[NGW Magazine] Europe braces for gas conflicts

Gazprom has rejected the Stockholm arbitration ruling, meaning more political tensions between Moscow and parts of Europe, but the pipelines running east-west are humming as never before.

Politicians in the European Union, Russia, Ukraine and the European Commission are asking each other how much gas will flow through Ukraine once the transit contract with Gazprom ends in 2019. There are also differences of opinion between some EU member states about the best way to bring in Russian gas. But with record flows in the first four months of this year, the outlook for Gazprom is not so bleak.

The US administration is keenly watching the progress of these talks to make sure that Ukraine receives something in the form of transit revenues to help prop up its weak economy, and it is also ramping up pressure against Gazprom’s five Nord Stream 2 financing partners with threats of sanctions. But so far the talks have been long on promise, short on detail.

Meanwhile Gazprom and the Russian government, its main shareholder, are considering all options to ensure secure and profitable deliveries of gas to Europe in terms of physical infrastructure, be it storage or pipelines, and they will be taking some comfort from the higher prices and volumes so far this year. But Nord Stream 2 is still the most critical item on the agenda.

So far the quietest partner in the project has been the French company Engie, which is becoming greener by the minute – in the space of a few days it announced the sale of its 3-GW coal and gas-fired power generation business in Asia, Glow, of which two-thirds was gas-fired, and the launch of a scheme to inject hydrogen into the gas grid – while German and Austrian firms BASF, Uniper and OMV have gone out of their way to express support for it. However, Engie told NGW June 21 that NS2 was of strategic importance to Europe's security of supply and that gas itself was part of the picture, at least in the first stage of the energy transition.

It is possible that if Gazprom’s pipeline exports to the west continue growing at the rate they have been, then Ukraine will be able to transit more gas from Russia than it was expecting to post-2019. But it is not clear that Gazprom and Ukraine will agree the terms of another transit contract. Unless the two both expect to abide by them come what may, including the dispute resolution clause, it could anyway be a wasted effort, as the protracted Stockholm arbitration ruling of February 28 has so far failed to stop the dispute. Gazprom challenged the implementation of the ruling at an appellate court in Sweden, and succeeded, claiming this vindicated its refusal to pay up; while Ukraine’s Naftogaz maintains that this ruling only related to the seizure of Gazprom’s Swedish assets. Naftogaz said it was confident that the Stockholm court would rescind its suspension decision once it had read Naftogaz’ own submission. Its similar suits to Dutch, Swiss and UK courts were all successful – although Gazprom has said it will go after those rulings too and try to overturn them.

Russia revives Yamal-Europe

Further hedging its transport bets, Russia will invest $3.5bn in the Gazprom-owned gas transport system of Belarus, Russia's president Vladimir Putin told the Union State Supreme State council meeting in Minsk in mid-June.

Of that total, $2.5bn will go on renovating the Belarusian section of the Yamal-Europe gas pipeline and the rest on additional underground gas storage facilities (UGS), which now total 1.1bn m³ capacity. The aim is to modernise the system by the end of the decade, the statement said.

"Given the technical condition of other routes for the export of Russian hydrocarbons, in particular gas, to Europe, they are, frankly speaking, unsatisfactory. So the Belarusian route becomes more important," Putin added, perhaps comparing it favourably with Ukraine’s. But expanding the capacity of Yamal-Europe would be an unexpected development as after Belarus, it enters Poland, with whom Gazprom has very poor relations, being locked in a take-or-pay contract dispute with it. Poland is also seeking to block the investors in NS2, on the grounds that they are in breach of competition law. And the dominant gas company PGNiG made no secret of its disgust with the EC for not exacting financial compensation from Gazprom as it concluded its seven-year-long anti-trust probe.

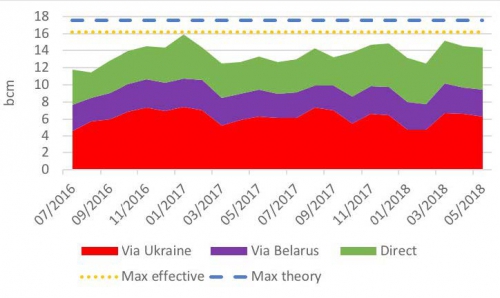

The way things are going though with Gazprom’s exports, meeting its targets of around a third of European demand will mean some gas will still have to flow through Ukraine even if TurkStream 2 (15.75bn m³/yr), Yamal-Europe (33bn m³/yr) and Nord Stream 1&2 (2x 55bn m³/yr) are at their combined maximum 160bn m³/yr. Gazprom Export is looking at deliveries of around 200bn m³ this year, which means possibly 40bn m³/yr still going through Ukraine.

Gazprom Export's balancing act

Gazprom Export head Elena Burmistrova told NGW that the company was happy with the sales so far this year, which were thanks mostly to its long-term contracts. In the first four months of 2018, Gazprom increased natural gas exports to European countries outside the former Soviet Union to an unprecedented 70.3bn [Russian] m³, she said.

Rather than shifting more and more of the exports on to spot deliveries at hubs, she says that Gazprom Export found its European partners were keen to extend their long-term supply contracts, as well as to sign new supply agreements. It has recently signed new long- and mid-term contracts with Croatia and Slovenia, and such agreements with other partners are expected this year.

With regards to the NS2 project, for Gazprom, building gas transportation capacity always means new volumes – not only spot-based, but also under long-term contracts, she said. Gazprom contracted to sell more than 20bn m³/yr of additional gas while implementing the first Nord Stream pipeline project.

Storage is also important to Gazprom Export, and differentiates its strategy from that of a pure trader. The role of gas storage during the abnormal frosts in February and March was immense, she said. “Several years ago everyone on the market was talking about gas storage as though it were something from the past.

Many industry players said that it was just for traders to balance rapid gas demand fluctuations. The experience of the two past winters has proved something opposite.

“Physical gas volumes that are securely stored underground are still needed. Over the last several years Gazprom with western partners invested heavily in the development of gas storage in Europe. Before the latest heating season, in addition to own storage capacities Gazprom had booked additional capacities on the market, and increased its own gas reserves in storage to 8.5bn m³.

“‘The Beast from the East’ proved that our approach was the right one. And now we hear more calls from the industry to strengthen the gas supply chain by building new storage capacities. The European gas market is not only about trading activities and profit margins. First of all, it is all about security of gas supply chain.

"Gazprom cannot allow the reliability of supplies to our European clients to be sacrificed for extra margins. But that doesn’t mean indeed that our storage business in Europe is unprofitable.

“For such companies as Gazprom with abundant gas reserves and extensive network of export pipelines, the underground gas storage business in Europe is commercially attractive. This is our unique competitive advantage which portfolio traders lack. For them, the storage business might not be that interesting," Burmistrova said.

Gazprom Export has also booked capacity in the UK-Belgium Interconnector pipeline, once all the present 20-yr contracts expire this September.

Europe’s gas market has significantly changed over the last few years. And so has Gazprom, she says. The company uses more market-based instruments, including hub-based pricing and short-term auctions. Gazprom Export, she says, is actively developing its trading business.

Gazprom exports, by route

Source: Gazprom, Entsog, thierrybros.com

"Additional agreements within the actual contracts, gas auctions and implementing trading practices allowed us to sell in last two years some 10bn m³/yr-15bn m³/yr above our contract obligations. Our pricing policy is flexible enough and market-oriented. If Gazprom’s sales are growing, it means that buyers consider the conditions offered by Gazprom as acceptable and competitive. We don’t have any interest in following the ‘dumping strategy’," she said.

Not so bullish in the Netherlands

The attitude of the Dutch government could not be further removed from that of the Russians. The cornerstone of the European gas market and once a big exporter, GasTerra is becoming more and more short-term, despite the traditionally long-term nature of the gas business, according to its CEO Annie Krist. She told NGW in May that the Dutch government just was not pro-gas – for example, starting in a few years' time, new houses will not be connected to the mains supply – and the economy ministry has drawn up the timetable for winding down production at Groningen, all of which is sold to GasTerra. This is despite the state owning 40% of the Groningen field and 50% of GasTerra.

GasTerra's two other shareholders, Shell and ExxonMobil each with 25%, have seen their former cash-cow and the foundation of Europe's gas market since the 1960s, the low-calorie Groningen field, forced to cut its output. It is now highly unlikely to be producing post-2030, leaving an estimated €50bn of value in the ground, at today's prices, Gasterra says. In the meantime, the market will bear the cost of nitrogen-injecting facilities so that high-calorie gas can replace gas from Groningen in its long-term gas supply contracts.

Groningen accounted for about a third of GasTerra's 57bn m³ gas sales in 2017; imports another third, and Dutch offshore gas from 'small fields' the other third. "We have a difficult four to five years before the nitrogen plant comes on, in terms of balancing the low-calorie market. If you are told that the backbone of your supply is to be turned off by the end of 2029, that lends a certain flavour to your activities, it tones down your ambitions," said Krist who became GasTerra CEO in February 2017 after running the Dutch gas transmission system GTS. "We cannot speak for our owners but GasTerra was set up as a single-purpose vehicle, to market Groningen gas. Norwegian, Russian and the small fields gas came later. We cannot say whether any of them will retain their interest in GasTerra but if the backbone is gone then the optimisation strategy will be different. The government could exit, so could the other two.

"Gas used to be long-term: we would find the gas, build the pipelines and market it. Now it is short term and we have moved from oil- to hub-pricing.

"Our last long-term gas sales contracts end in 2029 but we look first at 2022, when nitrogen injection means we can sell 6bn m³/yr low-calorie gas as a substitute for Groningen, out of 20bn m³/yr today. Some parts of our supply portfolio will move to high calorie gas, but also more nitrogen facilities will come on to produce low-calorie gas."

William Powell

Hungary supports Russian gas

To the south, Hungary, Serbia and Bulgaria are discussing co-operation to ship additional Russian gas into southern and central Europe. The trio met on June 14 to talk energy. Hungary’s foreign minister Peter Szijjarto said Hungary hopes Bulgaria and Serbia will invest in infrastructure to allow his country to import gas from TurkStream, which will carry 31.5bn m³ of Russian gas under the Black Sea to Turkey, with half continuing to Europe.

Hungary’s suggested new import route for Russian gas joins a tangle of proposed pipelines in southeastern Europe. Thanks to its geographic and geopolitical positioning, and stunted infrastructure links to the European network, the region is hugely dependent on Russian supplies and is the most exposed to Moscow’s plan to reduce transit via Ukraine. Hungary’s proposal to club together with Bulgaria and Serbia to meet TurkStream essentially revives part of Russia’s South Stream project. Moscow dropped its grand plan to ship 63bn m³/yr into southern and central Europe in 2014 in the face of stiff opposition from the EU.

However, Hungary’s chief diplomat suggested he hopes that the European Commission has changed its mind. The foreign minister is close to the autocratic prime minister, Viktor Orban, and his recent pronouncements on Hungary's gas ambitions match those of the powerful PM, even if not the country's energy industry.

"The new route would be a huge contribution to safe and secure energy supply to our region and we hope that we will have the support of the European Union," Szijjarto said as he announced the plan. He offered no details on the potential routing, but it is likely that the plan would depend on the gas entering Europe at the Turkish-Bulgarian border, rather than go direct to Bulgaria as senior Bulgarian politicians had hoped would be agreed, during a visit to Moscow and Sochi in May.

The timing of the announcement was also notable, coming just two days after the inauguration of the TransAnatolian pipeline, which will carry Caspian gas from Azerbaijan across Turkey towards Europe. Reflecting the strategic nature of the project, the leaders of Bulgaria, Serbia and Ukraine joined the presidents of Azerbaijan and Turkey at the June 12 ceremony. The competition between Russia and the EU has provoked a confusing morass of competing pipeline project proposals in the region. Hungary appears keen to take advantage by grabbing a role for itself as an important node, and there are suspicions that Budapest is seeking to leverage other local supply alternatives. Hungary hopes to see exports start flowing from ExxonMobil and OMV’s Neptun project in the Romanian Black Sea, which would arrive through the EU-backed Bulgaria-Romania-Hungary-Austria (BRUA) pipeline project. However, Bucharest and OMV have been infuriated by Hungarian pipeline operator FGSZ’s refusal to extend BRUA to Austria’s Baumgarten hub, as originally planned in 2016 when the EU handed the project €180m.

Officials from the Hungarian government and MOL – the partially state-owned energy company that controls FGSZ – strongly deny hub ambitions. They claimed to NGW recently that sending the gas to Austria via Slovakia would be cheaper, but also admitted that Hungary does not want all of the gas that arrives from Romania to go to Baumgarten.

Hungarian companies have booked the full 4.4bn m³/yr capacity of the first phase of BRUA which will carry Romanian gas exports into the country. Budapest has also shown interest in Croatia’s planned LNG terminal, which is also backed by the EU. Although Hungary has recently drawn back, suspicious of the project's viability, progress is being watched closely.

The officials insist that Budapest’s main aim is to reduce dependence on Gazprom. Hungary currently imports the bulk of its 7bn m³/yr or so annual gas consumption from Russia. The pair’s long-term contract ends in 2022, and the officials say the country is working hard to secure alternative supplies before talks on a new deal open. However, the bid to meet TurkStream suggests otherwise. More cynical observers suggest Budapest, which has been deepening energy ties with Moscow under Orban, is happy to promote Russian interests in the region.

Since South Stream was dropped, Russian officials have praised Hungary’s efforts to make itself a hub and have been parking reserves in the country’s large storage facilities. Earlier this year, Szijjarto announced that Gazprom would upgrade part of the Hungarian network to link with TurkStream.

Tim Gosling