[NGW Magazine] WoodMac: LNG Trade in the 2020s - New Pricing, Markets, Players

This article is featured in NGW Magazine Volume 2, Issue 20

By Mark Smedley

Global consultancy Wood Mackenzie analysed the medium to long-term global LNG outlook. The authors spoke to NGW In the wake of the Cedigaz’ updated ‘LNG Outlook 2035’ and the CWC LNG conference.

WoodMac expects the current oversupply to rebalance around 2023, possibly earlier on a seasonal basis -- somewhat sooner than Cedigaz’s latest 2023-24 analysis. The WoodMac forecast though is contingent on a number of factors – not least how successful Qatar is with its declared plans to expand LNG production over the next seven years.

The consultancy has a bullish view of how rapidly floating receiving terminals (FSRUs) will open up new markets – as it argued in its recent paper on southeast Asia’s forecast LNG demand growth (see separate feature). However, despite that growth, it believes it will take time for Asia-Pacific LNG price hubs to emerge and that a US Gulf Coast LNG price may emerge sooner.

LNG market rebalancing

“Currently we expect the market to rebalance around 2023, possibly earlier on a seasonal basis – that’s the sweet spot that developers are targeting for their pre-final investment decision projects,” WoodMac’s gas and LNG research analyst Lucas Schmitt, tells NGW. He acknowledges an element of sensitivity around the exact date: for example, there’s potential for upside in Asian LNG demand. Conversely, if several more projects are sanctioned than expected, it may extend the period of oversupply. Schmitt also adds: “Russia’s strategy for pipeline gas might influence the market as well.”

Asked about the feasibility of Qatar’s planned increase in LNG production by 30% to 100mn metric tons/yr by 2024, Schmitt says that Qatar would be in a good position as a low-cost producer: “They can increase capacity in a number of ways: there is some spare capacity in existing trains; they could look at debottlenecking some existing trains which would provide a relatively cost-effective option. But if they want to reach 100mn mt/yr, they will have to build a new train as well. You might say that the industry is at a low-point in the cost-curve, so now is a good time to look at those projects.”

Schmitt though says that it’s not only about cost: other factors will be at play, such as corporate drivers, and the momentum in other regions. “In the US, there is over 120mn mt/yr of pre-FID projects, the vast majority on the US Gulf Coast. You also have projects in east Africa, plus other debottlenecking opportunities elsewhere too, and other factors.” So, if Qatar’s plans were to succeed, where would that place its competitors? “It depends on the timing,” replies Schmitt: “If Qatar expands its capacity quickly, then it could extend the oversupply period. Obviously, it could also then push out some of the other pre-FID options as well. Our analysis would show that east Africa, as well as Russian pipeline gas, would essentially be the hardest hit by such a Qatari LNG expansion.”

What hubs will emerge?

Schmitt points to how, over the last five years, the appetite for long-term LNG supply contracts has declined: “If you look at the main term contracts impacted, it’s mostly those that are 20-years or more in duration, and some of the larger contracts of 2mn metric tons/yr or more. Those contracts are being shaved off a bit, as activity slows down.”

Of the world’s 263.6mn metric tons of globally traded LNG in 2016, according to the International Group of LNG Importers (GIIGNL), 28% (or 74.6mn mt) was sold either spot or on contracts shorter than four years in duration. That 28% ratio was the same in 2015, slightly higher at 29% in 2014, and just 27% in 2013, although clearly overall volumes have increased over that period. But definitions of duration are changing, observers say: now some traditional long-term buyers do not want to be tied in to contracts even as short as 18 months.

(Graphic credit: WoodMac / Tellurian / Energy Community secretariat)

But asked if WoodMac sees new spot LNG price benchmarks, like SLing futures or its Mideast equivalents, taking off by 2020 – the WoodMac response is cautious. “At the moment there is no LNG hub of itself,” replies Schmitt: “All the LNG indices lack liquidity. The big question is: Where is the liquidity going to develop? At the moment, the European gas market provides a lot of the physical and financial liquidity; so the Dutch Title Transfer Facility and British National Balancing Point provide a lot of that.” A number of companies, including Asian ones, have increased their physical exposure to the European market, in terms of regas capacity, put-options and swaps, explains Schmitt.

On the financial side, as the differences between Asia spot LNG and European prices have been getting smaller, companies are now able to achieve a decent hedge against liquid European hubs for Atlantic cargoes into Asia. “As we expect more LNG to come to Europe, mainly driven by the LNG oversupply situation, the physical and financial liquidity in Europe will be further reinforced,” he said.

There is though a pick-up in activity some Asian LNG indices: “We’ve seen a surge in the use of JKM swaps, that are financial instruments based on the Platts JKM index. Essentially this is a result of Pacific basin trade and of shipping differentials and seasonal spreads between European prices and Asian prices that could push further the development of more Asian LNG indices.”

But for more liquidity there, many more buyers and sellers would be needed, liberalised players would need access to infrastructure such as pipelines and LNG regasification, said Schmitt: “The market is going to transition into that later but it will take time. Some hubs are going to develop, and players will push for that in Asia, but the process is going to take some time.”

US pricing, Panama transits

Nearer-term he believes the US is a market to watch: “A lot of new flexible supply is coming from there which could boost the formation of a new LNG fob [free-on-board] price essentially. There could also be some shut-ins of US capacity, which could further accelerate the process by stirring some trading activity.”

Asia and both sides of South and Central America have tended to be the main markets for US Gulf LNG to date, which has led to perhaps higher volumes through the Panama Canal than some had expected. The canal’s administration said recently that 8.6% of all transits through its enlarged canal in the past 15 months had been LNG carriers.

WoodMac’s LNG Shipping & Trade analyst Andrew Buckland tells NGW that, according to the canal’s data, 149 LNG carriers transited between October 2016 to August 2017. “That doesn’t tell you whether those are loaded or unloaded. But if you assume half are laden, that’s about 5mn metric tons of LNG transited.” Slightly more may have transited laden than empty, he believes, just because empty tankers tend to get diverted.

FSRUs rapidly fill a requirement

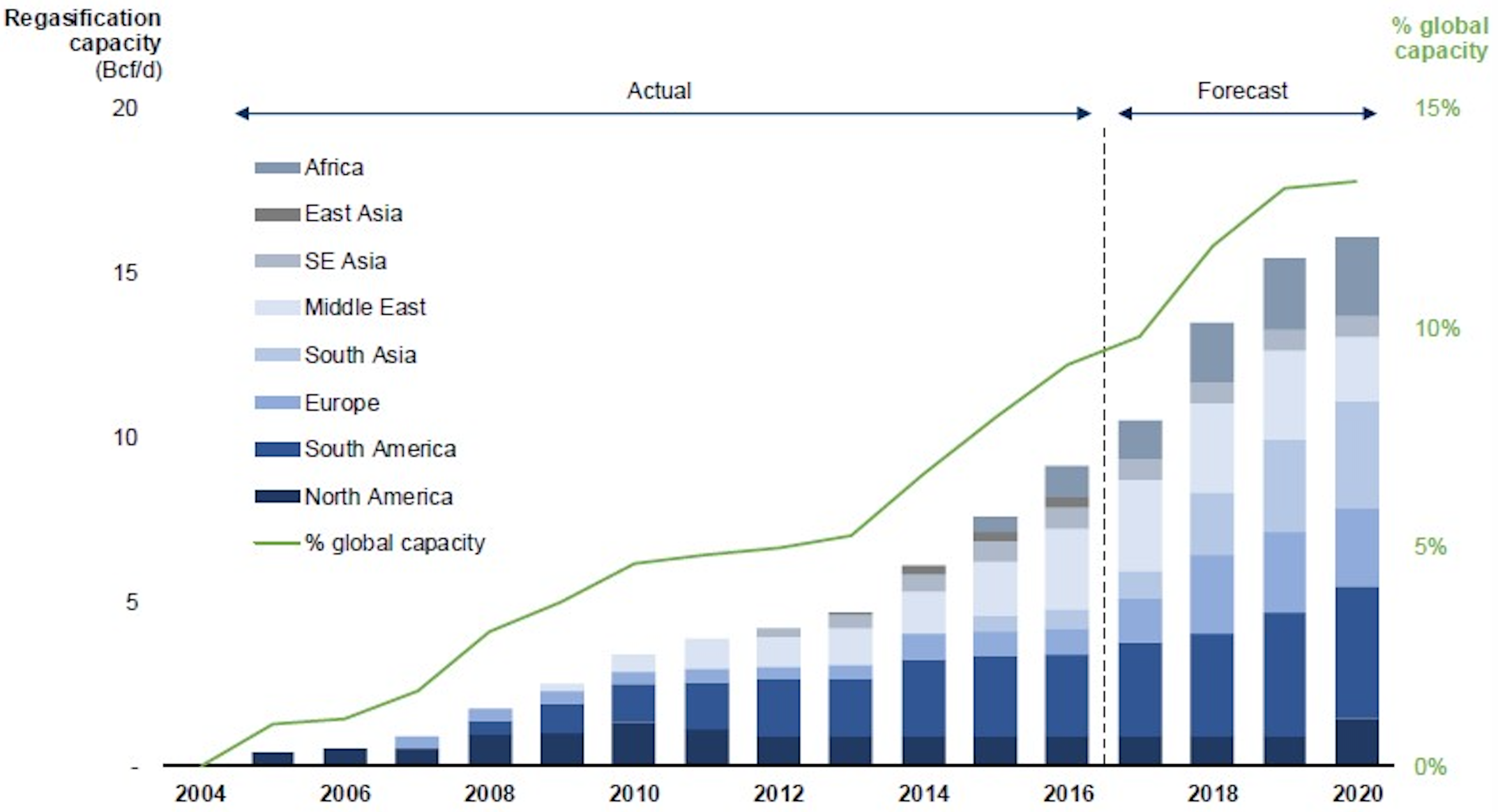

A slide – presented in Ljubljana and publicly distributed by the Energy Community secretariat (see below) -- shows a WoodMac forecast of a rapid deployment of floating import terminals known as Floating Regasification and Storage Units (FSRUs). It shows the capacity of FSRUs deployed worldwide in 2020 will be roughly double that of those in service in 2016.

This also shows south and southeast Asia, Middle East and Africa as the fastest growing regions. NGW asked how confident was WoodMac that FSRUs will be rolled out on places like Pakistan, Bangladesh and west Africa, when more than one project in Ghana has failed to materialise. “Pakistan already has one FSRU in place and will soon have a second, and next year should have a third, and there’s nothing to suggest that growth is not going to happen there,” said WoodMac’s Buckland, pointing to Pakistan’s declining indigenous gas output and rapidly rising power requirement.

“FSRUs can be implemented very quickly, in as little as six to nine months from drawing board to starting operation, although usually it takes longer than that,” explains Buckland. “Their flexibility compared to building an onshore regas terminal means that lots of projects come up, some fall by the wayside. But in terms of confidence that a lot of FSRUs will develop in these regions, yes we are confident.”

Turning to the situation in Ghana, where first Golar and now Hoegh are finding the going tough, Buckland tells NGW: “A lot of offshore gas discoveries are complicating the picture in terms of longer-term demand in Ghana, raising the question: ‘Do they actually need LNG imports in the longer term if they develop those offshore gas fields?’”

“That has complicated the picture in Ghana – and so has the government,” he notes.

Asked which sub-Saharan African countries might be importers by 2020, Buckland believes Ivory Coast is among the more likely, given Total’s backing. “That would be my favourite. South Africa is a possibility, although perhaps not by 2020. Ghana is still a possibility – but I wouldn’t want to choose which project will prevail there.”

Rise of the Trader

Who then may be best placed to tap into these and other emerging markets and buyers?

Total clearly has planted its flag in Cote d’Ivoire, west Africa. Other existing large portfolio players like Shell, BP, France’s Engie, Malaysian state Petronas, and the Qatar Petroleum-led combination of Qatargas and RasGas – including lately through QP/Exxon partnership Ocean LNG – have signed deals from Brazil (Ocean) to Pakistan (QP). WoodMac’s Schmitt sees Gazprom and Cheniere growing rapidly too.

“Most of these will be expanding their portfolios, because of projects starting up in the US, Australia, and also Russia,” he adds. So we should expect an expansion by the portfolio-players.

Schmitt though explains that in 2015 the main five traders – Trafigura, Gunvor, Vitol, Noble Group, Glencore – had captured 15% (10mn mt) of the 68.4mn mt spot/short term trade reported by GIIGNL.

“Essentially, that’s been facilitated by the fact that there’s now a lot more flexible supply available; that there’s increasing availability of spot charters; and that there will be emerging buyers with uncertain demand, and that some of those trading companies will be well placed to deal with riskier counterparts with higher credit risk. Traders usually have quite large oil trading businesses, and they already deal with a number of the countries that might have a higher financial risk as well.” Egypt since 2015 has been mainly supplied by traders willing to take market risk and credit risk, he adds.

Asked who will be the big players in ten years’ time, Schmitt admits it’s a tough call to make, saying it’s likely to be a combination of existing and newer ones: “Going back to the liquidity issues earlier in our conversation, perhaps traders have more of a role to play in developing liquidity – especially in Asia.”

Mark Smedley