Statoil To Pay $2.9bn for Brazilian Field Stake

Update at end on Libra phase 1 investment decision by Total, partners.

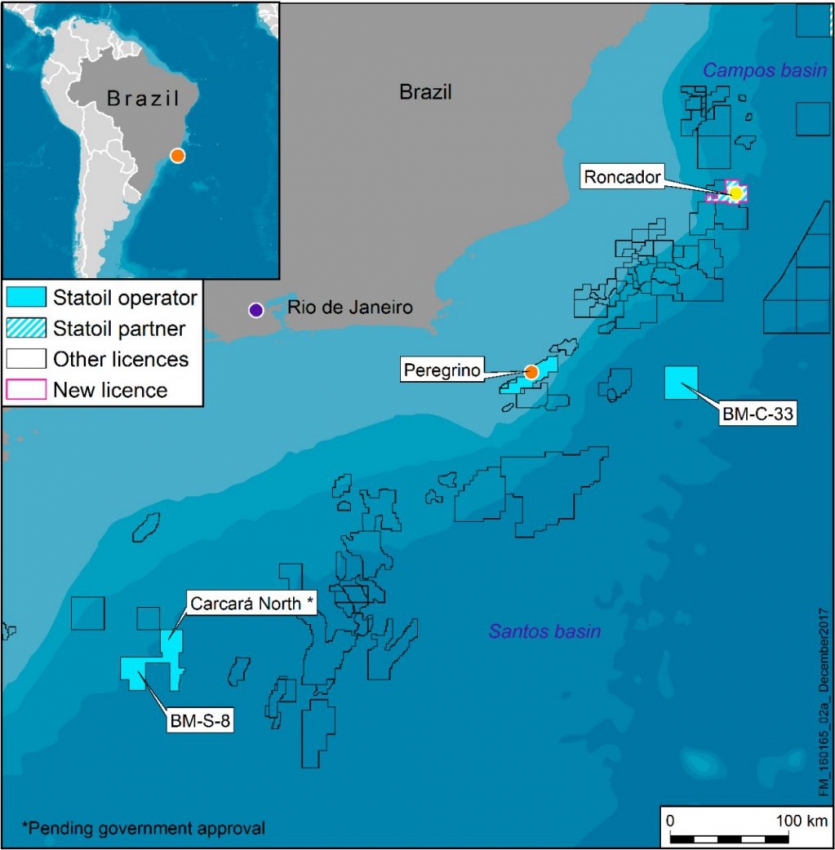

Statoil is to acquire a 25% interest in Roncador, a large oil field in Brazil's offshore Campos Basin, from Petrobras for an initial $2.35bn plus additional contingent payments of up to $0.55bn, the Norwegian company said December 18

It will increase Statoil’s net production in Brazil to 110,000 barrels of oil equivalent/day, from around 40,000 boe/d now. Petrobras retains operatorship and a 75% interest in Roncador.

Statoil said the field has been in production since 1999 with November 2017 output of around 240,000 b/d oil plus around 40,000 boe/d of associated gas. It was the largest discovery offshore Brazil in the 1990s and is the third largest producing field in Petrobras’ portfolio with around 10bn boe in place and an expected remaining recoverable volume of more than 1bn boe. The ambition is to increase the recovery factor by at least 5% to over 1.5bn boe.

Statoil and Petrobras have also agreed that Statoil will have the option to use part of the capacity at Petrobras’ Cabiunas natural gas terminal to allow for the future development of BM-C-33, where both companies are partners and which contains the world class Pao de Açucar oil discovery.

Petrobras CEO Pedro Parente is in Oslo to meet Statoil CEO Eldar Saetre in Oslo for the signing later December 18; it follows a memorandum of understanding agreed between the two firms in August 2016 and a heads of agreement in September 2017. The effective date for the Roncador transaction is 1 January 2018. Closing is subject to certain conditions, including government approval.

Map of Statoil interests in Brazil's offshore Santos and Campos basins, including the 25% stake to be acquired in Roncador (Map credit: Statoil)

Update December 18, 3.15pm

Total and partners have taken the investment decision for the phase one development of the Libra deepwater oilfield project, 180 kilometers off the coast of Rio de Janeiro, in Santos Basin consisting of a floating oil production ship (FPSO) of 150,000 b/d capacity and 17 wells. An early production system began producing Libra oil last month, thanks to a 50,000 b/d FPSO, and the larger 150,000 b/d capacity ship is expected to come onstream in 2021. In this context, Libra operator Petrobras also disclosed it had awarded the contract for the 150,000 b/d ship to Japan's Modec. In subsequent years, Libra will roll out with the addition of at least three other FPSOs, said Total, and eventually could reach production of more than 600,000 b/d gross; the Libra consortium is led by Petrobras (40%), partnered by Total and Shell (each 20%), plus Chinese state CNOOC and CNPC (each 10%).

Update June 15 2018:

Equinor (formerly Statoil) said it has completed its Dec.2017 transaction with Petrobras, whereby Equinor has acquired a 25% non-operated interest in the Roncador oil field in Brazil’s Campos Basin. Reflecting equity volumes produced since the effective date of January 1 2018 and the deposit paid upon the signing of the transaction, Equinor has now paid Petrobras an adjusted cash sum of $2bn; it has additional contingent payments of up to $550mn to pay, related to investments in projects to increase the recovery from the field.