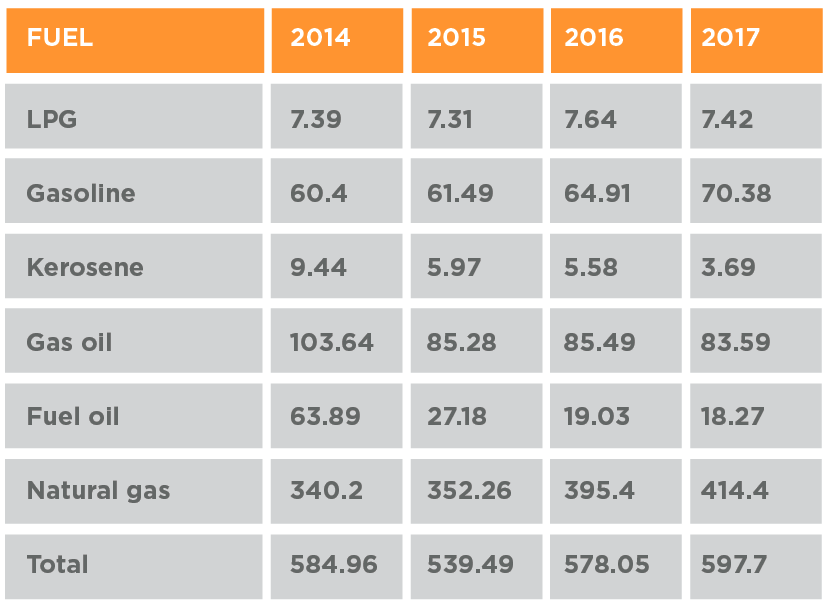

CO2 emissions in Iran from major fuels:

Source: NGW survey, combined with oil ministry’s energy statistics (metric tons/yr).

Despite declining diesel, kerosene and fuel-oil demand, the country’s rapid natural gas and gasoline use growth also saw a rise in flaring to 16.5bn m3/yr (50% more than 2014) which pushed up the total CO2 emissions.

Iran’s gas and major liquid fuels CO2 emissions:

.png)

Source: NGW survey, combined with oil ministry’s energy statistics, metric tons/yr

Iran has not published the statistics of total fossil fuels-related CO2 emissions for the last two years, but it stood at 602mn mt/yr in the year to March 2015, when the major fuels-related CO2 emissions was about 585mn mt/yr.

According to statistics, released by Global Carbon Project, Iran’s total CO2 emissions reached 656mn mt in 2016, about 8.6% more than the previous year. This is possible – and in line with NGW’s own analysis – because in addition to major fuels-related CO2 emissions, Iran also flared about 16.5bn m3, or about a third more than 2015. Iran also used other fuels: 1.8mn mt of coal and 8.3mn mt oil equivalent of various biomass fuels during 2016, according to NGW.

Natural gas (excluding flaring) accounts for about 63% of Iran’s total CO2 emissions, but the fuel accounts for over 73% of the country's total energy demand.

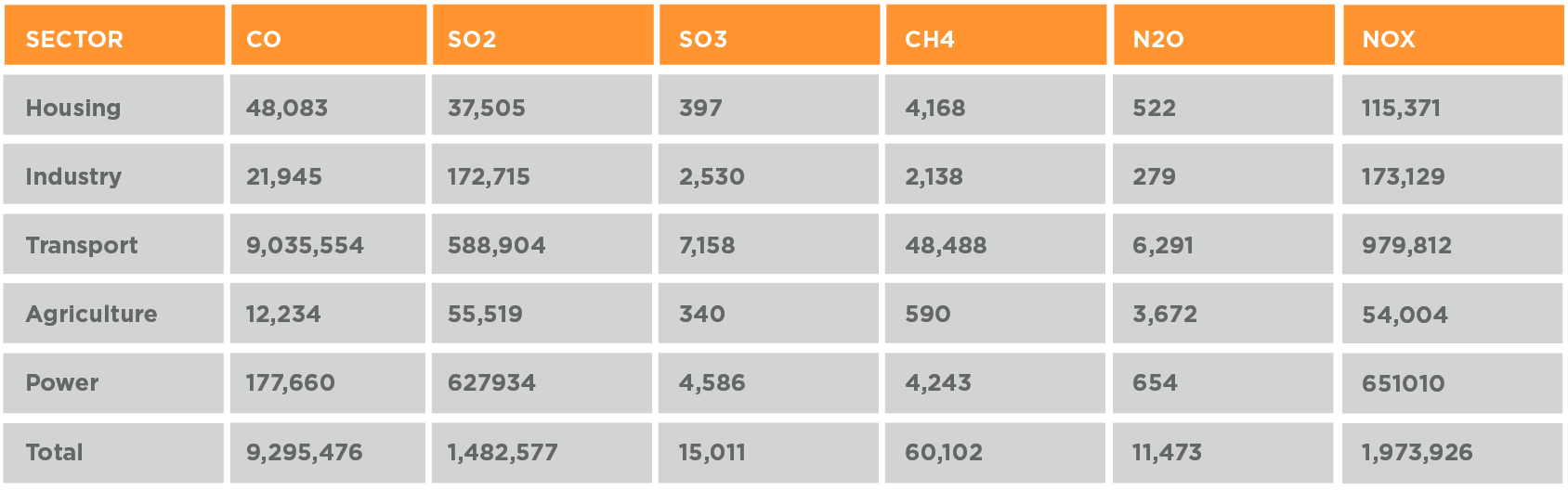

Other emissions (fiscal year to March, 2015; mt)

Source: Oil ministry

Iran’s plans for emission control

Iran had a $200bn plan to optimise energy demand (including emission reduction plans) – especially in curbing flaring, renewing urban transport and enhancing the efficiency of power plants – in order to halve energy intensity by 2030.

However, over the last three years, Iran only succeeded in replacing liquid fuels with gas in the power sector, cutting demand in this sector by 2.4 times to about 10bn litres in 2017, compared with 2014. However, in other fields, the country failed to fulfill its plans.

For instance, Iran has planned to add about 1GW to its renewables capacity during 2017, but in the event added just 58 MW; and its total renewable capacity of 322 MW is just 0.41% of total nominal power capacity.

In the power sector, it also has planned to increase the share of combined-cycle power plants from a quarter of the total installed capacity in 2014 to half by 2020, but the figure stands still at 25.78% as of now.

Iran also has planned to compress more natural gas and to import 17,000 buses and 140,000 taxis to run on it, but its CNG production remained unchanged at 20mn m3/d for some years and importing gas-fired vehicles is far behind the plan. Iran’s plan to improve rail transport system to save 13bn litres/yr is also fruitless.

In total, assuming a 6% GDP growth annually to 2030, the country would:

- cut 1,300mn boe from cumulative residential energy demand.

- cut 1,000mn boe from cumulative industrial energy demand.

- cut 130mn boe from cumulative agricultural energy demand.

In total, Iran would save 5bn boe cumulatively from 2015-2030. The government hopes to save $870bn (directly and indirectly) by halving the energy intensity at a cost of $200bn over 15 years. According to Iran's plans, its emission will reach 1.92bn mt/yr by 2030, but it has to cut that by 4% to 1.85bn mt/yr relying on domestic financing ($17.5bn). And if it can attract foreign funds, it would cut it by 12% to 1.689bn mt/yr.

Gas-related emissions

Natural gas (excluding 27bn m³ lost in the grid and flaring) accounts for above 60% of total CO2 emissions and for 73% of total primary energy demand in Iran. Housing uses about half of the country's processed gas.

More than 95% of Iranian households were supplied with gas. Iran needs to attract $2bn to optimise 600,000 boilers, while about 80% of Iran's households use 20mn heaters, consuming 1,500 m³/yr each on average, which is very high. On the other hand, this sector consumes 63.4 TWh/yr of electricity.

Iran is also working on combined heat and power (CHP) as well as combined cooling, heating and power (CCHP) equipment to optimise energy use as much as possible. Iran has made no progress in optimising gas or power demand in housing sector.

Iran's agriculture, industry and housing sectors use 3.3 times, 2 times and 1.5 times more energy than global averages according to the national agency, Iran Fuel Conservation Organization (IFCO).

According to the International Energy Agency, Iran’s energy intensity index is one of the highest in the world and twice the world average, and has been rising on average by about 3.4%/yr over the past 40 years. Energy intensity measures the amount of primary energy supply a country needs to generate a unit of gross domestic product (GDP).

According to documents obtained by NGW, the figure for Iran is 0.9mn mt oil equivalent to create $1000-worth of GDP, which is nine times more than Japan and Germany.

Dalga Khatinoglu