Ophir Targets Mid-2017 for Fortuna FID

A final investment decision for the Fortuna floating liquefaction (FLNG) project offshore the West African nation of Equatorial Guinea is “on track for mid-2017”, said UK independent Ophir Energy said March 9.

Ophir reported a net 2016 loss after tax of $77.4mn, down from its 2015 loss of $322.5mn. Its 2017 net production guidance is 12,500-13,500 barrels of oil equivalent (boe) per day.

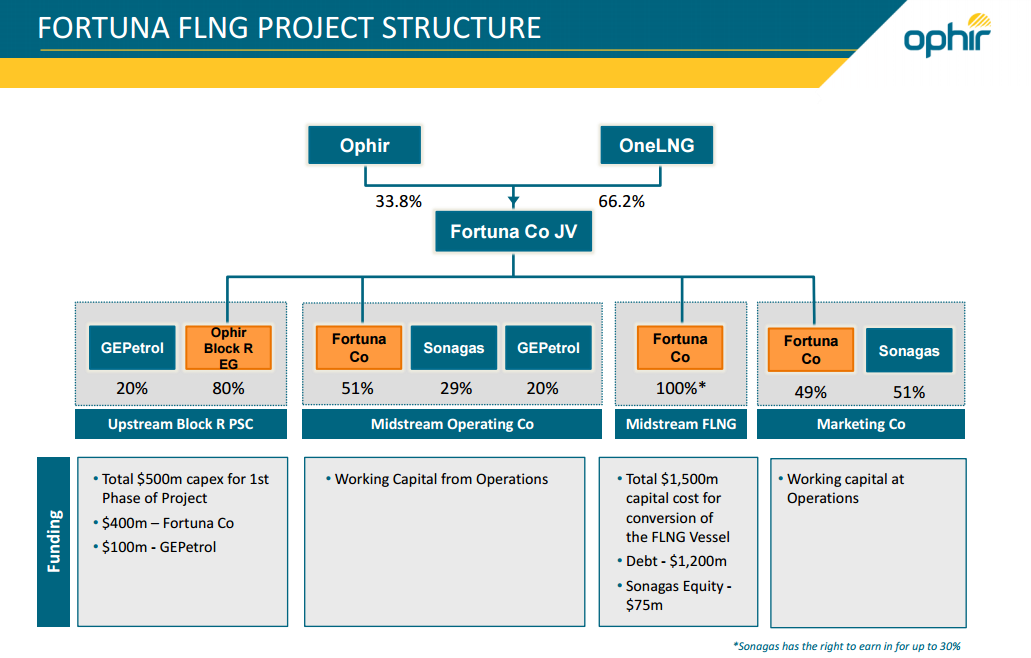

In its results statement, Ophir said it will invest no more than $120mn of the $2bn capex required in Fortuna FLNG to get to first gas in mid-2020; it expects a return of over five times that investment. The project at 100% equity would monetise 345mn boe, it added. That would provide about 16,000 boe/d net for Ophir's roughly one-third share.

A year ago, Ophir gave its FID target for the project as mid-2016 which was not fulfilled. But late 2016 it signed an agreement with Schlumberger/Golar joint venture, OneLNG, which now has two-thirds equity in Fortuna FLNG. Ophir now adds that a term sheet and in-principal debt approval has been signed with a club of Chinese lending banks, while it expects LNG sales contracts will be announced “in 2Q2017.” Two weeks ago Golar LNG's CEO Oscar Spieler also said he now expects FID on Fortuna in "mid-2017".

Fortuna FLNG project structure (Graphic credit: Ophir Energy, March 9 2017 presentation)

Elsewhere in its portfolio, Ophir said it expects to spud the Ayame-IX oil exploration well in Cote d’Ivoire May 2017, to ramp up its Kerandan gas production in Indonesia whilst continuing gas operations in Malaysia and Thailand, and in Tanzania to await “a clear legal framework” from the new government for the onshore LNG plant that will monetise offshore Shell-operated Areas 1 and 4 gas (Ophir equity: 20%). Ophir’s presentation did not give target dates for FID and first LNG in Tanzania, but some think exports may not happen before the mid-2020s.

Ophir also noted it has entered Mexico for the first time, as part of a US Murphy-operated consortium (alongside US fund Riverstone's Mexican upstream subsidiary Sierra Oil & Gas and Malaysian state Petronas), that won rights to block 5 in the first deepwater licence round last December; drilling is not expected to start until 2019.

Mark Smedley