Global LNG Trade Up 7.5% in 2016: GIIGNL

Global LNG imports increased by 7.5% to 263.6mn metric tons in 2016, according to the annual report of GIIGNL, the International Group of LNG Importers, published this week. Of that, 74.6mn mt traded on a spot or short-term basis or 28% of total trade.

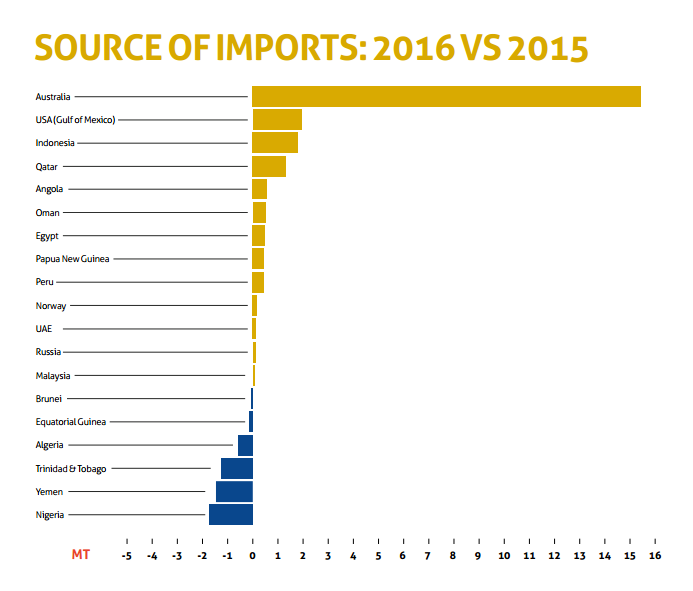

The 18mn mt, or 7.5%, increase last year contrasted with an average annual growth rate of 0.5% in 2012-15. Additional supply, primarily from Australia, was not as abundant as expected owing to production delays, slower ramp-ups and lower exports from historical suppliers, said GIIGNL, and meant some signs of market tightness were seen late 2016 as cold snaps hit Europe and northeast Asia.

However the “looming supply overhang” – Gorgon train 3 started up this week – has caused a slowdown in investment with several liquefaction projects being cancelled or deferred, said GIIGNL.

China (up 8mn mt) with Egypt and India (each up 5mn mt) posted the largest year on year increases in net imports.

Japanese net LNG imports declined by 2% last year to 83.34mn mt but remained the largest market, followed by South Korea, up 13% to 34.19mn mt, and China, up 10.4% at 27.42mn mt.

Asia continued to dominate LNG imports, with a market share of 72.7%, followed by Europe’s 14.6%, the Middle East 6.6% and Americas 6.1%. Brazil’s imports declined by almost 70% (over 3mn mt) to 1.46mn mt, while those into Argentina and Mexico also declined by one-sixth.

UK imports fell by a quarter to 7.5mn mt in 2016. Five years earlier in 2011, it was the world’s third largest market, importing 18.4mn mt.

Graphic credit: GIIGNL

World liquefaction capacity increased to 340mn mt/yr. Qatar supplied 30% of global LNG imports in 2016, while the Pacific Basin supplied 45%.

Regasification (import) capacity grew to 830mn mt/yr, including 11 new terminals commissioned adding 32mn mt/yr capacity during 2016.

At end-2016, six new offshore terminals and 13 new onshore ones were reported by GIIGNL to be under construction, of which five in China alone. There were also seven expansion projects underway, of which two in China.

The number of importing countries increased to 39 last year, as Colombia, Jamaica, Finland and Poland joined the ranks according to GIIGNL. Poland imported its first cargo in December 2015.

Mark Smedley

.png_f1920x300q80.jpg)