[NGW Magazine] Southern Europe lowers African gas in 2017

Southern European gas demand increased in 2017, pulling in more LNG, North Sea and Russian gas, but not from North Africa where production has stagnated in recent years.

Growing markets in Spain and Italy last year exerted a strong pull on LNG, and on some of Gazprom and Norway's record 2017 export volumes. But supplies to the region from North Africa declined.

The declining pattern of sales from north Africa may be the result of a production decline there, which may now reverse in 2018 as new Algerian fields such as Reggane Nord have recently started up. And yet it's surprising that, despite being the outlet for three pipelines from Algeria and one from Libya, neither producing nation increased sales to a continent with re-emergent demand.

Italy's gas use increased by 6% to 74.7bn m3, indicates Snam, the country's gas grid operator; the country thus remains the EU’s third largest market. Spanish gas use grew more strongly, by 9% in 2017 to 36.2bn m³ (389.7 terawatt-hours), according to its gas grid operator Enagas, while Portugal consumed 6.5bn m3 in 2017, up 25% according to Portugal's grid REN.

Italy

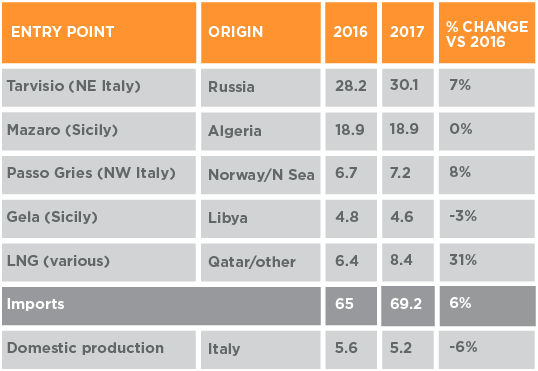

Russian imports into Italy grew strongly: piped gas arriving in northeast Italy, the key entry point for Russian gas into Italy, reached 30.1bn m³ – only just below the 30.3bn m³ record 2013 year for such flows – and 7% above 2016, according to Snam data which includes provisional data for December 2017.

Ukraine in 2017 notably remained to be the main transit flow for Russian gas to Europe, ahead of both Nord Stream and Ukraine, according to data compiled by expert Thierry Bros, carrying 47% of Gazprom’s sales last year to Europe. Even with Gazprom’s preference to shift more volume through Nord Stream in 2018, Bros forecasts that Ukraine – the key transit route for Russian flows into northeast Italy’s entry point of Tarvisio – will remain the largest transit route of Gazprom’s three main options in 2018 too. Italian demand remains one key reason for that.

Europe buys less North African gas in 2017

Source: Snam

Returning to Snam's data, Italian imports at Passo Gries – the primary route for Norwegian flows to Italy – were up 8% in 2017 at 7.2bn m³. This entry point from Switzerland is also used by other North Sea gas (and possibly Russian gas resold from Germany). Dutch gas follows this route too, but a sharp decline in the Groningen field output means its role in marketing to southern Europe is fading.

Italy also regasified 8.4bn m³ from LNG last year, 31% more than in 2016, according to Snam. Qatar has dominated such imports in the past and looks to have benefited in 2017 too – with its main import terminal, Rovigo offshore Venice, seeing a 20% rise to 6.8bn m³. But less frequently used terminals at Livorno and Panigaglia also increased their combined throughput to 1.5bn m³ from just 0.7bn m³ in 2016.

North African flows by pipelines to Italy, in contrast, stagnated – with Algerian flows via its Transmed subsea pipelines of 18.9bn m³, the same as in 2016. Such trade peaked in 2012 at 20.8bn m3, cratered to 6.8bn m3 in 2014 but had risen since. In 2013-15 Italian importers agreed to offtake less from Sonatrach, letting it focus both on LNG sales outside Europe at a time and on satisfying domestic gas demand.

Libyan flows to Italy, via the Greenstream pipe, declined by 3% to 4.6bn m³, having been in decline since 2014’s 7.1bn m³. Libyan state NOC’s partner Eni lost an arbitration case with main Italian importer Edison in late 2015, but it’s not clear if this is a factor or – more probably – whether more gas-fired power plants in Libya are now restarting as the worst of the fighting recedes. Siemens in January 2018 secured a €400mn contract from the country's power company, Gecol, for two future power plants totaling 1.3 gigawatts.

Italy meanwhile saw a 6% decline to 5.2bn m³ in its own indigenous gas production in 2017 – but this has been in decline for each of the past five years.

Provisional Snam data for January 2018 just out show that Italian imports at 5.3bn m3 were 23% lower than the very high 7bn m3 level imported in the bitterly cold month of January 2017, with Russian imports almost halved (down 47% to 1.7bn m3), Algerian flows flat at 2.1bn m3, and Libyan flows down by a third to 0.3bn m3; LNG regasified into Italy, in contrast, continued to rise by 20% to 0.6bn m3.

Spain

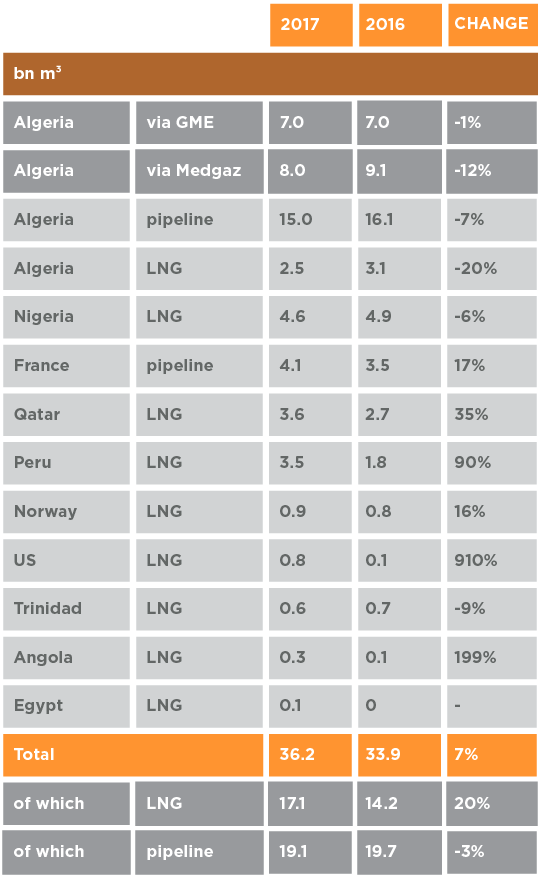

LNG supplied to Spain during full year 2017 from most other sources was sharply higher. And piped gas supplies from the north – chiefly Norwegian gas – also increased sharply, up 40% year on year.

Algeria was still the main overall source of supply to Spain, providing both LNG and piped gas. But Algeria's share of the Spanish market fell to 48%, from 57% in 2016. It supplied 15bn m³ as piped gas plus the LNG equivalent of 2.5bn m³ in 2017. That Algerian LNG supply was 20% lower than in 2016, while volumes delivered to Spain through both its pipelines from Algeria were lower: down only 1% at 6.95bn m³ via the Medgaz subsea pipe, but 12% lower to 8.05bn m³ via the ‘Maghreb-Europe’ pipe transiting Morocco.

Gas supplied to Spain, January-December

Source: Enagas; original data in TWh of gas, converted at 1 TWh = 0.093bn m³

GME = Gaspipe Maghreb-Europe

GME and Medgaz add up to Algeria natgas sub-total.

Entries showing less than 0.1bn m³ in both years have been excluded.

For this reason, totals may not add up.

Nigeria too – Spain’s second most important supplier, covering 13% of its supply – supplied 6% less year on year in 2017, at 4.6bn m³ (all as LNG). A number of Nigerian and Qatari LNG contracts into Spain, and Portugal, are due to lapse in the early 2020s – with suppliers keen to secure renewals.

Big gains though were posted by other long-haul LNG suppliers to Spain : imports increased in 2017 from both Qatar, by 34% to 3.6bn m³, and Peru by 90% to 3.5bn m³ , each covering 10% of Spain’s supply. The US and Angola posted big gains, but from a low volume base.

Spanish total LNG imports grew by 20% in 2017 to 17.1bn m3, inclusive of the 20% lower imports from Algeria. Thus LNG's share of overall Spanish supply increased to 47%, from barely 42% in 2016.

Piped flows of gas into Spain from northern were also significant too. France moved up to become Spain’s third entry source in 2017 at 4.1bn m³, accounting for 11% of Spain’s supply (up from 3.5bn m³ in 2016) owing to a near-40% increase in net gas volume arriving by pipe via the Pyrenees.

As France is not a producer, it was transit flows from Norway, plus some gas from other North Sea countries, and maybe Russia too. It’s often been said that Iberia is the only market not accessible to Russia, except by LNG. However the sheer volume of Gazprom’s 2017 exports – estimated by Bros at 165bn m³ into the EU – means that Spain could have imported some Russian molecules from Germany and France.

Mark Smedley