[NGW Magazine] Greece attracts the IOCs upstream

Yannis Bassias, the CEO of the Greek licensing agency HHRM, talks to NGW about the country's upstream hopes, following the discoveries made elsewhere in the Mediterranean, and the plans for the next few years.

Hellenic Hydrocarbon Resources Management (HHRM) is a Greek national company that manages Greece’s hydrocarbon resources. From its offices in Athens it promotes the development of Greece’s oil and gas sector and invites the global oil and gas industry to examine high quality seismic imaging and legacy data, and to be kept updated of licence applications and of the country's fiscal and legal terms.

HHRM is fast coming into prominence. Tell us about its activities since you took over as chairman and particularly the latest offshore licensing rounds.

Since November 2016 the company set up its development programme, which is divided into four major parts:

- To build a technical team able to evaluate, negotiate, follow, monitor and manage Greece’s hydrocarbon resources. Its team of professionals cover the areas of petroleum geology/geophysics, reservoir, data management, petroleum law and economics

- To inform the industry and the local stakeholders on the geographical, geological, fiscal and political advantages of Greece

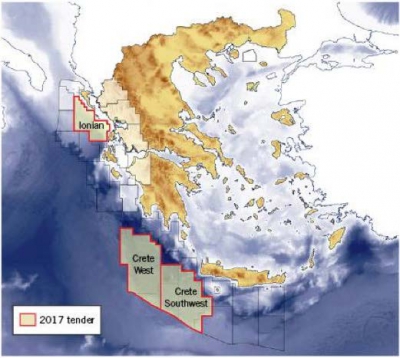

- To prepare and run licensing tenders, including offshore for the Ionian, west and southwest of Crete (Figure 1)

- To ensure Greece benefits from international technical experience in exploration and production (E&P), backed up by strong financial capability, especially deepwater offshore.

Figure 1: HHRM’s open hydrocarbon licensing tenders

Source: HHRM

Our key priorities in the period to 2020 are to attract investment interest in Greece’s hydrocarbon E&P and to enrich the geophysical database of western Greece and south of Crete. In order to achieve the latter we are working closely with other related organisations and universities in Greece. These tenders were published in the ‘Journal of the Greek Republic’ August 11, 2017.

Figure 2: Current E&P licences in Greece

Source: HHRM

What licences have been issued so far?

Blocks 1, 2 and 10 were included in an offshore licensing round that ended in July 2015. The awards of blocks 1 and 10 are still pending. Block 2 lies in the northern part of the Ionian Sea, and was awarded last year to the Total, Edison and Hellenic Petroleum consortium. Katakolon, which was discovered in the 1980s, was awarded to Energean in 2014. The company has already submitted its field development plan and it has been approved to drill in 2019. Exploitation rights were awarded in October 2016. The onshore blocks, Arta-Preveza, Aitoloakarnania and NW Peloponnese are under ratification by the Greek parliament at this stage. Block Ioannina was awarded to Repsol as the operator with 60% and Energean 40%.

There is also interest in the latest call for tenders for the Ionian and west/southwest of Crete. Why are IOCs so attracted to these areas?

Foremost is the potential for new, major, hydrocarbon discoveries. In addition, western Greece offers a geopolitical ‘safe haven’ for offshore operations compared with other regions in the Mediterranean.

However, the main attraction derives from the discovery of Zohr. This has introduced a new petroleum system in the eastern Mediterranean, based on carbonate formations, which has changed our understanding of the larger eastern Mediterranean with respect to carbonate environments. Given the success with Zohr and now with Calypso 1 in block 6 in Cyprus’ EEZ, it is proving to be very attractive for the industry.

Both the Ionian Sea and south of Crete include largely carbonate formations, with and without an overlying salt stratum, which allows us to check pre-salt conditions.

These are safe and secure areas where exploration, development and production can proceed unhindered, far away from the eastern Mediterranean’s challenges, in an EU environment.

In addition, the proximity to Italy and Europe makes transporting any discovered hydrocarbons to European markets possible by pipeline and thus very competitive. The competing eastern Mediterranean gas discoveries are not only more expensive to develop, but require liquefaction and transportation to markets, which make them quite expensive in the prevailing low gas price environment.

Can you expand on the geology and prospects?

HHRM is focusing its commercial action on promoting larger surface concessions. The primary purpose is to increase the chances of hydrocarbon exploration and discovery below the evaporites, which cover a large part of the offshore area south and west of Crete and to a lesser extent in the Ionian Sea.

These regions are largely unexplored. The prospective basins consist of carbonate platforms and transition zones to the east toward continental Greece. Play types include both stratigraphic and structural carbonate reefs. Western Greece offers a compacted, highly folded carbonate environment with potentially high reserves.

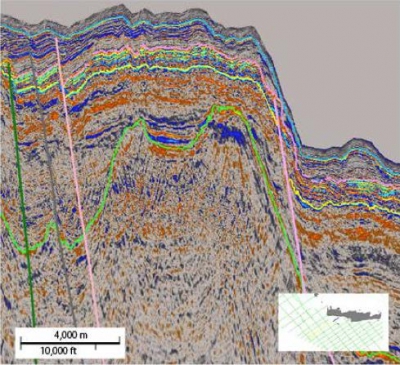

Seismic data acquired in 2012 exhibit bright spots in carbonate build-ups probably associated with gas-bearing sediments, Figure 3.

Figure 3: Carbonate build-ups

Source: HHRM

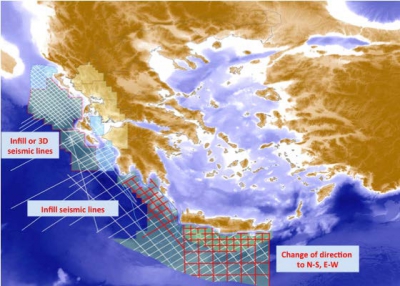

We are reprocessing existing seismic data, but we are also acquiring and processing new seismic data (Figure 4).

Figure 4: New offshore seismic projects

Source: HHRM

What prompted you to proceed with these tenders and what are your expectations?

The key driver was the expression of interest for the areas west and southwest of Crete by the consortium of Total-Exxon-Helpe. These areas are deepwater offshore and contain pre-salt geological plays, requiring international experience and financial capability, which this consortium provides.

For the Ionian block, we received an expression of interest from Energean, which is already licensed to explore in western Greece, onshore at Ioannina and offshore at Katakolon. Energean also has proven production experience in Greece at Prinos.

Our expectation is that these tenders will attract the interest of major IOCs interested for E&P in the Mediterranean, which would strengthen competition. Indications so far are promising.

Can you elaborate on the programme and process for tender submission, evaluation and award of licences. What are the key criteria?

The three blocks were formally offered for competition in the Official Journal of the EU December 2, 2017 for a period of 90 days. Tender submission deadline is March 5.

The key criteria for selection are:

- A good technical programme for the first 3-year phase

- Deepwater offshore experience, with pre-salt and carbonate environments

- Financial capability and production record.

The plan for HHRM is to announce preferred bidders in May.

HHRM has already prepared the infrastructure for the technical and legal information of prospective investors in readiness for tender evaluation. The comprehensiveness of the information is necessary to conduct successful negotiations, both with regards to the working programme of prospective investors, as well as the economic terms that will be have to be negotiated.

What is the plan after award? How is exploration/drilling expected to develop?

The plan after award is to prioritise shooting of 3D seismic, employing advanced exploration methods allowing better definition of the presence of bright spots in carbonate build-ups. The main challenge is to identify hydrocarbon structures in over 2000 m of water and total depth exceeding 5000 m. Such structures will pose challenges for drilling. HHRM has already reviewed the water depth mapping of the areas, especially south and west of Crete. These are characterized by small ridges rising above a bathymetric line of 1000 m or even less. This is very important not only for technical decisions but also for planning drilling budgets by the operators.

In the past IOCs expressed a degree of exasperation with the slowness of the process of awarding licenses. How are you addressing this and how transparent is this process?

Slowness was a problem indeed. HHRM has been addressing these concerns and have identified administrative pathways to speed up the process. We hope this will help to make things run faster. We have streamlined submission of our conclusions, evaluations, proposals, drafts for laws, decrees, and so on, to government ministries and administration and follow-ups to ensure faster response.

The Greek government is also keen to succeed, providing us with strong support, having launched an ambitious programme to discover more oil and gas, spurred on by the protracted financial crisis. Greece is now well on the way out of this and the political climate is more stable.

Tender evaluation will be carried out by HHRM, but licenses will be awarded only after approval by parliament and the Minister of Energy. This process includes the necessary safeguards to ensure transparency.

How is Greece getting ready to support new oil and gas developments?

The necessary infrastructure, services, facilities are largely in place, and where necessary are being improved. After the first phase of three years of exploration, the secondary and tertiary sectors of the local economy will feel the benefit.

HHRM is also aware that Greece’s tourism, wildlife, and fauna require a sensitive approach to exploiting potential reserves and has placed this high up on its list of priorities.

What are your expectations in terms of prospects for new discoveries and where are the potential export markets?

The two important prospective areas offshore are the carbonate platform in the Ionian Sea and the pre-salt subsea mountain chain southwest and west of Crete. This does not exclude the importance of the post-salt sediments and built-ups as prospective reservoirs. This is not uncommon in tectonic forearc settings, which characterise these areas. On the onshore side we will move progressively from the Epirus eastwards first in the messo-hellenic trough which extends significantly into Albania with similar geological features. The most obvious export market is that of Europe from Italy, which is our next-door neighbour.

Should this proceed successfully, when do you think Greece stands to benefit?

We estimate that it will take the first three years of exploration before we understand the full potential of these hydrocarbon plays, on the basis of which we will decide how to continue. This time is necessary between a first discovery and formulating decisions for development.

After that time steps accelerate and, if the environment is responsive and supportive for fast action, the work and cooperation between the country and the companies can be successful and beneficial to both parties.

The next three years will be active. After that, new seismic data, possibly new discoveries, and updated reservoir models will allow us to run another licensing round by 2021 to 2022.

What is the importance of this new sector to Greece's economy? How are you managing expectations?

First of all we are trying to avoid creating false expectations. Provided there are discoveries commercially acceptable by the operators this sector can be added to the portfolio of wealth of Greece and to contribute with revenues to the economy of the country.

For over 30 years Greece wasted many opportunities in the oil and gas sector. This is now our chance to recover this and we are determined to take it. Greece’s energy minister, Giorgos Stathakis, emphasised recently the importance of hydrocarbon discoveries to the recovery of the Greek economy. He also said that the state will ensure that national and European environmental legislation is enforced, to safeguard the environment, which is an important resource for tourism and thus for the national economy.

Greece’s hydrocarbon exploration and production industry has entered a new rather promising period, both in relation to the market environment and oil prices, but also as a result of the work done at the institutional level and at the level of preparation by HHRM. The relevant information on the scope strategy and work of HHRM is available on www.greekhydrocarbons.gr

Thank you, Mr Bassias

Charles Ellinas