Nord Stream 2 "Indispensable", says Defiant OMV Chief

Austrian energy group OMV chief executive Rainer Seele has insisted that the Gazprom-led Nord Stream 2 pipeline (NS2) project is “indispensable” to European gas security of supply and that OMV will implement it “as fully as possible.”

Whilst he said it was premature to assess the impact of US sanctions against Russia, Seele told a 1H results briefing August 10 that the US enabling act was "written in order to sell more LNG into Europe" and that Europe had correctly responded to such a challenge to its energy security by “laying down red lines.”

Nor OMV does expect US sanctions to affect progress with its two key upstream projects with Gazprom in Russia: the Yuzhno Russkoye gas field, and Achimov IV/V, he added. Seele's defiant tone matched that of Uniper CEO Klaus Schafer two days earlier.

Seele said meanwhile that the deal to buy a 24.99% stake in Yuzhno Russkoye from Germany’s Uniper for $1.85bn is now only awaiting Russian approval and is expected to conclude on schedule by end-2017. He also said that talks with Norwegian authorities over OMV’s plans to divest a 38.5% of its OMV Norge subsidiary to Gazprom – under an asset swap for the Achimov interest – would start this autumn.

Asked if OMV might exit the NS2 project, he said it was hard to read the future but that it remains OMV and its European partners intention to finance their full 50% share of the project.

Seele said the original plan was that, of that half share, 30% would come from direct equity from the five western firms involved (also including Shell, Engie, BASF and Uniper) and 70% from project finance. He said that banks’ willingness to lend was more open to question. “It may be that OMV may have to fund more than the 30%, but we’ve said we are willing to finance up to 100% [of the western partners’ 50% commitment],” explained Seele.

He argued that NS2 was indispensible as it would provide access to additional gas supplies that Europe will need, without the obligation to purchase.

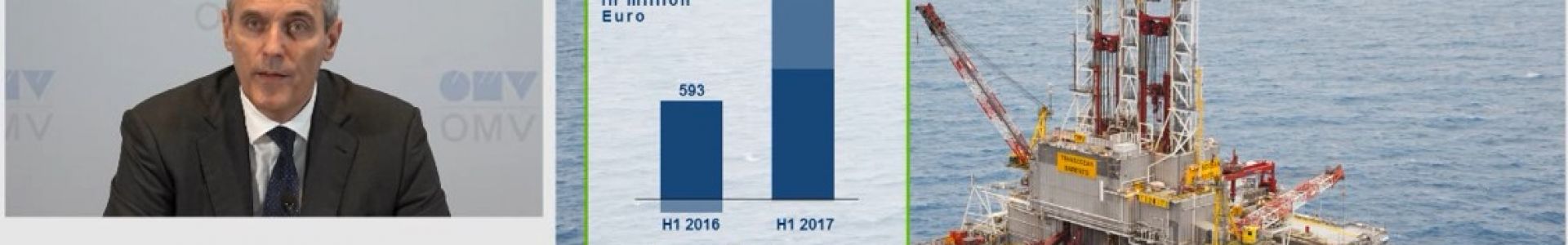

OMV's clean current-cost-of-supply (CCS) operating result in 1H2017 – the Austrian firm’s preferred measure of business performance -- was €1.467bn, up 147% from €593mn in 1H2016, with the 2Q2017 figure doubling year on year to €662mn.

However OMV made a net loss attributable to shareholders of €316mn in 1H2017 – and a €1.028bn net loss in 2Q2017 (so six times the loss of €168mn made in 2Q2016) chiefly as a result of a €1.2bn historic net losses on foreign exchange booked as a result of the completion in June of its divestment of Turkish downstream business Petrol Ofisi, which OMV sold for €1.368bn cash.

OMV also admitted that, of its €1bn sale of its UK upstream to Siccar Point concluded January 2017, the book gain made was a mere €137mn.

Net production to OMV was 337,000 barrels of oil equivalent in 1H2017, up 7%, and expected to average 330,000 boe/d in calendar year 2017. Of that natural gas made up 161.1bn ft3, up 3%, while liquids were 32.4mn bbls. Upstream earnings increased on higher volumes from Norway and Libya, and also on a 39% gain in OMV’s average realised 1H2017 crude oil price to $48.17/b and an 11% rise in its realised gas price in Europe to €15.25/megawatt-hour gas.

A further report on OMV’s Black Sea gas strategy will follow

Mark Smedley