More LNG needed after 2022 [NGW Magazine]

Global gas production is forecast to increase from 3.7 trillion m³ (358bn ft³/d) in 2017 to 4.4 trillion m³ in 2030, Rystad’s head of gas markets Carlos Torres Diaz told his London audience in early October. Growth will be strongest in North America, up 40% to 1.34 trillion m³, and also in the Middle East, up 52% to 910bn m³. He acknowledged a risk of lower growth than that in Iran, because of sanctions; but he said that China’s CNPC is expected shortly to be confirmed as South Pars phase 11 operator, replacing the French major, Total, which is leaving under pressure of US sanctions. The French company has already stopped buying Iranian crude, according to the CEO Patrick Pouyanne.

Henry Hub, the main US gas benchmark, will rise over time – but it will remain significantly below Europe’s dominant gas hub in the Netherlands, the Title Transfer Facility; and also Asian spot and oil-indexed prices, although there will be some convergence.

The mature European gas market will stay flat, with a modest increase from gas-fired power as coal and nuclear are decommissioned. In contrast, Torres Diaz sees the Chinese market doubling from 237bn m³ in 2017, to 411bn m³ in 2025 and 486bn m³ in 2030. This will come partly from industrial use, from 50bn m³ in 2017 to some 180bn m³ in 2030; and also from more power/heat generation.

The LNG market will tighten post-2022, and new final investment decisions (FIDs) will be needed to keep the market balanced after that, said Torres Diaz. He forecast the LNG market reaching 548mn metric tons in 2030, an 89% increase from the 2017 level of 289mn mt. While the spot market may reach 30% of the physical supply by then, long-term supply contracts would nonetheless predominate.

Of that 89% increase out to 2030, LNG demand growth is expected to grow in China by 73% to 112mn mt; ‘other Asia’ by 103% to 135mn mt; and the rest of the world up 83% to 301mn mt.

In North America, Torres Diaz expects some 1,080bn m³ of wellhead gas production to be commercial at $3/mn Btu in 2025, including gas from the Marcellus and Delaware US shales, so not far off the $2/mn Btu breakeven seen today for much of Middle East gas. As such, he expects the US and Qatar to lead the second wave of liquefaction capacity additions by 2025.

Qatar, US likeliest incremental suppliers

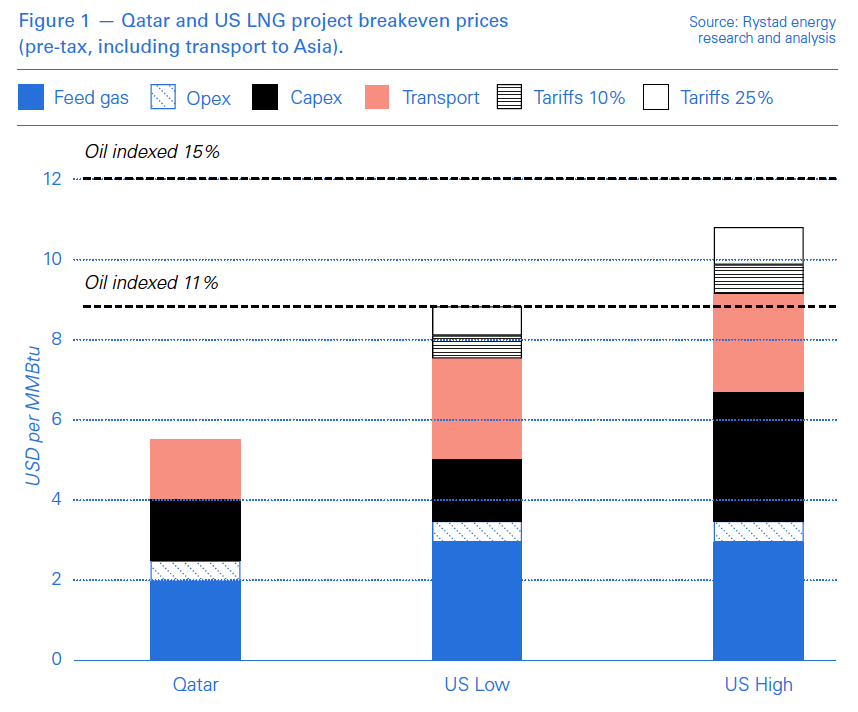

He expects Qatar to be able to breakeven at pre-tax delivered prices (including transport) into Asia of $5.6/mn Btu, whereas for US LNG such break evens will be complicated by Chinese tariffs (see graph).

Other projects are comparable on breakeven into Asia though, with Fortuna FLNG, PNG LNG T3 and Papua LNG trains 1&2 just below $7 (Fortuna is nearer $5/mn Btu into Europe and cheaper than most US LNG); while Sakhalin T3 and the Novatek-led Arctic LNG trains 1-2 are $7.5/mn Btu, and both Mozambican onshore ventures $7.9/mn Btu – just below some US Gulf projects such as Sabine T6, Magnolia T1-4 and Golden Pass at $8.2/mn Btu.

Iran, the US and the oil market

While China is expected to take over at Iran’s main foreign gas investor, despite US sanctions, Rystad oil markets head Bjornar Tonhaugen expects Iranian oil exports to be much more severely hit.

In a base case, he expects the US call on the world to boycott Iranian oil to lead, in a base case, to a loss of 877,000 b/d exports and in a severe case to a loss of 1.213mn b/d exports next year – in both cases from a ‘pre-sanctions’ Iran export figure of 2.149mn b/d in the nine months to February 2018.

West Africa may have to wait

In Africa, much has been discovered but not so much developed, said Rystad senior upstream analyst Aditya Ravi. That’s especially true offshore, as a result of the 2014 oil price crash. He said 7bn boe remains undeveloped offshore Nigeria, a further 5bn boe offshore Angola, with 1bn boe undeveloped but at least sanctioned in Mauritania. He said Rystad expects about 8bn boe of that to be sanctioned between now and 2025, but suggested that delay in Nigeria’s adoption of its Petroleum Investment Bill (PIB) will delay further developments there and lead to a decline in Nigerian oil and gas production in the near to short term, as part of a rapid decline in West African regional near-term production (largely owing to Angola).

Moreover, the four of the high-impact wells drilled to date in 2018 off Africa mostly for gas have been dry: Eni’s Rabat Deep off Morocco; Lamartin off Mauritania and Requin/Tigre off Senegal (both Kosmos/BP); and Cormorant offshore Namibia (targeting oil, Tullow). However the Nour prospect offshore Egypt might be another Zohr for operator Eni.

The view from Timera

Rival consultancy Timera Energy released some of its insights into new LNG project developments. In a blog on October 8, it said that high gas prices in 2018 are signalling a tightening market.

It recalled that Chinese demand has grown at 31% and 47% across 2016 and 2017, and by 50% in 2018 through August – but that it actually declined by 4% in 2015, something that might recur.

However, it said that two factors have reduced the risk of LNG prices declining, relative to 2015: “more than 50% of the current wave of new LNG liquefaction capacity is now online; the time window of potential oversupply has narrowed accordingly. And the current growth trajectory for Asian demand is keeping pace with new supply. This reduces the risk of a ballooning surplus.”

Timera sees little to no surplus LNG spilling into Europe over the 2019-21 horizon, and a need for new LNG supply from 2022, noting that the only incremental projects of scale committed since 2016 are the Qatari expansion (up 43% from 77mn to 110mn mt, pending FID) and the 14mn mt/yr Shell led LNG Canada project announced October 2. But it admits LNG could develop along either a ‘consensus’, squeeze or slowdown scenario out to 2025.

Traders capitalise on LNG

LNG has been “a market with explosive growth” for the world’s four main independent oil traders. Among their attributes is risk-assessment: while LNG projects struggle to persuade banks that their customers are creditworthy governments, major traders can instead buy on term contracts and sell on. “They put a value on optionality, whereas utilities want LNG for their own use,” Tellurian’s marketing and trading manager Tarek Souki told Oil & Money conference in London.

On the other hand, big utilities are also traders, as the chairman of Jera Henk Gordenker pointed out: and so they combine the best of both worlds. With 33mn mt/yr of power-station demand for LNG behind it, Jera can offer LNG producers a high degree of stability: “We have substantial control, unlike traders who are trying to stitch deals together.”

However these traders appear to be doing a bit better than that description suggests. Their efforts at working arbitrages have made LNG a core and growing area for the world’s four largest independent oil traders, as top executives of Vitol, Trafigura, Gunvor and Glencore told the conference.

“LNG trading is growing faster for us than oil trading,” said Gunvor CEO Torbjorn Tornquist, one of four panellists, adding that gas was already eating into traditional oil demand. Gas is very competitive when it comes to production costs, and those costs are going down. Gas would remain cheap relative to oil, he added, and Gunvor would continue to invest in it.

Trafigura CEO Jeremy Weir noted that Chinese LNG imports had grown by about 50% last year and again so far in 2018: “It will keep growing. How much is unclear, but it will keep growing and we shall keep our focus there.”

Weir said Trafigura had developed its LNG business a lot, ventured into regasification, and signed long-term contracts. As examples, Trafigura signed a long-term contract to buy 1mn metric tons/yr from Cheniere for 15 years starting 2019, while Vitol inked a 0.7mn mt/yr deal with the same US supplier this September for roughly the same period but starting almost straight away. Vitol did not have a buyer in mind; but knew such a contract would be cheaper than building a plant itself.

Traders are expected to have their eye on a slice of Mideast contractual volumes left unrenewed by Asian buyers. Asked by NGW if 4.2mn mt/yr left unsold by Adnoc LNG from April 2019 might be sold spot, long-term, through joint ventures with traders, or used domestically in Abu Dhabi, majority owner Adnoc’s CEO Sultan Ahmed al-Jaber told the same London event: “All of the above.”

Last year already marked a big increase in the four traders’ activity: Trafigura reported 2017 LNG annual traded volume of 8.1mn mt, up 27%, while next placed Vitol’s 7.4mn mt almost tripled its volume – the two accounting for 5.25% of global LNG trade.

Consultancy Wood Mackenzie said in January 2018 that the four collectively amounted to 27mn mt of LNG sales or 9% of total LNG trade. Spot import markets such as Pakistan and other countries unable to enter into long-term contracts with project developers owing to their credit rating, strongly boosted the traders’ activity.

The Oil & Money panellists were asked if traders would continue buying physical upstream, refining and other assets. Vitol chairman Ian Taylor retorted that assets on offer from the majors now were “pretty crappy” and that he struggled to see much attraction at the current oil price value.

Glencore oil and gas chief Alex Beard concurred – yes, the majors were still divesting, but much more slowly than before, and any acquisition would have to add value for traders.