Statoil Swings Back into Black, Watches Costs

Statoil's adjusted earnings tripled to $12.64bn last year, from $4.07bn in 2016, while 4Q 2017 earnings were $3.96bn versus the year-ago quarter's $1.66bn.

The Norwegian state-controlled company reported February 7 net income for 2017 of $4.6bn, contrasting with a net loss in 2016 of $2.9bn, while in 4Q its net income was $2.58bn, up from a net loss of $2.79bn in 4Q 2016.

CEO Eldar Saetre said that, whereas in 2013 its new projects were required to break even at $70/b, that breakeven target had been slashed to $27/b in February 2017, and now has been reduced further to $21/b. Despite this, Statoil expects to bring 3.2bn barrels of oil equivalent (boe) onstream by 2022, based on that $21/b breakeven.

“I believe we have used the downturn well, but the real test is happening now as prices recover, I see as a former CFO how easy it is to relax. We are determined not to allow this,” he said.

He said the return on average capital employed (Roace) is forecast at above 10% in 2018, and noted how cost per well drilled had decreased by 10% between 2016 and 2018.

Full year 2017 net equity liquids and gas production was 5% higher at 2.08mn boe/d, and up year on year in 4Q2017 by 2% to 2.13mn boe/d. The 4Q increase was primarily due to higher flexible gas production to capture higher prices; increased production US onshore; and the ramp-up of new fields. It said this represents all time high production, and shows an underlying production growth of over 6% in 2017.

Pre-tax adjusted earnings from E&P Norway were up from $2bn in 2016 to $3bn in 2017, while E&P International was $438mn – a $1.1bn improvement from the $638mn loss in 2016.

Organic capital expenditure in 2017 was $9.4bn. Statoil expects this to go up to around $11bn this year. The rise in costs reflects a ramp up in spending at the big Johan Sverdrup oil development, plus smaller ramp-up in spend at Gina Krog (oil and gas) and “some issues” being resolved at the Eni-operated Goliat oil field where Statoil is the other partner. (Statoil separately announced that the cost of phase 1 of Johan Sverdrup is now estimated at kroner 88bn [$11.2bn], amounting to a reduction of kroner 35bn or 30% since its plan for development and operation (PDO) was approved August 2015; the phase 1 breakeven is now reduced to below $15/b)

On new project sanctions, Saetre said that big final investment decisions (FIDs) in 2018 would be Johan Sverdrup phase 2 and the Troll gas field phase 3 expansion. Troll is the biggest and most flexible gas field.

There were reversals of impairment of $628mn in 4Q2017 that boosted net operating income. Statoil also said the positive benefit of the US tax change on its 4Q2017 earnings was $350mn.

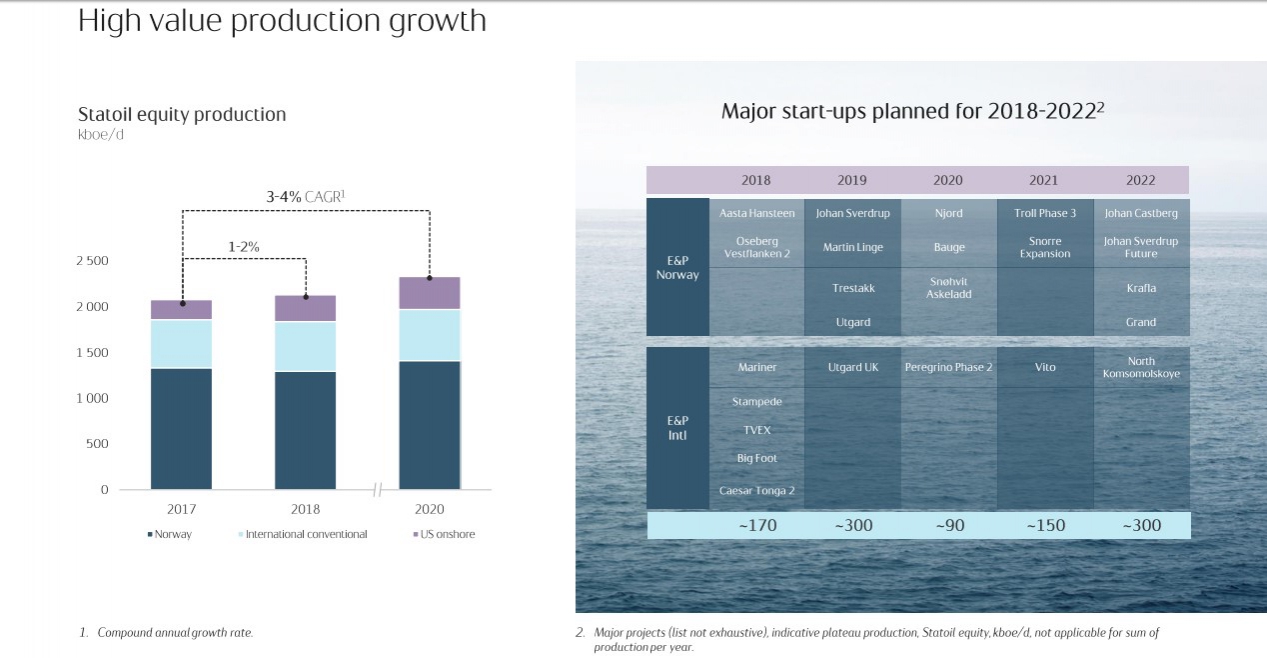

Statoil also expects 1%-2% production growth in 2018 and an annual production growth of around 3-4% from 2017 to 2020. It also expects to drill around 40 exploration wells in 2018 costing some $1.5bn.

Some 25-30 of those would be offshore Norway, but of the remaining 10 or so, three or four would be offshore Brazil where it last year bought into some of state Petrobras' acreage; as well as a few onshore wells to be drilled in Turkey and Argentina.

He said Statoil was midway through an exploration campaign in the southeast Barents Sea, above the Arctic Circle in Norway, and that four or five wells are targeted there in 2018, after which Statoil would review results. The drilling yielded little in 2017 and there are legal challenges ongoing to Arctic exploration over awards made by the government to all operators in its 2016 licence round.

The oil-gas ratio is shifting in favour of gas, thanks to the Q4 surge when production was 1.12mn b/d liquids, down 4%, and 1.013mn boe/d gas, up 9%. But Saetre said there was no strategic push towards oil or gas: He said production was roughly 50-50 in Norway: “What we’re looking for is value – whether from oil or gas doesn’t matter for us ….We are value driven, I don’t want to set volume targets.”

He also said that Statoil is now free cashflow positive above $50, such that last year with the average Brent price of $54.2/b (up 24% on 2016) it realised a $3.4bn free cash flow. At $70/b, it could generate $12bn, he said. However in a more conservative forecast, he will tell analysts at Statoil’s Capital Markets Day later this morning: “We expect to increase returns and can deliver $12bn in free cash flow from 2018 to 2020." He also said that Statoil expects to invest 15%-20% of total capex in new energy solutions by 2030.

In 4Q 2017, while Brent rose 24% to $61.3/b, Statoil's average realised E&P Norway liquids price firmed 27% to $57.2/b while its E&P international liquids price was 29% higher year on year at $54.4. Its 4Q average invoiced Europe natural gas price was 18% up year on year at $6.27/mn Btu, whereas its average invoiced US natgas price was flat at $2.53/mn Btu. Its refining reference margin was 4% lower at $5.5/b.

Statoil slide (January 7 2018) showing major field start-ups planned in 2018-22

The banner photo is Valemon platform in the North Sea (Photo credit: Statoil / Harald Pettersen)