Siemens Advances Egypt Mega-CCGTs

Germany’s Siemens marked a further milestone in its construction of three giant gas-fired power generation complexes in Egypt, each of 4.8 gigawatts, on August 11 when the first heat recovery steam generator (HRSG) modules for Beni Suef in Egypt began their five-week journey from South Korea.

On its arrival mid-September, the boiler is scheduled to be installed at the Beni Suef plant. In May, four Siemens gas turbines, each of 400 MW, were delivered to the same site from Germany. The Beni Suef complex is due to go online before summer 2017.

The modules are shown being loaded at the port of Ulsan in South Korea for their five-week journey to Egypt where they are due to arrive in mid-September (Photo credit: Siemens)

A total of 24 HRSGs are to be delivered to the three 4.8-GW combined-cycle power (CCGT) projects being built at Beni Suef, Burullus and New Capital, with eight such boilers for each plant. Dutch NEM, whose design was used to make the HRSGs in South Korea, was acquired by Siemens in 2011.

Siemens' three giant projects underway are just part of the massive expansion anticipated in the Arab Republic's generation capacity.

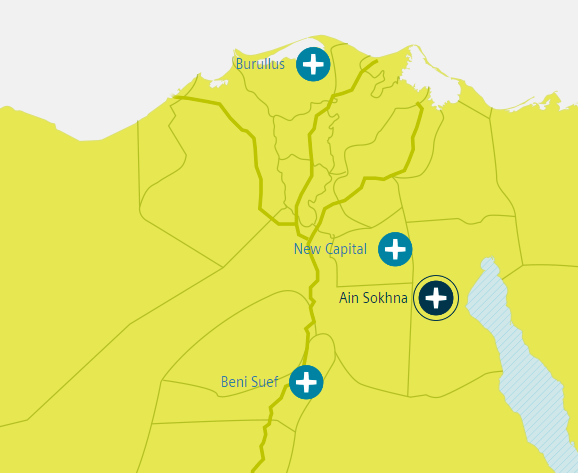

Map showing the three locations of the giant CCGT complexes, plus the Egyptian LNG import terminal at Ain Sokhna on the Red Sea near where Siemens is to build a factory to make wind turbine blades (Map credit: Siemens)

The contracts to install the three giant CCGTs, plus up to 2 GW of wind farms in Egypt (in the form of 600 wind turbines), plus a wind turbine blade factory at Ain Sokhna, were signed in June 2015 and are worth €8bn to Siemens as chief contractor, representing its biggest single order.

Egypt will need to invest $28bn in power generation, a report by ApiCorp said in May, to raise its generation capacity by 21 GW to reach 56 GW in 2020 – inclusive of the 14.4 GW that Siemens is now building. Tight gas supplies might deter new investment in generation capacity in the short term, it said. But once supplies start flowing by late 2017 from the 30 trillion ft³ Eni-operated Zohr field – and from others’ fields – investor anxieties would be allayed. An Egyptian newspaper reports that the country is coping with this summer’s peak generation demands, thanks to LNG import capacity added last year.

Mark Smedley