[NGW Magazine] LNG Market to Stay Oversupplied Until 2023-24: Cedigaz

This article is featured in NGW Magazine Volume 2, Issue 18

By Mark Smedley

Paris-based research institute Cedigaz expects the global supply glut to continue until 2023 or 2024.

Cedigaz, the Paris-based industry-funded research institute, has updated its LNG Outlook 2035.

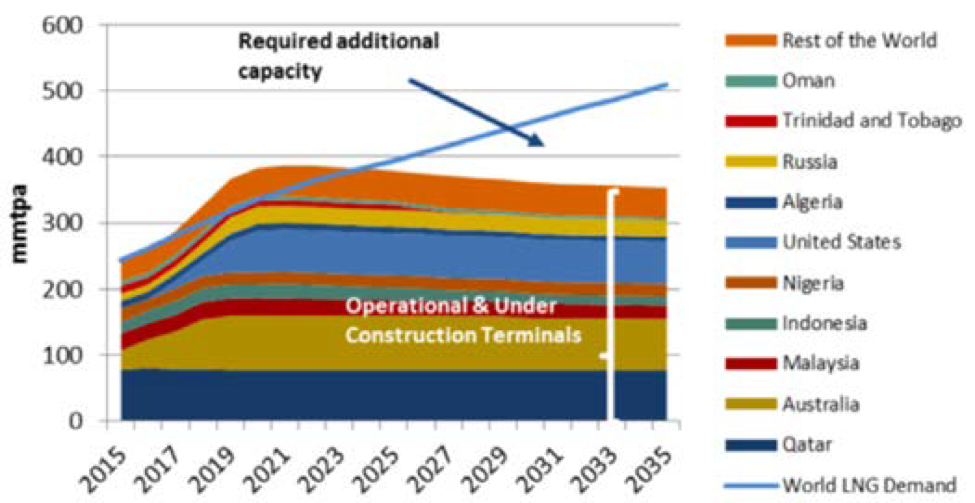

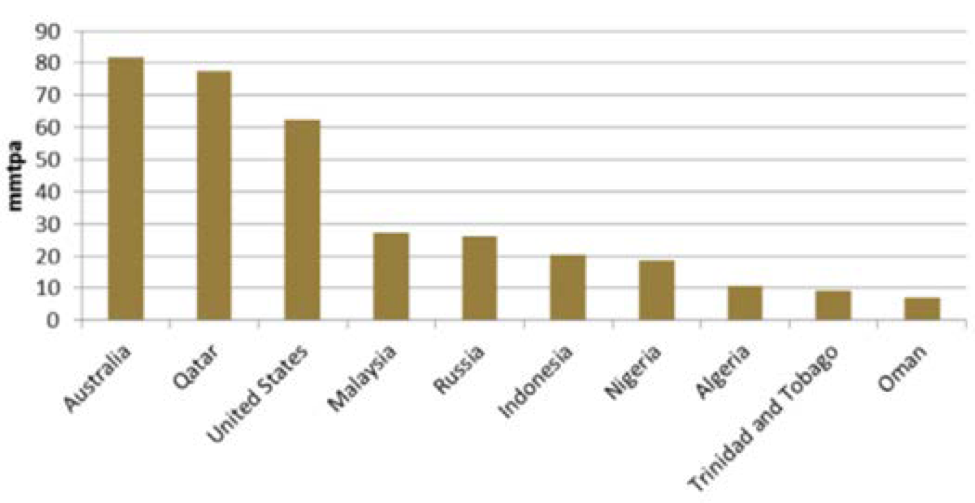

Effective liquefaction capacity from existing and under construction projects is expected to increase significantly from 244mn metric tons/yr 2015 to 387mn mt/yr in 2021, it said September 6, adding that the strong growth is to be led by Australia and the US until 2019 and 2021 respectively. Cedigaz forecasts that by 2021 North American liquefaction capacity will have reached 66mn mt/yr (US 64mn and a 16% global share, plus 2mn in Canada).

“Demand will struggle to keep up with supply ramp-up at the beginning of the projection period and an over-supply situation should prevail and an oversupply situation should prevail,” it added.

LNG market to stay oversupplied to 2023-24

Rebalancing of the market is not expected before 2023, or even 2024 if probable developments (including Fortuna FLNG offshore Equatorial Guinea) and potential upside from currently idle capacity (Egypt, Yemen) are taken into account, added Cedigaz.

Major LNG exporters such as Shell last year were saying the global LNG supply glut could end by 2022, but Cedigaz’s latest forecast appears to bury such optimism on the part of exporters. Also Italy’s national energy strategy (SEN) this June forecast that global LNG prices would decline until 2024-25.

The latest Cedigaz LNG Outlook, however, says that new projects will need to come online post 2023-2024 to accommodate rising LNG demand and that it expects the strongest increases in such LNG capacity from post-FID projects to originate from the US, Canada, Mozambique and Qatar.

However, unless new projects are launched, Cedigaz cautions that after 2021 a gradual decline in production capacity is to be expected, because of both the ageing of some facilities (southeast Asia) and growing constraints on resources (Trinidad, UAE, Oman Algeria, Indonesia and Malaysia).

Assessing which and how many projects will come onstream by the mid-2020s was complicated by Qatar's July 4 announcement it intends to increase exports by 30% to 100mn mt/yr by then, by how feasible such a huge Qatari ramp-up is, and what impact it may have on competing projects elsewhere.

By 2035, Cedigaz expects the US to be the No.1 LNG producer by 2035 with a market share of 19%, ahead of Australia and Qatar, with Russia moving up to 4th rank thanks to new projects. Canada, Mozambique and Papua New Guinea would join the top 10 while Algeria, Trinidad and Oman would exit. More details are on Cedigaz's LNG Outlook is on its blog.cedigaz.org while the full Cedigaz LNG Outlook 2035 report is available to its subscribers.