[NGW Magazine] Tanzania launches probe into gas sector

As Tanzania launches an official investigation into what are the benefits it gets from gas, some investors are going further, and asking if they can ever benefit from doing business there without more regulatory stability.

Tanzania's parliament has launched an investigation to ascertain the benefits that the east African country is deriving from its natural gas.

Gas producers have welcomed the probe – one of the many to be undertaken by the government since 2015 into the country's natural resources sector, and particularly mining – but warned that more of the same could destabilise the emergent natural gas production sector.

The Speaker of Parliament, Job Ndugai, picked an 11-member select committee in November 2017 but the taskforce only started work on January 2, 2018. He mandated it to establish why natural gas continues to contribute a small fraction to the economy and to recommend ways to address the shortcomings.

"I am concerned why Tanzania, with such a large portion of [the Indian] Ocean, gets 3.2bn Tanzanian shillings [$1.4mn, in taxes and royalties] or about 1.4% of GDP. This is the same place where over 400bn shillings ($178mn) is not accounted for," said Ndugai on November 17 2017, in remarks that echo populist president John Magufuli's drive for the country to benefit more from its natural resources.

Tanzanian upstream gas divides into two types of operations. Small fields – Songo Songo which has produced for over a decade, Mnazi Bay (started up in 2015) and Kiliwani North (in 2016) – produce modest volumes for the domestic market through a 487-km Chinese-built pipeline to the capital Dar es Salaam; they are operated by independents who are constantly wary of the government's ability to pay for the gas they supply.

London-based Business Monitor International (BMI) in November 2017 put Tanzania's annual 2016 gas consumption at 1.3bn m³ (45.9bn ft³) and forecast it would reach 1.7bn m³ in 2017. Much of that has been used to generate electricity some of the time, from about 607 MW of gas-fired plants, or 45% of Tanzania's total installed generation capacity of 1.357 GW.

Then there are large offshore fields accounting for most of Tanzania's estimated 57 trillion ft³ (1.61 trillion m³) of gas of gross recoverable gas resources. Two consortia have proven this offshore gas since 2010.

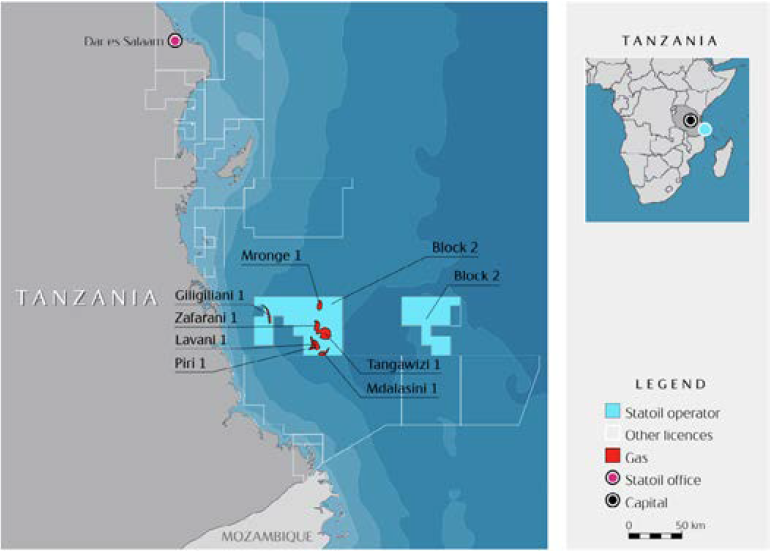

The first led by Shell, partnered by UK independent Ophir and Singapore-based Pavilion Energy, have some 17 trillion ft³ under their belt in Tanzania offshore Areas 1 and 4. The other, operated by Norwegian Statoil with ExxonMobil as partner, has found 22 trillion ft³ in its offshore Area 2. Each group wants to develop it through a large LNG export project, and jointly they are negotiating with the government over plans to build a combined $30bn onshore gas processing, liquefaction and export complex at Lindi in southern Tanzania.

But each has told the government it will not be rushed into development, arguing that the global LNG market will remain over-supplied until 2023-25. Any one of these investors, moreover, would probably prefer to invest in a low-cost Qatari LNG brownfield project, than a greenfield one in East Africa. Shell last year described Tanzania as "one of many projects" in its portfolio.

Sharing the spoils

Ndugai though is unconvinced that the country is getting as much as it should from the resource hence his decision to appoint the probe team. The parliamentary investigation is the latest of three to be instituted by Magufuli – nicknamed 'the bulldozer' – into the local mining sector.

A government-appointed committee in June 2017 reported that the economy lost $78bn through fraudulent activities by some companies since 1998. It said the firms were evading taxes, under-valuing their exports and not declaring revenues.

Statoil's Tanzania activities (Credit: Statoil)

The committee in particular accused Acacia Mining, a subsidiary of Canada-based Barrick Gold, of operating illegally. By July 2017, the issue had escalated, with the government telling Acacia that it owed $190bn in unpaid back-taxes and penalties. The saga prompted Shell CEO Ben van Beurden to pointedly remark July 27 2017: "The fiscal environment... needs to be conducive. I think there’s a bit of work to do there."

Acacia immediately rejected the demands, but in October 2017 agreed to settle by paying $300mn to Tanzania, also offering the government a 16% shareholding in its three mines.

Last June too, the committee recommended that all mining firms receive their revenue in Tanzanian bank accounts, that mining agreements be renegotiated to allow the state to buy shares in the companies and that any arbitration be handled by local courts. The government has since enacted two laws to bring on board some of the committee's recommendations.

Apart from the gold investigation, the government also audited the operations of diamond and tanzanite miners. Tanzanite is a rare gemstone only found in Tanzania.

Gas companies have welcomed the latest inquiry saying they have nothing to hide, but cautioned that more radical decisions of that nature could make the country unattractive to investment. Statoil spokesperson Erik Haaland told NGW that the company will co-operate if asked to.

"Statoil does not interfere with the processes that are being set up by any government to ensure its own effectiveness and achieve its stated policies," he said. "In relation to Statoil's investments in Tanzania, it is important to note that sanctity of agreed terms, stability and predictability of a legal, commercial and fiscal framework are the necessary elements for the success of LNG development. These are currently being negotiated through a host government agreement (HGA) with the government negotiation team."

Haaland added: "In setting the framework, considerations are taken also on the magnitude of current and future investments, the expected long duration of the project and the need to ensure that the Tanzanian LNG project is globally competitive and can attract the required financing by project participants as well as third party, international lenders."

US-headquartered Symbion Power, which has a 120-MW gas-to-power plant in Tanzania but is locked in a dispute with the government over its power purchase agreement, said if approached it will co-operate. But its spokesperson is concerned by the controversies that have dogged Tanzania's mining industry in recent years. "Since president Magufuli assumed power there has been an emphasis placed on restructuring deals that investors had already completed," she said.

"In some cases large gold mines have been forced to renegotiate new deals that improve Tanzania's position. This, coupled with the fact that many disputes exist between government institutions and investors, has created apprehension in the investor community. If similar situations now occur in oil and gas sector investor confidence may be further eroded," she said.

Symbion challenges Tanesco

On March 13, 2017 Symbion took its fight against state utility Tanzania Electricity Supply Company (Tanesco) to the Paris-based International Court of Arbitration. Symbion is demanding $561mn from Tanesco for breaching its 112-MW power purchase agreement. It says its case is strong and that it is confident it will prevail when an arbitration ruling is given some time in 2019/2020. The plant was forced to shut down in 2016. Experts warn that although Tanzanians have high expectations, a downturn in the global oil and gas market could dim their hopes for an immediate bonanza from the resource.

A September 2017 report by the New York-based Natural Resources Governance Institute (NRGI) said: "Given the inherent unpredictability of prices, we use the average price over the past 15 years [of $11/mmBtu] as a reference point. At this price, we estimate that government revenues would average $2.3bn/yr over the period of gas production, equivalent to only $20 per person or 1.2% of GDP a year. Revenues are not expected to reach the 3% of GDP."

Prices too low?

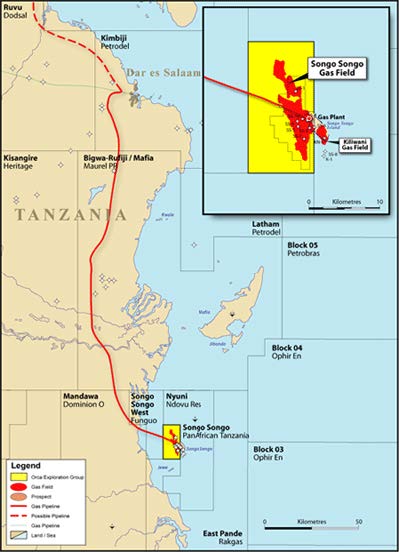

Today's contractual prices received by independent gas producers at Tanzania's Songo Songo and Mnazi Bay fields are a lot lower than $11/mn Btu. Orca Exploration, the operator and owner of the Songo Songo field, was paid $3.56/mn Btu ($3.63/'000 ft³) in 3Q 2017 on its gas sales to power plants and $7.50/mn Btu on its smaller sales to industry in Tanzania.

Calgary-based Wentworth Resources was paid $5.36/mn Btu in 3Q2017 on its share of Mnazi Bay production by state utility Tanesco, and just $3.04/mn Btu by state upstream producer TPDC. Mnazi's operator is Pertamina's Maurel & Prom, while TPDC also has an equity stake in the field. Tanzania's third largest field, Aminex-run Kiliwani North, has had technical problems that have severely reduced production.

Songo Songo gas field (Credit: Orca Exploration)

Mnazi Bay (at 100% equity) averaged 62.2mn ft³/d production in 4Q 2017, with Wentworth forecasting it will average 65mn to 75mn ft³/d (also at 100%) during full year 2018. It recently reported that state-owned customers were paying more promptly for gas, now that commissioning of Tanzania's new Kinyerezi-2 gas-fired power plant has advanced.

Gas was first discovered on Tanzania's nearshore Songo Songo field in the Indian Ocean in 1974 and production started 30 years later. It was the country's first gas development, and its operator Orca produced 45.1mn ft³/d in 3Q 2017 from Songo Songo largely because of low demand from Tanesco – but it added that its field had capacity to produce as much as 155mn ft³/d if both pipeline and buyer constraints were removed. Orca though is now engaged in a process to divest up to 40% in its Tanzanian operations and assets to locally-based Swala Oil & Gas for up to $130mn.

Tanzanians, meanwhile, are generally supportive of their president's resource nationalism agenda. A leading newspaper The Daily News reflected this position in a recent editorial: "The ban imposed on the export of minerals marked the first step towards this war against thievery. The president went on to form committees that probed operations, content and value of minerals and exported by mines. And from there, everything became history and the country is now benefiting from its mining sector.

It said sanity is "fast returning to the mining sector" and there is need to focus on other sectors. The move by the Speaker of the National Assembly was therefore very timely, if Tanzanians are to "enjoy the benefits of their natural resources. Let's all rally behind this crusade for the betterment of the country and its people."

Thulani Mpofu