[GPP] EU Quo Vadis: a theoretical exercise with an anti-Russian Flavour?

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

By Andrey Konoplyanik

The 30th meeting of the European Gas Regulatory Forum (Madrid Forum) takes place October 19-20. One of the key items on the agenda is the debate on the functioning and future developments of the internal wholesale EU gas market whose developments are critical for Russia and its key gas exporter Gazprom.

The DG Energy Quo Vadis project – “A Study of the gas market regulatory framework” – will frame the debate on this, providing a quantitative assessment of the “EU welfare” growth arising from EU gas market regulations from 2010-2016 and being based on the provisions of the Third EU Energy Package (TEP) as of 2009. This is the proclaimed aim of the study. Nevertheless, in reality, it seems to present a set of scenarios with radical changes of this regulatory system with a clear perceived anti-Russian bias.

Quo Vadis appears to erect barriers in the way of Russian pipeline gas in the process making things easier for more expensive US LNG. This is on top of the obstacles that US sanctions have placed on Russian gas export pipelines. One can treat Quo Vadis as the proposed action plan for the next (post-2018) Commission. It correlates well with the content of the expanded anti-Russian US Congressional sanctions, signed by the US president Donald Trump, but will lead, most probably, not to the growth of “EU welfare”, but its reduction.

Quo Vadis Report: the Aim

On June 26, 2017, a second stakeholders meeting on Quo Vadis project was held in Brussels where the consultant of DG Energy on this project, the companies EY and Hungarian consultancy REKK, presented their provisional report “Quo Vadis EU gas market regulatory framework – Study on a Gas Market Design for Europe. Preliminary Report. Draft for discussion purposes”. After intensive debate, it wasdecided to have another, more technical meeting on the modelling methodology, July 26 in Budapest. But despite the technicalities of the modelling, based on the June report, it seems that the conclusions of the study have already been decided.

From my view, the five qualitative scenarios proposed for quantitative modelling in the preliminary report present an integrated programme of Russian gas substitution in the EU, at least in its Eastern part, by US LNG. An inter-related system of actions is proposed to push out Russian gas to the periphery of the zone where EU energy acquis is implemented and to create economic barriers for its entry to the EU. The programme is also proposed for creation of gas transportation/transmission infrastructure from regasification facilities/LNG import terminals on the EU coastline to the traditional delivery points of Russian gas inside the EU, from where it should be pushed out to the Russian-Ukraine border, and its supply volumes may be diminished through the de-facto proposed but yet to be modelled system of artificial measures.

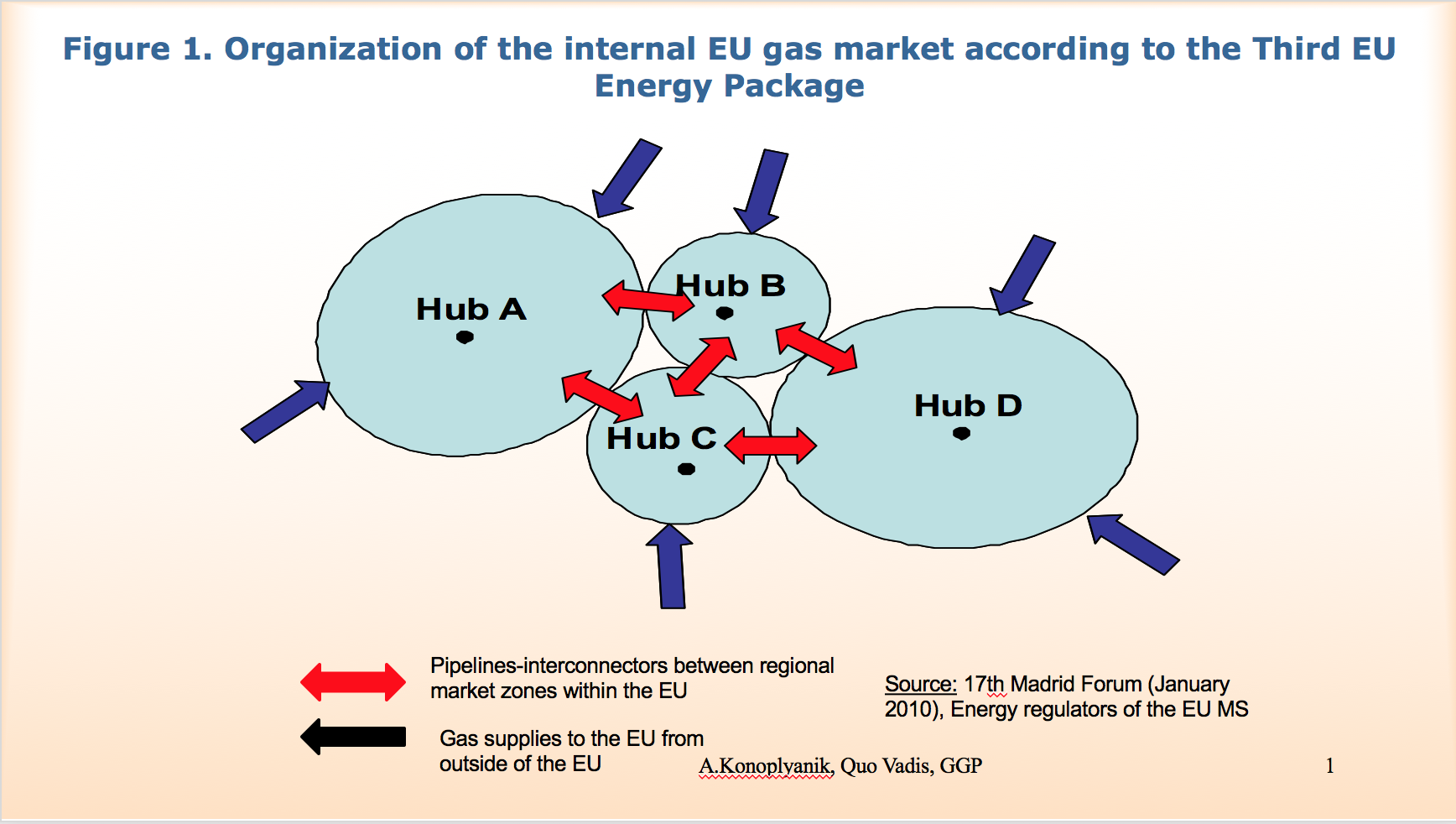

As well known, EU internal gas market architecture based on the provisions of the Third EU Energy Package (see Figure 1) presents:

- combination of market zones (separate for wholesale and retail markets), linked one to another by pipelines but each with its own pricing signals;

- separate ownership of gas transport and gas supply businesses,

- tariffs organized on “entry-exit” principle, where the responsibility of transportation within the zone lies with the transmission system operator (TSO),

- gas trading to take place at hubs where liquidity will grow,

- gas producers both from inside and outside of the EU are able to deliver gas directly to the end-users, by-passing to the extent they consider appropriate the midstream companies (traders-resellers) which have been the key historical buyers and resellers of, say, Soviet/Russian gas to the EU, etc.

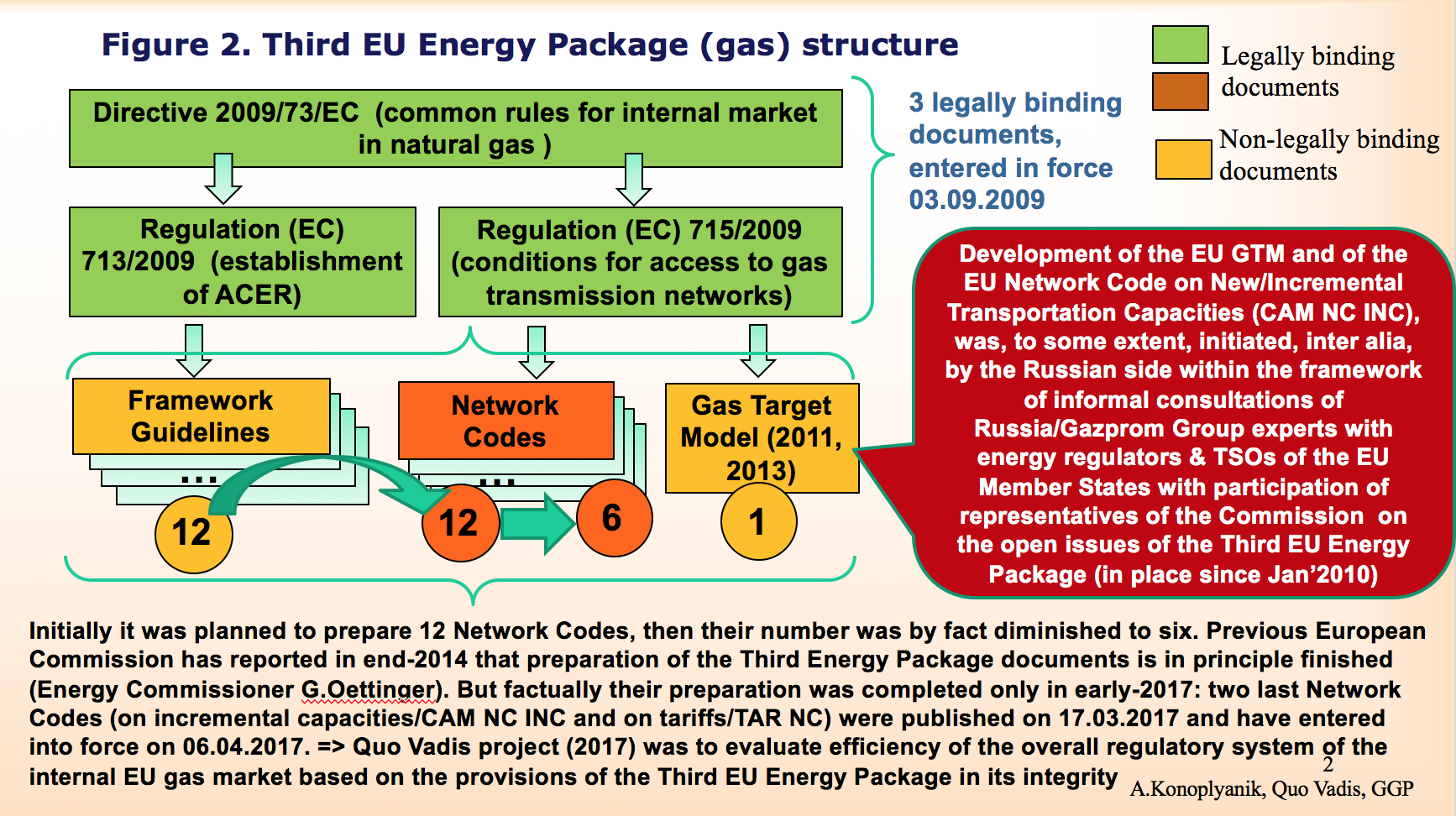

In 2010-2016 a system of Network Codes and related instruments was developed and is now being implemented, which formed the application procedures of the TEP principles (see Figure 2). These codes are intended to conclude the development of the regulatory framework for the EU internal gas market.

The aim of Quo Vadis project, as mentioned at the website of DG Energy, is to “provide substantiated analysis as to whether the current regulatory framework in the EU gas sector is the most effective in order to maximise overall EU welfare or whether amendments may be necessary, and if so provide recommendations.”[1] Based on the substance of the consultant’s preliminary report, the answer to the question in the title of the project can be considered as predetermined.

The report identifies the following “inefficiencies of the current market” such as:

- different levels and imbalanced structure of gas transportation tariffs,

- persisting contractual and physical congestion in supplies;

- low utilization level of EU gas transportation/transmission system;

- high market concentration at both the EU and the individual Member States’ level,

- national regulators are in control;

- limited transparency of market functioning.

But then, instead of proposing corrections of the existing system, the study proposes five scenarios for radical change to the current regulatory system before it has even been implemented in full in all EU Member States.

Scenarios to be modelled: the mean

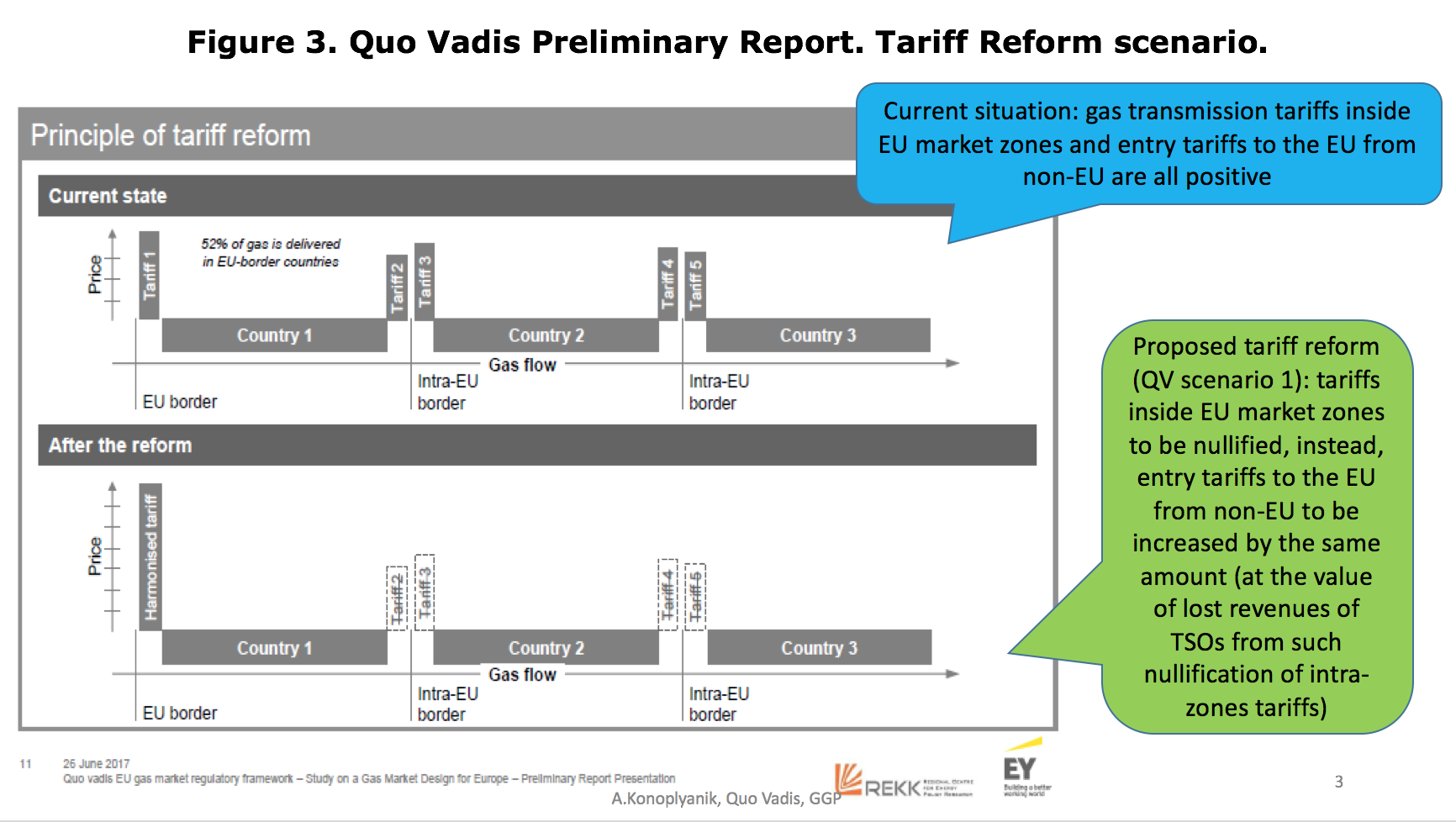

Scenario 1 – Tariffs Reform. It is proposed to enlarge (merge) market zones (see Scenario 2) and to redistribute the expected level of income between the TSOs the enlarged zone, on the one hand, and its external suppliers as a “zero sum game”. It is proposed to scrap entry-exit tariffs within the enlarged EU market zones and to compensate to TSOs of these zones their tariff losses, first by transfer of:

- either incorporating the intra-zone tariff losses wholly into the entry tariffs to the new enlarged zone,

- or splitting them equally between entry charges to the new enlarged wholesale market zone (transfer of 50% of extra costs to the exporters to the EU) and exit tariffs from wholesale to the retail zone (transfer of another 50% of extra costs on the end-users).

Second, it is proposed to aggregate the higher entry/exit tariffs in favour of the TSOs of the merged/enlarged zones to allow them to finance their maintenance and development through the newly proposed to be established special fund – the so-called “TSO Compensation Fund” (TCF). TCF should be managed, as proposed, by the supra-national European Agency for the Co-operation of Energy Regulators (ACER), established according to TEP (see Figure 2). TCF is presented as a key instrument in all five scenarios proposed for quantitative modelling of EU welfare.

It looks like a proposal to establish a new Ljubljana-based (where ACER is located) former Soviet-style GOSPLAN.

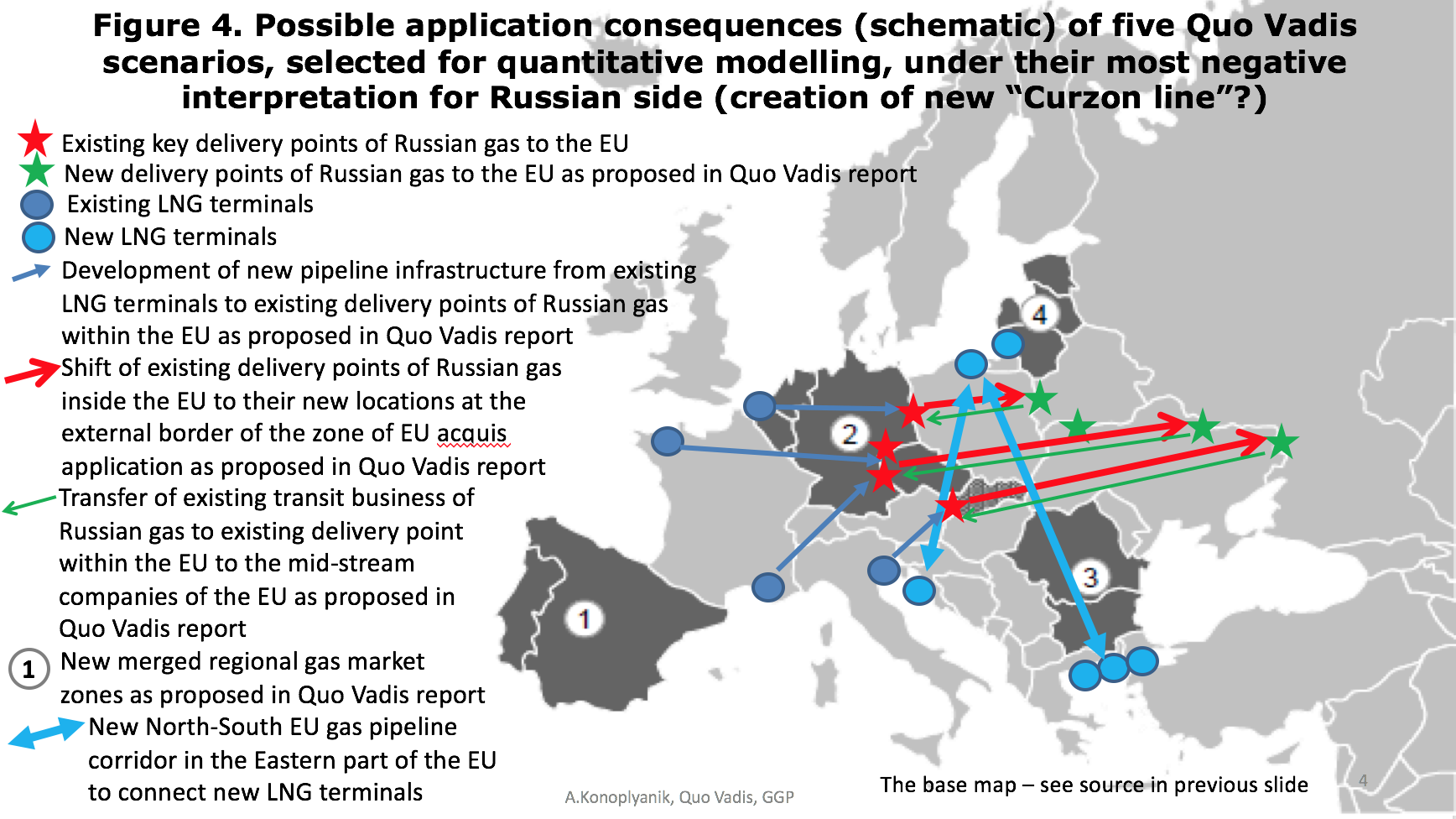

Scenario 2 – real market zones merger of homogeneous zones, with roughly equal levels of liquidity, their enlarging to “regional”. This will help, as expected, to adjust (line up) hub quotations within the enlarged zone and will enable implementation of scenario 1. In Quo Vadis Preliminary Report it is proposed to establish four enlarged regional zones: (1) the Iberian Peninsula, (2) the biggest one consisting of Germany, Benelux, Czech Republic and Slovakia, (3) south-east Europe (Bulgaria-Romania), and (4) the Baltic States (see Figure 4).

Scenario 3 – provisional merger, which means virtual merger of heterogeneous market zones, with different levels of liquidity, or even with illiquid zones, which provide an opportunity to apply, in an illiquid zone, price quotations from more liquid hubs.

An important prerequisite of such virtual merger is well-developed infrastructure. This makes quite evident for me the purpose of the proposed undertaking. The natural first candidate for such conditional zones’ affiliation would be the virtual merger of Ukraine to form an enlarged regional zone (2). Ukraine is a member-state of the Energy Community Treaty, and applies the EU’s energy acquis on its territory and is therefore included in the Quo Vadis project.

The virtual affiliation of Ukraine within the enlarged zone (2) is based on the existing gas infrastructure to carry Russian gas to Slovakia, Czech Republic and Germany. Thus the preconditions are created to imply through all above mentioned infrastructure (through all linked market zones) within a newly established virtually merged regional zone (2) with Ukraine of the “virtual reverse flows”.

But this can only be achieved by keeping stable large-scale export transit flows of Russian gas through this transportation corridor. Only then can one apply “virtual reverse flows” in the opposite direction (from west to east). This means not only the physical flows of gas, but also related gas price quotations from more liquid hubs in the northwestern parts of the EU to the illiquid zones in the east of the EU (say, in central Europe) or in the Energy Community – for example Ukraine.

Thus it is one other argument which makes it clear for me the firm and steady desire of the EU and its trading companies to preserve large-scale transit of Russian gas to the EU through Ukraine post-2019.

Scenario 4 – transfer of delivery points from inside the EU to the external border of EU, though in practice this means – to the external border of EU energy acquis implementation (this means the EU and the Energy Community area). This scenario applies almost in full to Russian gas since other pipeline exporters (Norway, Algeria) and all LNG exporters bring their gas to the coast, and so supply it at the external border of the EU (within the first entry EU Member State).

On top of this, it is proposed that transit (transportation) of Russian gas from the newly proposed delivery points at the Russia-Ukraine border (see Figure 4), where its entry transportation tariff is proposed to be increased according to Scenario 1 (see Figure 3), will be the job (post-2019) either of European midstream companies – the wholesale resellers of Russian gas within the EU (according to Quo Vadis Preliminary Report proposal) and/or by non-Russian companies (in line with new Ukrainian legislation).

Scenario 5 is aimed at diluting the gas market concentration within the EU by expanding/creating pipeline infrastructure to deliver regasified LNG to customers deep within EU territory. This means, first, to the existing delivery points (mostly of Russian pipeline gas) at the former EU-Comecon border. Financing its development is (seems to be) proposed to be organized from the TCF funds, which means, mostly, from higher entry tariffs’ collection to be paid by gas exporters to the EU.

Consequences: devil’s advocate reading

A preliminary assessment of the five scenarios (below) shows the worst-case assessment among other available options. These five scenarios could:

(i) move delivery points of Russian gas to the external border of the EU/Energy Community area and to create entry barriers to the EU.

First, these five scenarios are aimed at pushing out Russian gas supplies from delivery points inside the EU to the Russia-Ukraine border (by proposed transfer of its historical existing delivery points in long-term contracts from inside the EU to the external border of the EU energy acquis application) with immediately higher entry tariffs.

This will diminish the margin of Gazprom (the export pipeline monopoly, under Russian law) by the difference between the commodity price within the EU and the increased entry transportation tariff to the EU, and will make its gas export business to the EU less competitive. Simultaneously, this will thus clear up the competitive niche for alternative gas suppliers to the EU, firstly, for US LNG, especially in the eastern part of the EU.

Transportation tariffs growth to/within the EU on the given transportation routes have two causes: (i) the “entry-exit” transportation tariffs for Russian gas within Ukraine, if its transit through this country lasts after 2019, will be higher than the existing distance-based transit tariffs, as Ukraine has warned (as if in result of the country’s accession to the Energy Community Treaty and thus to application within domestic gas market of Ukraine of EU energy acquis), and (ii) this increase will be fully or at least half allocated to the “entry” tariff, as proposed in the Scenario 1 on Tariffs Reform (see Figure 3), which means to Gazprom.

The intention to push out Russian supplies to the eastern border of Ukraine has been already followed by practical actions.

Within the ten-year network development plans for gas (TYNDP) and the development programmes of “projects of common interest” (PCI) the new North-West gas transportation corridor is being formed within the EU on its eastern margins. It would connect new (already built, being built and yet to be built/planned, stationary and FSRU) regasification facilities/import LNG terminals in the north, in the former Comecon or Soviet states (Poland and Lithuania), and in the south, in Croatia, Greece and Turkey (see Figure 4). It seems this north-south gas transportation corridor, with its reverse flow capacities at all interconnection points (all new pipelines in the EU shall have capacities for physical reverse flows at all interconnection points, according to TEP/GTM), regasified US LNG – or any other LNG, if any at all – will enter the EU to compete primarily with Russian pipeline gas.

The eastern part of the EU (former Comecon countries) was formerly Russia’s exclusive domain. Prior to collapse of the USSR no other gas could enter this area. After USSR dissolution not too many alternative options were developed for former Comecon states, even after their accession to the EU, until very recently. So this (firstly, as expected, coming from US) LNG will substitute in the former Comecon area of nowadays EU the pipeline gas from Russia, which will be prevented by artificially increased entry tariffs to enter geographical area where EU energy acquis is implemented. This will decrease its competitiveness at the EU market. Firstly – against US LNG.

(ii) transfer Russian gas business in EU/Energy Community to EU mid-stream companies

Second, these five scenarios are aimed at transmitting gas transit/ transportation business inside the EU/Energy Community area from the newly proposed delivery points at the external border of the EU/Energy Community to the historically existing delivery points deep inside the EU to the midstream companies of the EU gas business – either to historical intermediaries-importers of Russian gas to the EU or to new gas traders - which will then forward it to the EU end-users. This will enable EU companies-intermediaries to preserve their shipping business within the EU. It is well-known that after TEP took effect there was an inevitable narrowing of business zone for such mid-stream intermediary companies. TEP has provided to the gas producers, including exporters from the non-EU, an opportunity for direct access to the end-users bypassing mid-stream wholesale EU intermediaries.

And it was these wholesale EU-originated intermediary structures that have been providing further delivery of Russian gas to the EU retail markets/end-users from its delivery points which were first located at the external eastern border of the former EU-9/12/15, and after EU enlargement in 2004/2007, when the former Comecon countries have entered the EU, appeared to be placed deep inside the EU. This expansion of the business zone for midstream EU companies will boost “EU welfare”, by expanding the taxable base of the business of these companies in EU member states.

So a preliminary assessment seems to prove that “increase in EU welfare” is supposedly be reached, within the Quo Vadis scenarios proposed for quantitative assessment in the Preliminary Report, by transferring incremental risks and costs to external EU gas suppliers, chiefly the biggest by volume: Russia.

Terms of Reference for new Commission? In favour of the US LNG?

DG Energy’s tutor of Quo Vadis project has called its Preliminary Report at the meeting in Brussels in end-June as just an “intellectual exercise”. He has proposed to consider it as just an attempt to make a quantitative modelling of its scenarios independent of their enforceability. It is true, their enforceability is questionable, since, say, scenario 4 is non-enforceable unilaterally because it is related to the renegotiation of existing long-term supply contracts. Nevertheless Quo Vadis can be considered as the proposed line of action, sort of “Terms of Reference”, for the next (post-2019) Commission. It is the Commission’s project, it has been undertaken based on the Commission’s (DG Energy’s) Terms of Reference[2] and under its guidance.

By ventilating now these ideas about the “EU welfare increase” derived from the five above-mentioned scenarios the next Commission will find it easier to start the practical implementation of proposed scenarios. Nobody will most probably think that these scenarios propose to radically change the existing architecture of the EU internal gas market based on TEP, that they propose to deviate from TEP without waiting for its full implementation within the EU Member States, without passing through “learning curve” of its implementation.

In the meantime, in its current vision – as being presented in the Preliminary Report (which seems to be a final vision of a qualitative approach to assess the efficiency of the existing regulatory framework of the internal EU gas market and a final guidance for corresponding quantitative modelling) - Quo Vadis project is de facto aimed at replacing cheap Russian pipeline gas with more expensive US LNG.

This is why Quo Vadis fits in well with the substance of the expanded anti-Russian US sanctions, now signed by the President Trump, which aim to prevent creation of new pipelines for Russian gas to the EU by-passing Ukraine, and which impoverish, rather than enrich, “EU welfare”. It seems that the Quo Vadis scenarios are constructed not in the interests of the EU, but of the US, and thus diminish EU competitiveness in its global competition, including with the US.

Andrey Konoplyanik

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

[2] DG ENERGY. Call for Tenders. № ENER/B2/2016-413. “Quo Vadis EU gas market regulatory framework – Study on a Gas Market Design for Europe”. Tender Specification, 29 pp. (was available at https://etendering.ted.europa.eu/cft/cft-display.html?cftId=1818 through the period of tender procedures)