LNG projects line up for FID [NGW Magazine]

Progress at proposed LNG projects around the world has picked up over recent months, with faster-than-expected demand growth soaking up a forecast supply surplus and leading to firmer predictions of a significant supply deficit by the early/mid-2020s. NGW looks at this year’s approved projects and some of those now lining up for final investment decision (FID) in 2019 – which could be a record year in terms of volume.

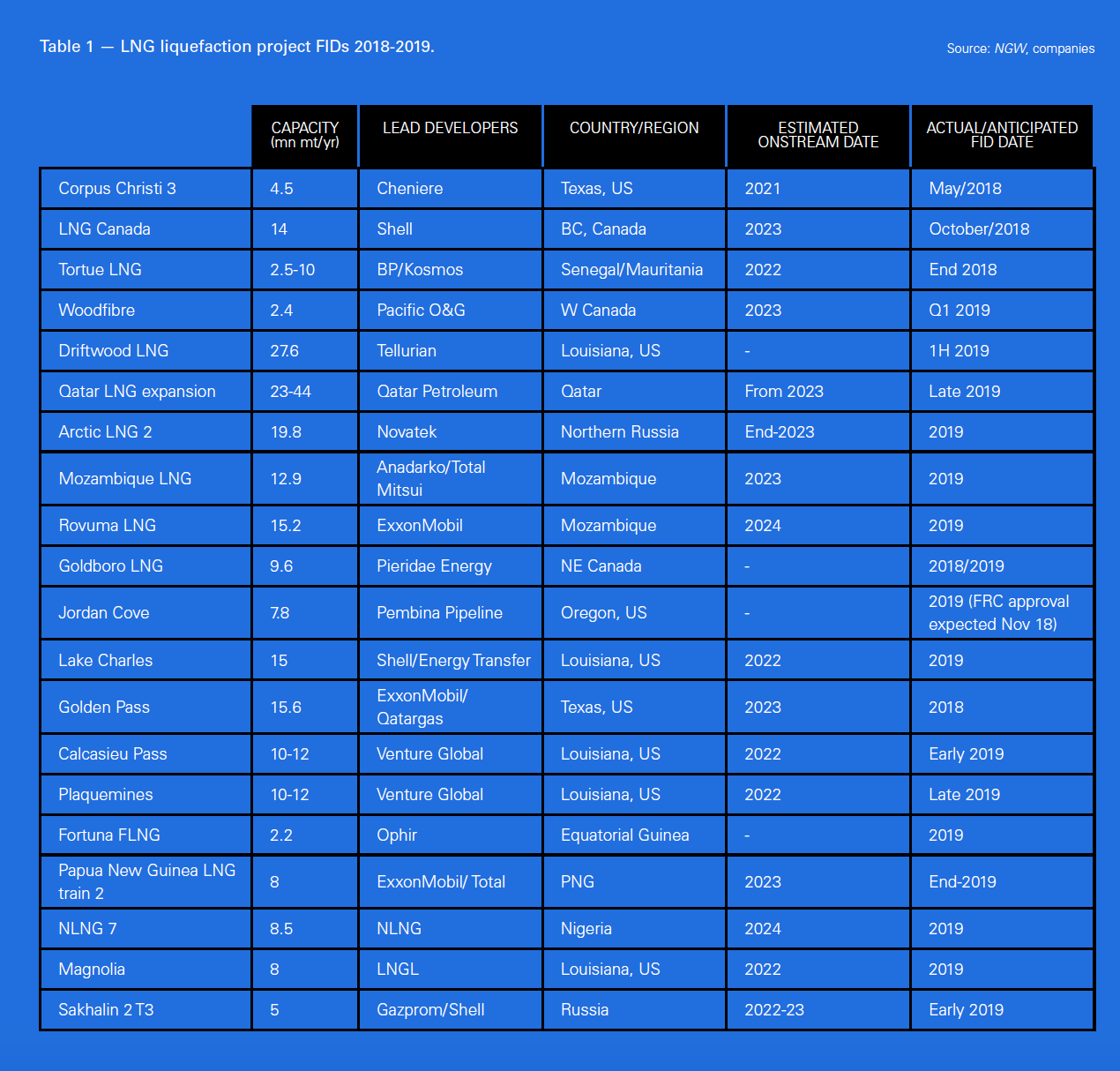

With most analysts now forecasting about 65mn mt/yr deficit in supply by 2025, developers are scrambling to launch projects to capture volume in the expanding market. Demand is already 40mn mt/yr higher in Asia – largely thanks to China’s efforts to reduce coal use – than had been forecast only a couple of years ago. In total, 2018 is likely to see over 20mn mt/yr in LNG capacity approved for FID, while 2019 could see as much as 60mn mt/yr approved – including Qatar’s LNG expansion, Arctic LNG 2, and several in North America (see table) – raising the question of over-supply.

Earlier this year, Cheniere’s Corpus Christi 3 FID was announced, underpinned by long-term supply agreements with Chinese state CNPC and Poland's state-run PGNiG. Then, in October, LNG Canada became the first onshore greenfield FID since 2013, following Eni’s 3.4mn mt/yr greenfield offshore Coral FLNG plant, which was given the go-ahead in 2017. The site could accommodate a further two liquefaction trains, with FID expected by 2020.

Shell put the approval down to strength in the plant’s target Asian market, where demand is up 20mn mt over the last year. LNG costs have also softened, with Shell bringing levels down to $1000/mt/yr – although this is still higher than brownfield or expansion projects, with Corpus Christi 3, for example, priced in at $667/mt/yr. The project is using a larger train size at 7mn mt/yr, which helps with economies of scale, along with a modular construction approach.

The added impetus of Malaysian state Petronas taking a 25% stake after it shelved its Canadian Pacific Northwest project in July 2017 – having taken provisional FID in 2016 – also helped push the project to the fore. And with each partner responsible for allocating their own share of LNG and with substantial LNG sale and purchase contracts to service, it was not essential to sign up third-party buyers. This has not precluded deals, with Mitsubishi signing up 0.9mn mt/yr of its 2.1mn mt/yr offtake with Japanese buyers after FID.

Shell and its partners in the project – Petronas, PetroChina, Mitsubishi and South Korea’s Kogas – will use gas from equity holders’ upstream assets in the Montney shale formation in the eastern Rockies, where all apart from Kogas have assets. The Montney gas price in southern Alberta is very competitive, having traded on average at about $1.50/mn Btu this year – about $1.40/mn Btu below Henry Hub.

According to a note circulated by acreage holder Calima in early November, “after a quiet second half to last year there has been a pick-up in Montney mergers and acquisitions activity during 2018 which has seen land prices after adjustments for production and infrastructure jump from an average of C$2,500/acre during 2017 to C$4,500/acre this year. Liquids rich plays though still command the premium.

A total of 35 Canadian LNG export projects have received export licences. Of these, a number have been shelved, but three could take FID in the next two years. These include the front-running 2.1mn mt/yr Woodfibre LNG project, which could achieve FID in Q1 2019, and which recently announced a deal to supply Chinese state Cnooc with 0.75mn mt/yr for 13 years starting 2023, adding to a 1mn mt/yr deal with Guangzhou Gas done in 2016.

Big hitters

The biggest expansion would be from Qatar Petroleum, which has plans to add 44mn mt/yr by 2024, bringing total Qatari capacity up to 110 mn mt/yr. The expansion will begin with three new mega trains of 7.8 mnt/yr each, with first LNG deliveries pencilled in for 2023. This project will be the lowest cost of any planned LNG supply additions globally at $5-$5.6/mn Btu delivered in Asia, setting a tough competitive benchmark for other new LNG supply projects.

The biggest project in the pipeline outside Qatar and the US is Arctic LNG 2, with 19.8 mnt/yr capacity. In May, Total bought a 10% stake in the project from Novatek – of which it owns 19% anyway – adding to its 20% share in Novatek’s Yamal plant, which is situated across Russia’s Ob estuary from Arctic LNG 2. The project comprises three liquefaction trains of 6.6mn mt/yr capacity each, and has already signed supply and finance deals with Asian customers and banks.

Earlier this year, the project announced cost reductions, which are now estimated at 70% of those at Yamal LNG, where capex was $1,100 to $1,200/mt/yr. This may be enough to attract equity interest and finance from Saudi Aramco, with senior Saudi officials indicating In November that they were keen to invest and market their share of the gas to customers, particularly in south Asia.

Both the Qatar and the Novatek-led projects are unusual in that they are strategic or government-led; most of the others are privately operated. As such they might have to meet a lower threshold for commerciality – although it would be difficult to beat Qatar on low costs and on its record of reliable deliveries. Novatek’s first project, the Yamal LNG which is now operational, benefited from a number of substantial government initiatives to speed work up. So the commerciality of these projects is not the yardstick the market will judge them by; rather their reliability.

In the US, the low-cost Golden Pass and Lake Charles projects, backed by deep pockets, are progressing with FID earmarked for 2019. And in mid-November, Driftwood LNG developer, Tellurian, said it expected to start construction in the first half of 2019. It told NGW that it expected to sell all the capacity of at least three and possibly five of its trains this year.

Unlike most other proposed US LNG export projects that will liquefy gas for a fee, Tellurian is proposing buyers to not only sign for LNG offtake, but also to provide 65-70% of upstream and liquefaction project equity. Tellurian claims 35 customers are interested in partnering with and hence taking LNG from the project.

Other US projects include Magnolia and Calcasieu Pass, which are targeting a liquefaction cost of $500-700/mt/yr, via multiple, small-scale liquefaction trains that can be pre-fabricated off-site. But, in these cases, FID is being held back by a lack of sufficient and firm long-term offtake agreements. Potential financiers are facing tension between the growing trend to shorter and smaller contracts that buyers are demanding, and the requirement for stable revenues to back the debt required for LNG infrastructure.

Another plant expected to be given the go-ahead shortly is BP’s Tortue floating LNG plant off West Africa, which will start at 2.4mn mt/yr, expanding up to 10mn mt/yr. A key consideration for this and other smaller FLNG projects, such as Fortuna in Equatorial Guinea, is the availability of floating storage and regasification units (FSRUs) and floating liquefaction natural gas vessels (FLNGs). By using these, developers can start bringing in revenue quickly, making it easier to secure finance.