Country focus: Kuwait – onwards and upwards for LNG [Gas in Transition]

For a country sitting on proven reserves of 1.7 trillion m3 of gas, prospects for developing an LNG export sector are by no means unrealistic. Instead, Kuwait had to turn, in 2009, to imports, which have grown gradually ever since. In 2022, the country imported 8.4bn m3 of LNG, making it the largest LNG importer in the Middle East and a significant mid-scale LNG importer in global terms.

In August, the Kuwait National Petroleum Company (KNPC) upped its summer deliveries in the face of exceptionally high temperatures, which boosted demand for air cooling and therefore electricity, which is generated predominantly from natural gas. Temperatures in August peaked over 50°C. Warmer temperatures for Kuwait mean more power and water demand.

Gas key to meeting growing power demand

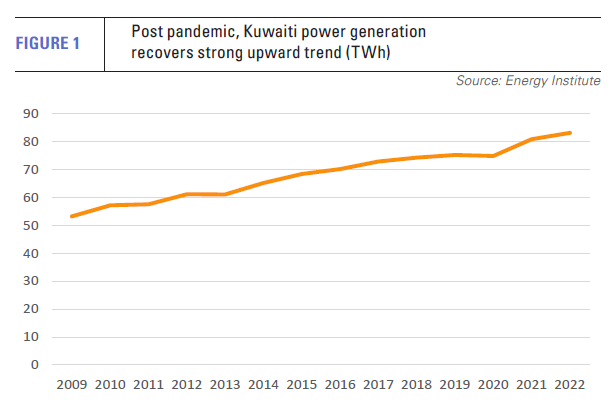

Kuwait’s electricity consumption is on a strong upward trajectory having risen from 61 TWh in 2013 to 83 TWh in 2022, according to Energy Institute data (see figure 1).

The country has one of the highest per capita electricity consumption rates in the world. Both water and power in the country are sold to consumers at heavily subsidised rates.

Population growth has been rapid, although it was dented by the loss of foreign workers during the COVID pandemic. However, growth appears to have returned. In the first half of this year, the population grew 8% year on year, surpassing the pre-pandemic peak for the first time to reach 4.82 million people, although expatriate employment remains 6.6% below its highest level reached in 2019. Non-Kuwaitis comprise more than two-thirds of the population.

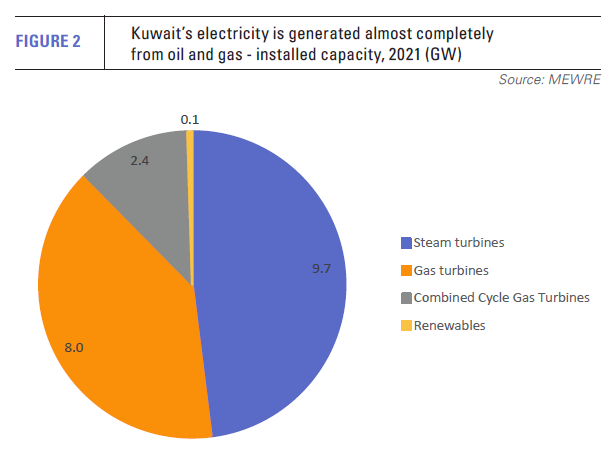

Almost two thirds of electricity is generated from natural gas and the remainder from oil and oil products with only a small fraction met by coal and renewables (see figure 2). Kuwait has prioritised gas in power generation because of its availability as associated gas from the country’s oilfields and because it is cleaner than oil and frees up the latter for export. Oil exports are the primary source of the country’s state revenues.

Almost two thirds of electricity is generated from natural gas and the remainder from oil and oil products with only a small fraction met by coal and renewables (see figure 2). Kuwait has prioritised gas in power generation because of its availability as associated gas from the country’s oilfields and because it is cleaner than oil and frees up the latter for export. Oil exports are the primary source of the country’s state revenues.

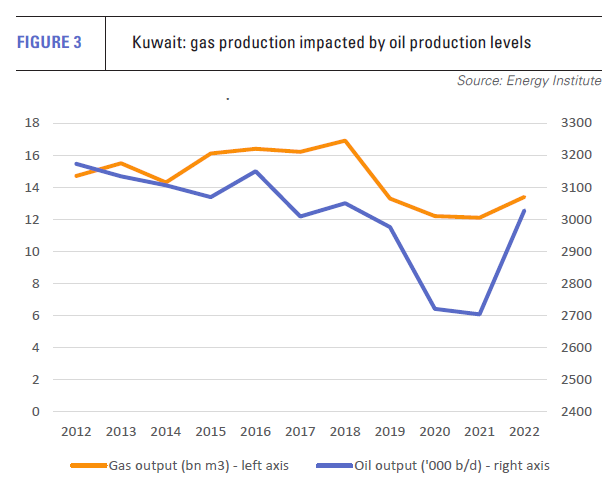

Natural gas consumption has increased by 22% over the last decade to 21.8bn m3. However, as most Kuwaiti gas is associated gas, domestic production waxes and wanes with oil production, which is determined both by global market conditions and OPEC policy (see figure 3). This creates an elasticity on the gas supply side, which is not matched on the demand side. As OPEC limited oil production, gas output slumped from 16.9bn m3 in 2018 to 12.1bn m3 in 2021, rising to 13.4bn m3 last year.

LNG has filled the gap. The fuel is imported at the onshore Al Zour LNG facility, which started up in 2021 with a capacity of 11.3mn t/yr (15.4bn m3/yr). LNG was previously imported via a floating regasification and storage unit at Mina Al Ahmadi.

The FSRU was changed in 2014 to the Golar Igloo with 5.8mn t/yr capacity, but the vessel was relocated to Eemshaven in the Netherlands in September 2022.

There are thus three primary elements in assessing the country’s likely future LNG demand: growth in domestic gas consumption, led by the power sector; the expansion of domestic gas production; and the development of alternative sources of electricity supply.

Renewable energy and nuclear power

Kuwait initially adopted a target of renewables supplying 15% of electricity demand by 2030, but progress has been extremely slow.

The target was later modified to aim for 15% of projected peak electricity load in 2030, which could require more renewable energy capacity than the previous target, depending on the mix of renewable energy sources employed, as wind generation, for example, does not correlate with peak load demand.

A study, Impacts of Kuwait’s proposed renewable energy goals on grid operations, published in the International Journal of Sustainable Energy in July, estimated that the original goal, using a 50/50 mix of wind and solar PV, would require 4.5 GW of wind and 5.5 GW of solar PV to generate 22 TWh of electricity.

Under the modified target, 7.8 GW of solar and 6.25 GW of wind would be required, again based on each technology generating about half of the power required. In this scenario, renewables would generate 29.72 TWh/yr out of forecast demand in 2030 of 148.7 TWh.

Under the modified target, 7.8 GW of solar and 6.25 GW of wind would be required, again based on each technology generating about half of the power required. In this scenario, renewables would generate 29.72 TWh/yr out of forecast demand in 2030 of 148.7 TWh.

As such, the increase in renewable energy generation, if achieved, still implies a rise in other types of generation of about 36 TWh, equivalent to a 44% increase by 2030.

As of the end of 2022, Kuwait had just 106 MW of renewable energy capacity, including 12 MW of onshore wind, 43 MW of solar PV and 50 MW of Concentrated Solar Power.

Despite high levels of solar radiation, solar panels can experience too much heat in Kuwait, as well as desert winds which create dust, reducing efficiency. This creates a constant need for maintenance and cleaning for a country in which water is a scarce resource. The need for desalination plants to increase available potable water is another primary driver of power demand.

Solar uses much less water than fossil fuel plants, but the water needs would be, like the generation itself, more broadly distributed than centralised plants.

Political deadlock

Seemingly continuous political deadlock between the branches of government and successive dissolutions of parliament have made it difficult for energy projects of any kind to progress.

1.5 GW of solar PV was planned as a second phase of the Shagaya Renewable Energy Plant, which hosts much of the country’s existing renewable energy capacity, but this fell foul of the legislature and was cancelled.

Unless the government undertakes a special initiative, the only bodies mandated to construct power plants in the country are the Ministry of Electricity, Water and Renewable Energy (MEWRE) and the Kuwait Authority for Partnership Projects. Phase 2 of SREP was to be built by KNPC.

Based on its current track record, and legislative immobility, moving from 106 MW of renewables to more than 10 GW by 2030 looks ambitious.

Kuwait has also considered nuclear power. In 2010, it announced an intention to build four 1 GWe nuclear reactors by 2022, but the decision was reversed the following year in the wake of Japan’s Fukushima disaster. The country has nuclear cooperation agreements with a number of countries and is in the process of finalising draft legislation for the use of nuclear power, but there are no firm plans at present for construction.

Domestic gas production to determine LNG requirements

Kuwait is targeting production increases from both associated and non-associated sources to meet future gas demand. Key projects are the expansion of Jurassic gas production in the north of the country, which is expected to rise by 3bn m3 in 2024. The gas is sour, which adds additional recovery and treatment costs.

In 2022, Kuwaiti signed an agreement for development of the Dorra gas field offshore in the neutral zone. The neutral zone is a 5,770 km2 area between Saudi Arabia and Kuwait, the borders of which have never been defined. The two countries share joint sovereignty. Oil and gas resources in the neutral zone have been exploited under joint cooperating agreements, but disagreements led to a suspension of production in 2015, which lasted until 2020.

Last year, Kuwait and Saudi Arabia agreed to develop Dorra with production expected to be 10bn m3/yr of gas and 84,000 b/d of condensate, shared equally between the two. The field’s reserves are estimated at 220bn m3.

However, development of the field is complicated by Iran’s claim that 40% of the field lies within its maritime territory. Both Kuwait and Saudi Arabia dispute this and the maritime boundaries remain ill defined. Development of Dorra could thus be stymied either by complications with Iran or disagreements over the development plan and resource sharing between Saudi Arabia and Kuwait (as in the past). The boundaries of the field itself also need delineation.

Overall, KNPC has large-scale plans for increased gas production, targeting 25.8bn m3 of non-associated gas by 2040. Associated gas volumes will also increase as the country pursues an expansion of its oil production to 4mn b/d, a target once set for 2020, when total liquids production reached 2.67mn b/d.

Overall, KNPC has large-scale plans for increased gas production, targeting 25.8bn m3 of non-associated gas by 2040. Associated gas volumes will also increase as the country pursues an expansion of its oil production to 4mn b/d, a target once set for 2020, when total liquids production reached 2.67mn b/d.

However, as with renewables, missed targets are the norm rather than the exception. As a report by ratings agency Fitch notes, the country’s 2040 target for non-associated gas is ambitious given the lack of projects targeting free gas coming on stream over the next decade.

The report observes that a target of 25.8bn m3/yr has been pushed back from 2030 to 2040 and a target of 10.3bn m3 by 2020 was missed by some margin.

Fitch put non-associated gas output at 5.4bn m3 in 2021 and expects total gas production to grow by 5.2% a year between 2021 and 2030, which implies an increase from 12.1bn m3 in 2021 to about 20bn m3 by the end of the decade.

Although there are many factors involved, if all this gas were used for power generation (based on US gas to power conversion rates in 2021), it could meet forecast demand to 2030, but only if the country’s renewable energy targets were completely met.

If some slippage in both the renewable energy targets and gas production forecasts are assumed, coupled with the evident desire to continue displacing oil use with gas in power generation, it is likely that Kuwait’s LNG demand will continue to rise, albeit fluctuating in line with OPEC policy and the level of associated gas generated from oil production.

This opportunity may well be snapped up by Qatar’s expansion of its LNG output, given the short haul economics of deliveries within the Middle East, but Kuwait LNG imports to date are diverse, suggesting opportunities for other suppliers. Qatar supplied only 3.9bn m3 of Kuwaiti LNG demand in 2022, with the remaining 4.5bn m3 sourced from the US (1.5bn m3), Nigeria (1.5bn m3), the UAE, Trinidad & Tobago, Oman, Egypt, Algeria and some re-exports from Europe.