Eni Makes Loss, Keeps 2016 Production Target (UPDATE)

Adds senior executive remarks from Eni's 1pm BST conference call about Sooros and Zohr in Egypt, Coral FLNG timing, Dutch GasTerra arbitration

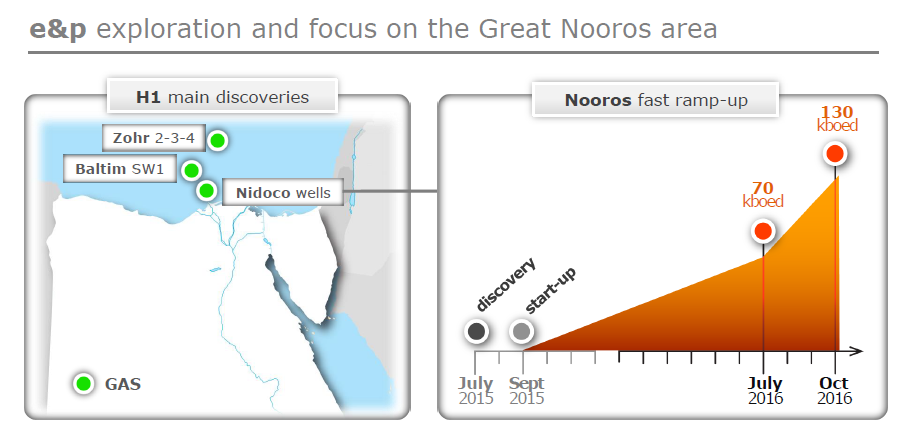

Eni CEO Claudio Descalzi told analysts July 29 that it is maintaining its full year 2016 production guidance at 1.76mn boe/d, noting that the new Egyptian Sooros gas field in which it and BP are partners is already producing 70,000 boe/d gross and ramping up, and that the giant Kashagan oil field in Kazakhstan will return to production this October. Upstream chief Antonio Vella said the latter is due to reach 370,000 b/d gross by mid-2017.

Asked about Coral floating LNG project in Mozambique, which has yet to get the green light, Eni's operations chief Roberto Casula said that the final investment decision is targeted for 4Q 2016 and the process for reaching it is "well advanced". However it's worth recalling that Eni has already deferred FID on Coral by a year. Eni also insisted its case for a lower Dutch gas price from GasTerra isn't over, despite an adverse arbitration ruling.

Eni's final group net loss of €446mn in 2Q 2016 contrasts with a net profit of €498mn in 2Q 2015, as low oil prices, a poor trading environment, a four-month shutdown at its southern Italian Val d’Agri oil field, and sabotage at Nigerian installations sapped earnings. Descalzi said it's hoped to resume production at the southern Italy field within weeks.

Adjusted operating profit in 2Q 2016 was €188mn, 88% less than its €1.55bn in the 2015 period – so on a similar scale to Shell’s 93% collapse in earnings reported July 28 which was also related to low prices and Nigerian disruption.

Eni oil and gas production fell by 2.2% to 1.715mn barrels of oil equivalent/day (boe/d), with liquids down 5.6% at 852,000 b/d though gas increased by 0.8% at 4.7bn ft³/d.

Descalzi chose instead to look at 1H 2016, up 0.5% at 1.734mn boe/d, arguing that production “beat expectations, offsetting the suspension of activity in Val d’Agri and the disruptions in Nigeria.” He told analysts the loss of Nigerian production over the period was 13,000 boe/d.

Realised 2Q prices were 27% lower for oil at $40.58/b and 33% less for gas at $3.11/’000 ft³ – an aggregate $29.30/boe, down 30%.

The company said it has achieved five of its six main start-ups for 2016, including Norway’s Goliat oil field, and Egypt’s Nooros gas field (with BP) expected to produce 120,000 boe/d gross by end-2016.

CEO Descalzi said that Eni is now drilling the fifth well on its giant Zohr field, in the southern part of the structure, having lately drilled wells 2, 3 and 4 but had not issued any update on Zohr resources, despite recent reports that the north of the structure -- closer to Cyprus -- looked better than first forecast. Eni was the only company to have submitted bids for all 3 blocks , ahead of last week's deadline, in Cyprus' third offshore licensing round.

.png)

(image credit: slides from Eni's 2Q 2016 presentation)

Upstream 2Q adjusted operating profits were 78% lower at €355mn, while Eni’s gas and power division made an adjusted operating loss of €229mn compared with a small €31mn profit in 2Q 2015, as its worldwide gas sales fell by 6% to 21.15bn m³, of which just 8.63bn m³ in Italy (down 18%). Eni sold more gas in northern Europe, but sales in Turkey and Spain also fell.

Eni said the poor result in that sector reflected lower one-off benefits from contract renegotiations and other non-recurring events, lower margins on commodity sales owing to an unfavourable trading environment, and competitive pressure. Eni lost a long-running arbitration claim for €2bn covering 2012-15 against Dutch supplier GasTerra earlier this month, reducing any prospect for better earnings in 3Q. But 2Q refining adjusted operating profit was 49% higher at €156mn.

Asked if Eni would make provision for a €1bn award against it in the recent GasTerra arbitration, the Italian firm's gas and power chief Umberto Vergine said it would not, insisting that the arbitration process is not over, and that it has requested a new Dutch gas price review based on different concepts. He said there would be no impact from the arbitration in Eni's 2H 2016 earnings, and that any impact to date has been included in its 1H results.

Vergine added that negotiations with other contractual gas suppliers are ongoing, with a positive result on take-or-pay volume, and that now 65% of Eni's overall gas portfolio is hub-indexed.

Mark Smedley