[NGW Magazine] New LNG: It's All About the Money

The US cost sets the ceiling for new LNG projects: if a project elsewhere in the world cannot undercut it, on a delivered basis, then it will always face competition from potentially the biggest global exporter.

The world is facing a supply shortage opening up in the middle of the next decade, according to numerous studies of the LNG market; and yet investment decisions have been only modest for the last two years, with only a few small projects sanctioned.

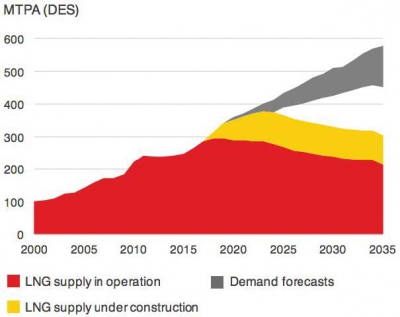

Some future projects might be taken as given, such as those with strong political support. This includes the Qatar expansion (23mn mt/yr) and Novatek's second and possibly even third Yamal projects adding perhaps 40mn mt/yr, both with low costs; others are moving forward, such as Mozambique (13mn mt/yr) or still strongly endorsed by their sponsor such as LNG Canada. Then there are bigger unknowns such as Alaska. But there could be a 200mn mt/yr supply gap by 2035, based on what is operating or under construction now, versus demand.

Emerging LNG supply demand gas

Credit: Shell

That is partly because of the uncertainty of finding a market, when so much competing capacity could be brought on stream in the US, at a fairly predictable price. This was a common message delivered at London’s IP Week gas event on February 21 by companies as disparate as Anglo-Dutch major Shell and US Cheniere Energy. Shell is one of many oil majors that allowed LNG project costs to blow out until the 2014 oil price shock rudely forced them to buckle up.

Cheniere developed a giant Louisiana import terminal just as the US shale gas gale killed off US LNG imports, so it borrowed money to up-end its asset into what is now a successful and pioneering low-cost US Lower 48 LNG export venture.

Their message was delivered in the week that a major export project – curiously with no involvement by an international oil major – announced a further milestone towards development.

The Mozambique LNG venture, led by US independent Anadarko Petroleum, had the previous day announced its signature of a firm long-term contract to supply 1.2mn metric tons/yr to French giant EDF over 15 years, subject to the venture taking a final investment decision (FID), with EDF remarking that its supplies may start from 2023 (see box).

The EDF deal itself followed preliminary deals inked by Mozambique LNG late 2017 both for 15 years: one with Thai PTT for 2.6mn mt/yr, pending approval from Bangkok; and the other by Japan’s Tohoku Electric.

Mozambique on February 7 granted Anadarko and its Area 1 upstream partners approval of its plan of development. Although the US firm has yet to comment in detail, it told NGW that it was "very encouraged" by news from Mozambique of its plan's approval.

It is understood to involve construction of two onshore liquefaction trains, each of 6mn mt/yr, in northern Mozambique fed by gas from the Atum/Golfinho fields in Area 1. The onshore project cost has been estimated at US$15bn, a figure not confirmed by Anadarko.

‘Don’t show up if you can’t compete’: Cheniere

Cheniere Energy vice-president for strategy, Andrew Walker, acknowledged that the LNG business was unlikely to see new 5mn mt/yr contracts signed over 20-25 years as in the past, but said there is interest in competitively-priced supply projects.

This year, his company has signed three smaller, long-term LNG deals: one with trader Trafigura, and two others with China’s CNPC, covering the supply of 1.2mn mt/yr out to 2043.

“We have seen increasing LNG supply availability, so the market will be a cost-plus, rather than fuel-switching-minus model,” said Walker, alluding to how many buyers – especially in Europe – have long abandoned oil as a feedstock for power generation and so see no point in indexing contracts to it.

“If you have a new project that costs more than US prices plus the midstream costs, you shouldn’t show up at the party,” the Cheniere executive said.

Asked later by NGW on the event’s margin if Mozambique LNG’s supply cost economics mean it’s now able to ‘show up at the party’, Walker said he could not comment on Mozambique LNG costs.

Buyers will however “sometimes pay a premium for some supply diversification”, he added. Given that the US though has now set a visible long-term price marker for the LNG sector, this “won’t be a big premium.”

Cameroon floating LNG, a project that took FID in the dark days of 2015, and expected to start producing in 1Q 2018, said how its cost structure could withstand supplying Europe at $5/mn Btu. The Fortuna FLNG project offshore nearby Equatorial Guinea, led by Ophir Energy and as yet still without a a financing plan or an FID, has declared it can meet the same $5 benchmark, and – thanks to geography and cheap feedstock – be competitive with US LNG into Europe.

Shell has amplified that chorus now, with Clare Harris, executive vice president at the supermajor’s Integrated Gas division and in charge of developing new ventures, saying in her IP Week speech that clean air and climate change policy imperatives, especially in Asia, now favour gas – which emits less than a tenth of the emissions as coal. And yet.

“The future success of gas wasn’t assured then, and it isn’t now,” she said. “The industry should take action on cost. Rising costs have challenged the affordability of our product. We have allowed this to become an excuse.”

Technology can help unlock step-changes toward cost reduction and Shell was using that and its resilient portfolio of upstream gas to “structurally remove cost without environmental compromise.”

“For us at Shell, it means lowering the total cycle cost of our new LNG to $5/mn Btu,” said Harris.

Total too said it was concerned to “optimise the full value chain, and drive down costs in all segments,” according to a paper by its head of gas Laurent Vivier, delivered in his absence by gas research manager Maria-Luisa Berlose.

Total’s target for liquefaction installed cost was to repeat the 2009 figure of $500/metric ton set in 2009 by its Yemen LNG. The project has halted exports since April 2015 because of the ongoing civil war.

A few days later, at Shell’s 2018 LNG Outlook launch, Shell’s Integrated Gas & New Energies chief Maarten Wetselaar – so Harris’s line manager – was even blunter. New upstream LNG projects need to be cheaper per metric ton per year than those built in the US, said Wetselaar February 26.

New trading patterns: Yamal may surprise us

Cheniere’s Walker appeared alongside Vitol’s head of LNG, Pablo Galante Escobar at the IP Week gas session on February 21, acting respectively as LNG market bull and bear.

The Cheniere and former BG executive said that 2017 had seen the second largest increment in the history of global LNG trade, exceeded only by 2010 when Qatar started up multiple export trains.

“So far there’s been no oversupply as yet, despite large new supply volumes,” he said, adding that Asian spot LNG prices this winter briefly touched oil parity, and Europe still had no LNG glut.

Escobar acknowledged his 2017 predictions of “softer prices” going into the winter had not turned out as he’d foreseen.

No-one forecast a near 50% increase in LNG imports to China in 2017, he said. However, it was impossible that this would happen in 2018. The reason, he argued, is that its storage is only up to taking 5%-6% of its annual gas use, much less than Europe and the US, and so can’t store in summer as much as what’s needed for the winter. “So, we still expect weaker summer prices,” he said.

All Yamal shipments have come into the Atlantic basin, Escobar added. However, once the northeast Arctic passage opens up in spring and Yamal cargoes start heading east, that could exert a bearish effect on the global market: “Cargoes will be able to reach the Far East in 14 days in the summer. Prices could be set by Yamal.”

Escobar estimated that by summer 2018 there will be 50mn mt/yr extra supply to the market than in summer 2017, adding that the current extra supply is already 30mn mt/yr more than last summer.

“We know that, in Egypt, new gas production is displacing LNG imports and that the country could be a net exporter of LNG in 2019/20,” said the Vitol LNG chief. For that reason, he said he remains bearish regarding LNG prices this summer. He admitted though this could be part of a pattern of more seasonality in 2019 – so with weaker prices in the summer, but maybe stronger winter prices.

Cheniere’s Walker however countered: “I suspect we’ll be back here [in a year] discussing how the LNG market turned out stronger than expected. Supply is visible. But demand is less so. I think the clever people will do things with new supply.

“In 2020, there will be 70 cargoes a month coming out of the US, with 24 lifters. We shall see free-on-board liquidity, and a US price index starting to form,” said Walker. There would also be increasing liquidity in JKM trades.

Liquidity alone however was not a panacea for buyers as it had to go hand-in-hand with new LNG supply volume which, according to Walker “will provide the sweet spot for buyers.”

Floaters and traders

While Escobar had looked at the possible defining role that floating liquefaction (export) projects might have in the future in increasing supply, Walker said that floating (import) ventures could be as effective in increasing demand – noting that 16 of the 25 more recent LNG markets to have opened up were through floating terminals, using FSRU (floating storage and regasification unit) ships. He said a further 20 new markets could “realistically” be opened up in the mid-term by FSRUs.

Both executives agreed that trading houses – Trafigura, Gunvor, Vitol, Noble Group, Glencore – played a key role in future markets, perhaps for reasons of the importers’ perceived higher credit risk; or politics.

Walker said that these five leading western traders had sold about 20mn mt LNG last year, and that such trade could increase significantly in 2019. That 2017 volume is twice the 10mn mt sold by these five in 2015, according to analysis provided last year by consultancy Wood Mackenzie.

Pakistan in particular had embraced traders and the role they can play, said Escobar, claiming also that Vitol alone had accounted for 7.5mn mt of global LNG sales last year.

Mark Smedley

EDF talks to NGW about LNG, indexation and gas contracts

EDF sees LNG as a buyer's market, and Europe is one where hubs are more and more liquid. The French utility's executive vice president for gas and Italy, Marc Benayoun, told NGW in an interview: "Hub indexation plays a very big role in the pricing of this gas. Having to manage and hedge oil indexation is not an easy thing to do. The LNG market right now is a buyers’ market. So, it’s clear that, with current contracts, there is more hub-indexation than the indexation to other fuels that was the case in the past.

"Over the last few years we decided to diversify our portfolio a little towards LNG. That’s one of the reasons why the Dunkirk LNG terminal was developed. The Mozambique contract is moving into that direction, because it will offer EDF a volume into a region where we are very active, namely France and Belgium."

He did not want to comment on whether there would be profit-sharing on diversions, but he said that for Mozambique LNG, "it was key to have access to both Europe and Asia. It has signed a number of contracts, and the main role for this contract [with EDF] is to access the European market. In my view, that makes a lot of sense in the long term. Right now, if you take a pure trading perspective, you might want to take LNG cargoes into Asia where prices are higher. But if you are developing a project with a 20-year time frame, it’s important that you have access to different markets."

Benayoun said he was confident about FID at Mozambique: "This is a significant 1.2mn mt/yr contract with an emerging liquefaction market. We believe this project has a lot to offer and that the chances are very likely that the FID will be taken within the time frame identified by Mozambique LNG, namely late 2018 or maybe early next year. We believe they have made significant commercial campaign and that the project is well structured, so we are confident that the FID will be taken. It’s our first contract with Mozambique and is primarily designed to serve our European needs."