Take-over gives Harbour critical mass [NGW Magazine]

EIG Partners-backed Harbour Energy has sunk its teeth into its third set of assets in three years – subject to shareholder and creditor approvals – making an all-shares bid for Premier Oil October 6.

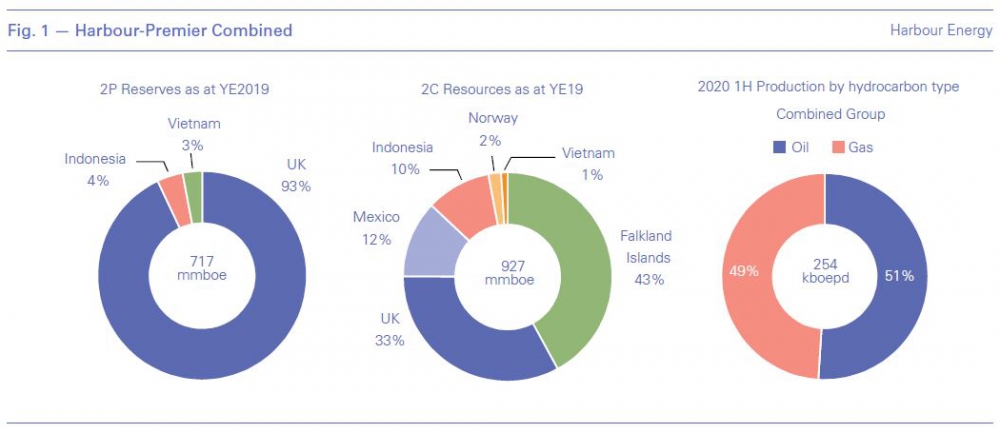

In a reverse takeover, Harbour’s European operating company Chrysaor will, with Premier’s assets, form the largest independent oil and gas company listed on the London Stock Exchange. It will have combined production of around 254,000 barrels of oil equivalent (boe)/day, of which 49% is gas; and 90% comes from the UK. Their combined proven and probable reserves were 717mn boe as of end 2019, with 93% in the UK.

About 70% of production is operated, giving advantages such as more control over cash allocation and field development timings, the two companies said in a webcast announcing the transaction. Combined first-half revenues were $1.76bn and profits net of tax, interest and exploration expenses were $1.27bn. Operating costs would have averaged $10.5/boe at that time.

Premier’s production ended last year at 78,400 boe/d spread across UK North Sea and southeast Asia – including a long-term gas supply contract with Singapore that lasts until 2029.

Although the parties called it a merger, the board of directors of the new company all come from Harbour, with Premier CEO Tony Durrant due to leave at year-end.

Premier’s shareholders have been watered down to no more than 5.45%, albeit now owners of a much larger company: their former $200mn holding is now worth nearer $300mn, by analogy with Aker BP and Swedish Lundin.

Harbour will pay off $2.7bn of debt and other liabilities on completion, expected early next year. Creditors will receive the money in a mix of cash (up to $1.23bn) and shares. Another $400mn in letters of credit will also be repaid. The deal was part-financed by a $1.5bn reserves-based loan with a margin incentive for hitting carbon emissions reduction targets, which is believed to be the first of its kind.

Premier had got into a deep water this year, trying to pay down debt while also negotiating the purchase of complementary and “advantaged” UK North Sea assets from UK major BP and Dana Petroleum. The latter part-owns with Premier the 20-25,000 boe/d Tolmount project which is not going to bring in cash until next summer. Premier went to court defending – successfully – one of its refinancing schemes of arrangement against one of its largest creditors, who feared it was over-stretching itself financially.

It did however negotiate a lower price for BP’s assets after the Covid-19 slump. It also dropped its bid for the Tolmount stake. However its debt, at 7%, would, after refinancing to make the purchase, have probably been even more expensive at 8% at least; while the new company’s average debt is priced at 5%, the webcast audience heard.

The company has now terminated those talks with BP that perhaps triggered the circumstances in which Premier now finds itself – although the new entity might decide to revive them.

At time of press, 43% of the creditors had publicly accepted the bid, with Premier’s goal being to secure approval of 75% by November 3. Durrant said he was confident of success, with the deal expected to complete in Q1 2021. He said nothing can be read into the present low percentage of acceptances as the consultation process began with a smallish group who had to be involved from the outset. Now all the creditors’ support is being solicited.

Head of research at Westwood Energy, Keith Myers, told NGW that it “seems a reasonable deal for Premier's shareholders given Premier was on the brink of being insolvent. And 5% of a financially robust company is worth more than 100% of potentially nothing. I am not sure the creditors will say they have come out well as they will only get 61-75 cents in the dollar back. But it is really the creditors who are calling the shots and if they approve it, then the shareholders don't really have much choice.”

A view to a kill

Harbour was set up in 2014 with private equity from EIG Partners and managed by Linda Cook, whose 29-year career at the Anglo-Dutch Shell ended with her resignation from the board in 2010. She told the October 6 webcast that she had long taken a contrarian view on the upstream, expecting a growing range of low-cost but high value assets to come to market. And she was agnostic on how Harbour grew – organic versus inorganic growth, oil versus gas output – as long as the growth had value.

Harbour, she said, had had an eye on ConocoPhillips’ UK assets, including the Britannia field stake, for a long time before being able to reach a deal in September 2019. And so a number of Shell assets came first, in late 2017. She sees the strategy as vindicated and expects more on the way: the last six to 12 months has yielded a healthier crop of prospects than any point in the last five years, she told the webcast.

She mentioned the Mexican Zama field and southeast Asia as attractive assets in Premier's portfolio, but when asked about the Falklands, another big basin for Premier, she took the same negative view that Premier had of it in the present market. In the UK, she said there were a lot of opportunities. She highlighted the UK-Norway median line which bigger companies tend to avoid; the J-Block area; and the Britannia area as being rich in prospects.

A new chapter

Premier said the deal marked "a new and exciting chapter in Premier's history.” And with a simpler financial structure, there would be fewer constraints on its business, said Durrant.

Durrant told the webcast there was a lot to be done over the coming months: as a private company it does not have all the paperwork needed for a prospectus, including a competent person's report to provide details on the reserves and resources.

Premier's shareholders are expected to own up to 5.45% of the combined group, creditors 10.6% while Chrysaor's largest shareholder, Harbour, is expected to own up to 39.021% of the combined group, which is yet to be named. Other Chrysaor shareholders will have about 45%.

Cook will be CEO of the combined group and Chrysaor CEO Phil Kirk will be its president and also CEO Europe; the two other non-executive directors will also be appointed by Harbour.

The companies had combined 2020 H1 revenue of $1.76bn and pre-tax earnings of $1.27bn. Their operating costs are $10.5/boe and they claim sector leading strategies to reduce the carbon footprint of their operations. Chrysaor for example is a partner in the Acorn carbon capture and storage project which it hopes to take to completion, while Premier aims to make the unmanned Tolmount platform practically emissions-free.

The new business, the two companies said in a stock-exchange statement, will have a "stable platform for future growth and the ability to fund and realise value from its development portfolio and international exploration projects." Cook said that Harbour’s backers were not in a hurry to exit but dividends were an eventual possibility. The combined group will have net debt excluding letters of credit of about $3.2bn on completion but there will be cost and tax synergies, accelerating the use of Premier's $4.1bn of UK tax losses and "unlocking significant value for shareholders."

GlobalData oil and gas analyst Daniel Rogers said that with private equity players unable to execute high-value exit strategies through initial public offerings or divestments under current market conditions, this deal makes a lot of sense for both parties. With the stock price down over 80% from the start of the year, Chrysaor has taken advantage of the expansion opportunity to list the combined businesses on the London Stock Exchange, he said.

|

A good deal for the UK and Chrysaor Upstream lobby group Oil & gas UK welcomed the deal as good news for hydrocarbon production. CEO Deirdre Michie said: “Chrysaor and Premier Oil are great stewards, contributors and champions of this industry so this investment is encouraging news for the UK continental shelf. “With companies increasingly looking to see how they can work together to meet as much of our oil and gas demand from domestic resources instead of imports, this merger will help to stimulate further activity for our hard-pressed supply chain and contribute to an inclusive transition towards a low carbon economy,” she said. Wood Mackenzie’s chief corporate analyst Greig Aitken said that size matters in oil and gas, particularly in tapping additional sources of finance during periods of volatility. “Bigger, more efficient producers that are resilient enough to see through the cycles – but small enough not to be weighed down by internal competition for capital and high general and administration costs – are better equipped to collaborate with the supply chain, maximise recovery and deliver consistent returns to shareholders,” he said. Merging can be defensive, therefore. But there have been several failures among the minnows this year. Myers told NGW: “It continues to be very tough to raise finance for smaller companies and further consolidation is inevitable. Egos are always the biggest barrier to mergers.” As examples, Independent Oil & Gas and Reabold Resources have both been rebuffed by cash-rich Deltic – formerly Cluff Natural Resources. Deltic and IOG are yet to flow gas, while Reabold used its existing cash flow as an inducement and poured cold water on Deltic’s resource figures and the geological risk. It had expected Deltic’s shareholders to welcome the certainty of existing cashflow and scope for expansion that Reabold represented. Both Deltic and IOG have the same partner in their key drilling programmes: Shell. Another new company, RockRose, scented blood as a major backer of IOG, London Capital & Finance, hit the buffers. It made increasingly blunt overtures toward IOG’s shareholders in the spring. But IOG management deterred them and Rockrose was later bought by Viaro, a major energy trader, in the summer. |