GB Winter Review Finds Gas Market Worked Well

The British gas market managed the higher than expected demand over the winter well, transmission system operator National Grid (NG) said June 7 in its Winter Review, an annual report. This was despite major outages and the freezing weather and lower LNG deliveries than in the previous year.

The system was never operationally at risk, it said, as peak-day demand of 417.6mn m³ is low compared with what it used to be a decade or so ago: above 440mn m³/d.

Nonetheless March 1 was the seventh coldest day since records began almost 60 years ago, prompting NG to issue a 'gas deficit warning' in order to draw attention to the supply and demand imbalance and to encourage market participants to take action.

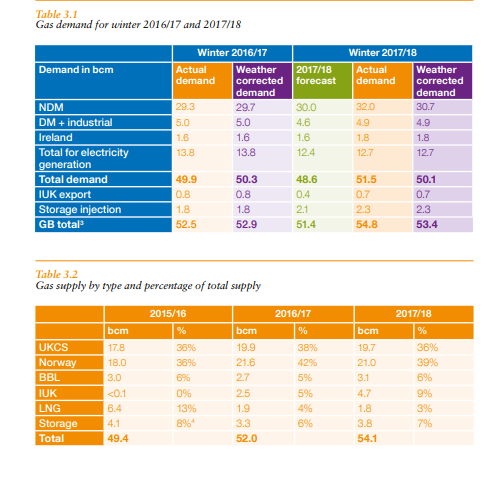

Demand however was met on all days, despite the disruption to the Forties pipeline in December and unusually cold weather in late February and early March, as deliveries from Norway over the winter were high, albeit slightly lower than the winter before (21bn m³ during the six-month period from October 2017 to March 2018 covered by the report, down from 21.6bn m³ in winter 2016/17).

Imports through the Interconnector were much higher than last winter, even if they never reached the daily maximum of 74mn m³/d, NG said. Over the period the UK-Belgium pipeline carried 4.7bn m³, almost twice the 2.5bn m³ in 2016/17. Flows through the Dutch-UK Balgzand-Bacton Line (BBL) increased as forecast to 46mn m³/day, close to the maximum capacity, in December, in response to the Forties pipeline shutdown. Flows through BBL in January were above 35mn m³/d, rising to 44mn m³/day in early March, when temperatures were at a seven-year low for the UK.

Withdrawal of gas from Rough, the UK's biggest storage facility until it was no longer classified as such, started in September. In January, it was formally classified as a producing field rather than a storage site, and deprived of that asset, shippers cycled gas more than the year before, using mid-range storage for short-term arbitrage.

The report made no reference to the very high spot prices and the effect they had, if any, on damping demand during the depths of winter. In past years NG was able to restrict gas supplies to major industrial customers who had interruptible transport contracts; these however no longer exist.

Tables from National Grid's 2018 Winter Review and Outlook, published June 7 2018, and available here. Winter in this context refers to October-March periods.