The Russian gas war: who suffered most? [Gas in Transition]

Gazprom plunged to a net loss of $6.9bn in 2023, its first annual loss in more than 20 years, as sales to Europe plummeted in the wake of Russia’s war in Ukraine. This result was expected, as to stay profitable, Gazprom needed to sell more than $21bn of gas/quarter. On top of that, in a recent tweet[1], the UK’s Defence Intelligence mentioned that not only “high taxation on Gazprom’s revenues in 2022 and 2023 has almost certainly reduced the ability and incentives for Gazprom to invest in its expansion to alternative markets” but also “the Russian government plans to further increase the tax burden on Gazprom in 2024, which likely contributed to Gazprom’s decision to cut its investment for 2024 by around 15%.”

But the real question is who suffers the most from the Kremlin’s weaponisation of gas supply: the EU and Russia? If energy security is defined as the uninterrupted availability of energy sources at an affordable price, it is interesting to assess the cost of failure to ensure that security. Amid skyrocketing energy prices, €390bn (or 2.5% of EU GDP) is estimated [2] to have been effectively spent in 2022 at the EU and member state level to reduce the burden of record high energy prices using direct subsidies. If we assume that the €124bn dedicated to renewables, nuclear R&D and energy efficiency are long term subsidies to fast track the energy transition, it leaves €266bn (or 1.7% of EU GDP), that represents the failure of properly addressing EU security of energy supply. Fortunately, those subsidies have been falling since 2022, but are still material. If, on the other hand, we estimate that the full 7.6mn b/d of Russian oil and oil products exports are restricted to the EU+G7’s caps, then Russia is losing $69bn/yr. If we then add the 112bn m3/yr of gas exports curtailed to the EU, another $21bn revenues are lost. In total, forgone revenues amount to $90bn for Russia. In 2022-2023, contrary to consensus, the Russian budget was less affected by the Western sanctions than the EU contending with its energy crisis. This is about to change, so Russia will need to be innovative for its army to perform better with less money. The government reshuffle mid-May which sees the Russian defence ministry now led by a former deputy prime minister who specialises in economics, shows that finance is of paramount concern.

EU gas-fired power generation declines further

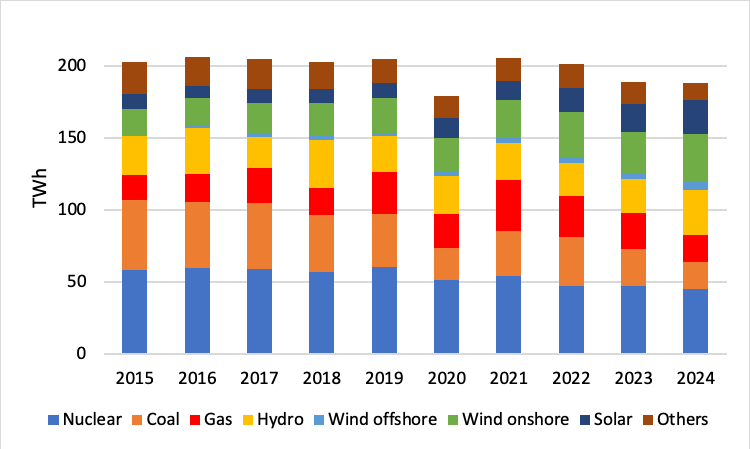

In Q1, with hydro, renewable and nuclear power generation up year/year by respectively 25%, 12% and 4%, coal and gas power plants had to be switched off. Coal- and gas-fired power electricity were down by respectively a massive 24% (26 TWh) and 10% (10 TWh).In April, the situation further deteriorated with flat electricity production.

EU public net power generation in April

Sources: Energy-Charts.info, thierrybros.com

Gas for power was down by 25% (6 TWh) in April. Wind and solar alone added 11 TWh in April (after 19 TWh in Q1). For gas demand this four-month drop equals to an annualised drop of 10bn m3 (or -3% versus total 2023 demand on an annual basis). Power generation should again be the single biggest cause of gas demand destruction in the EU in 2024.

With €0/MWh for electricity spot prices for long hours around sunny lunch time in Southern Europe, utilities are going to face further financial stress and residential customers will be further incentivised to put more solar panels to avoid paying an inflated full price (inclusive of taxes) to utilities.

With virtually no growth in electricity demand expected and wind and solar adding 90 TWh/yr or 3.7% of total 2023 production, coal and gas are moving out fast of the power system.

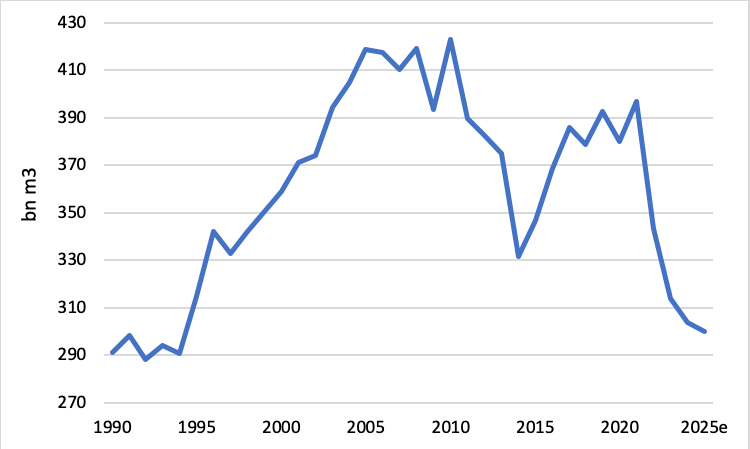

EU gas demand

Source: EI Statistical Review, thierrybros.com

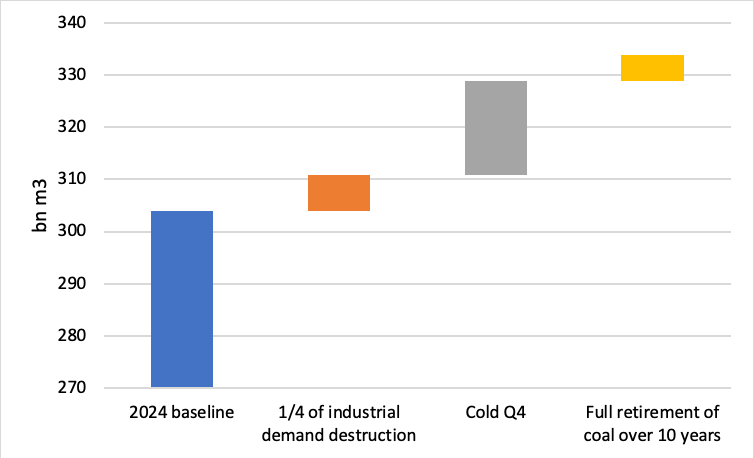

In front of this coal-and-gas-switch-to-renewables, the remaining hopes for the gas industry could be:

● Some of the industrial demand destruction witnessed in 2022, to come back;

● A cold Q4 2024;

● For coal to be retired faster than gas (as discussed at lastest G7). In 2023, 327 TWh of electricity were produced with fuels more polluting than gas. To replace what could be left in 2024e (250 TWh), it would need an additional 50bn m3 of gas.

Maximum possible upside remaining for gas in 2024e

Source: thierrybros.com

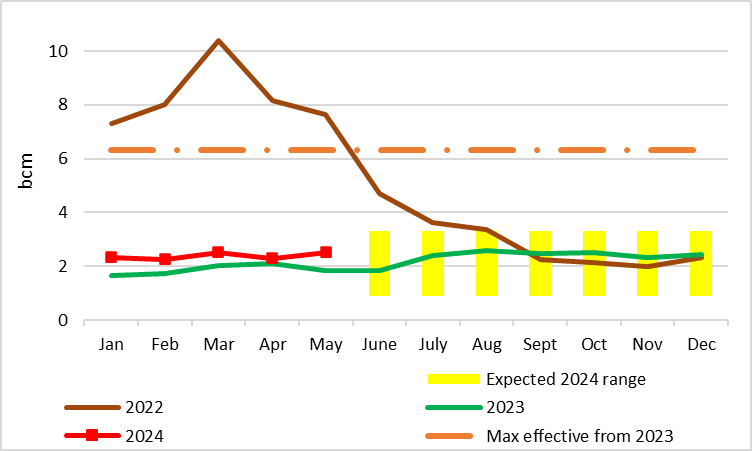

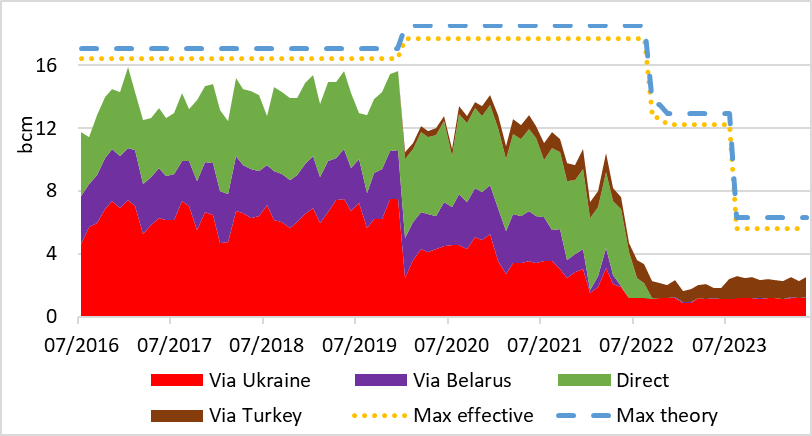

With 2.5bn m3 exported in May 2024 versus 1.8bn m3 in May 2023, Gazprom’s exports to Europe have been up yr/yr for nine months in a row. Since the begining of the year, exports are up 28% yr/yr, when EU policymakers continue talking about reducing both domestic demand and Russian supplies[3].

Gazprom's monthly gas exports to Europe

Sources: Entsog, thierrybros.com

We should continue to witness Russian pipe flows to move in the expected narrow range of between 0.9-2.4bn m3/month.

Split of Gazprom's monthly gas exports to Europe by route

Sources: Gazprom, GTSOU, Entsog, thierrybros.com

The European market seems to have gotten used to gas prices of around $10/mn Btu. As Asian contracts are oil-linked, as long as Asia takes its contracted volumes, Europe will have to pay a spot price closely linked to the Asian oil-indexation of around $85bn. After years of trying to move away from oil-indexation, Europe is caught back up by the formula it wanted to avoid at all costs.

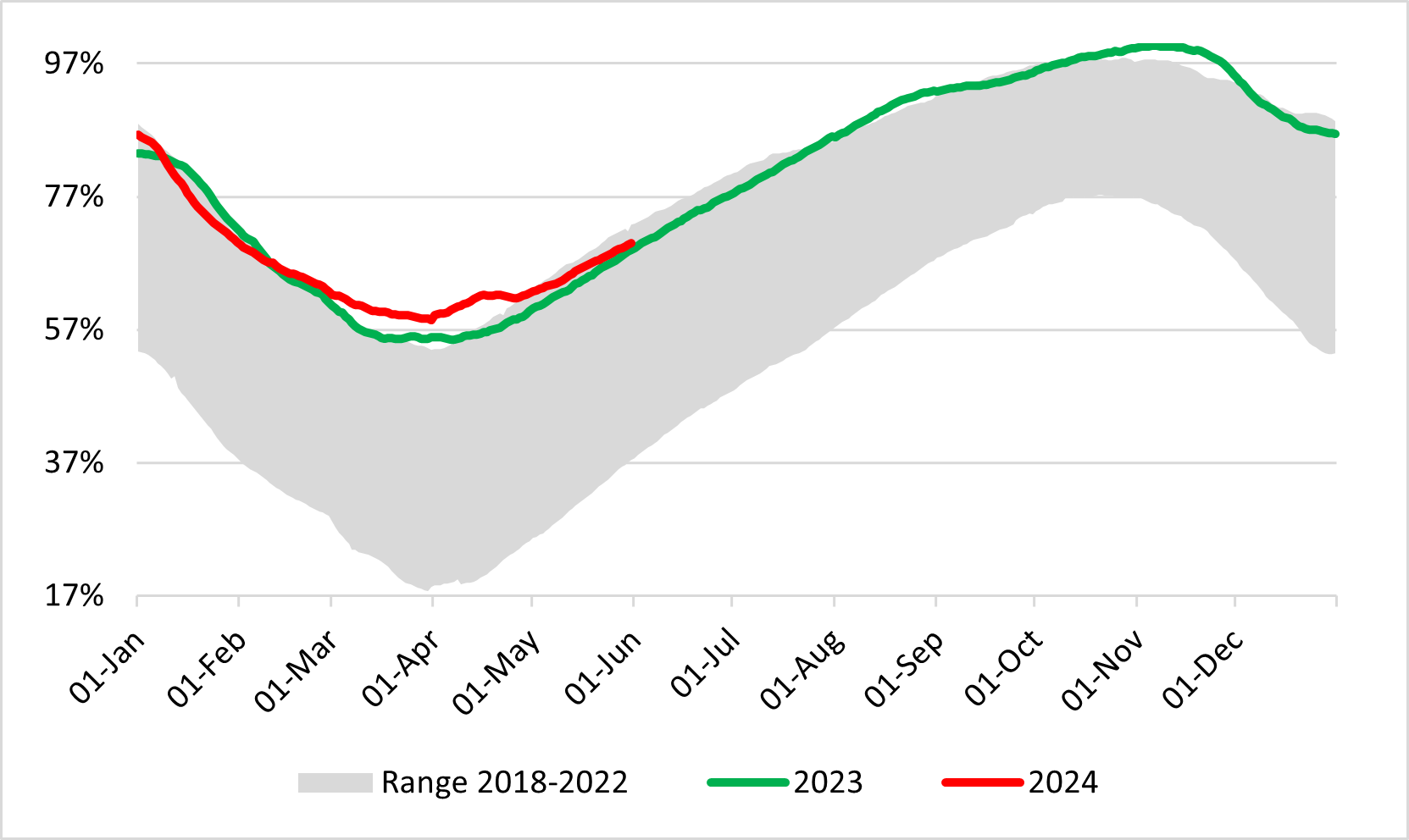

On March 31, with storage facilities filled to a record of 58% of capacity, the summer injection started. Unusually cold temperatures in the second half of April caused storage levels to move back in the historical range. Storage utilisation ended May at 70%, close to record level.

EU gas storage utilisation

Sources: GIE, thierrybros.com

Dr. Thierry Bros

Energy Expert & Professor

June 3, 2024

[1] Ministry of Defence

_f1920x300q80.jpg)