Global Gas Flaring Up Again in 2016: World Bank

Gas flaring at oilfields rose by a further 2bn m³ last year to 149.3bn m³, from just over 147.2bn m³ in 2015 and has risen in each of the three years since 2013, according to the World Bank-led Global Gas Flaring Reduction (GGFR) initiative. The estimate is based on data from 60 major producing countries.

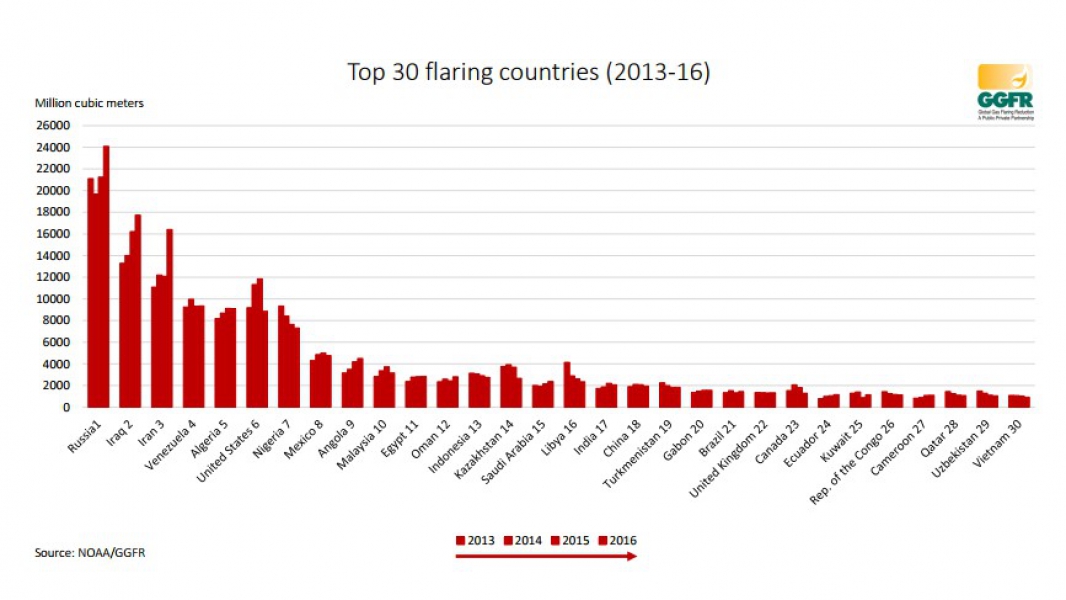

The worst offenders – Russia, Iraq and Iran – all significantly increased gas flaring in 2016 as their associated oil production rose with no pipelines in place to market the gas.

The flaring data is based on analysis by the US National Oceanic and Atmospheric Administration (NOAA) using imaging from space by NASA’s satellite-borne Visible Infrared Imaging Radiometer Suite (VIIRS).

Russia’s gas flaring increased to just under 24.1bn m³ in 2016, from just over 21.2bn m³ in 2015, according to the GGFR data. That 13% increase far exceeded the country's 2% increase in oil production.

Iraq’s flaring also surged to 17.7bn m³ last year, from 16.2bn m³ in 2015 and was disappointing as a number of new industry/government initiatives were in place to gather associated gas and pipe it to power plants (see p26-27 of NGW Magazine Vol.2, Issue 12, mid-June 2017). Such efforts though failed to keep pace with a 10.8% increase in Iraq’s oil production in 2016, according to BP's latest Statistical Review of World Energy.

Iran, the world’s third-ranked flaring nation, flared 16.4bn m³ in 2016, compared with 12.1bn m³ in 2015 according to the GGFR data, as its oil production soared by 18% according to the BP review.

Flaring Reduced in US and Nigeria

On the plus side, flaring in the US declined in 2016 for the first time in three years, while Nigeria managed to continue reducing flaring such that it fell from fourth to seventh worst-flaring nation between 2013 and 2016.

This meant Nigeria’s flaring fell to 7.3bn m³ last year, from almost 7.7bn m³ in 2015. In the US, it plunged by almost 3bn m³, to 8.9bn m³ in 2016 from 11.9bn m³ the previous year.

Disruption to oil and gas production in the Niger Delta last year though caused Nigerian oil output to fall by 12%, while US oil production declined by 3% – both possible factors for the reduced flaring.

Little change among medium-ranked flarers

Countries such as crisis-hit Venezuela, now the fourth ranked flaring nation (it was the US in 2015), plus Algeria in fifth and Mexico in eighth place, saw little change in their respective 2016 flared volumes of 9.4bn m³, 9.1bn m³ and 4.8bn m³. Angola in ninth place saw its flaring creep up by 0.3bn m³. This is despite its LNG export plant – the first in the world built to run solely on associated gas – having operated for much of last year, after a two year outage since mid-2014.

Flaring intensity per well

Saudi Arabia, Norway, Azerbaijan and Ukraine had some of the least-flaring wells, typically all at 1mn m³ or less per producing oil well. That compared with about 5mn m³ in Russia and twice that in Iraq/Iran.

Uzbekistan cut flaring per well from over 65mn m³ in 2013 to just over 50mn m³ in 2016 but has far to go. In contrast, war-torn countries saw average flaring per oil well soar, in Syria’s case from 20mn m³ in 2013 to 60mn m³ in 2016, and in Yemen’s from just over 15mn m³ to almost 60mn m³ over the same period.

Zero routine flaring by 2030

Thirty-one companies – including Russia's biggest private oil company Lukoil, as of last month – and 24 governments – including Iraq which joined in May – and 15 development institutions have now joined the Zero Routing Flaring by 2030 initiative launched two years ago by the United Nations and World Bank.

The 147.2 bn m³ flared in 2015 could generate 750bn kWh of electricity if harnessed, the bank points out, noting that exceeds the current annual consumption of the entire African continent.

One of the 31 companies, Italy's Eni, asserted its commitment to flare reduction on a visit to the World Bank in Washington DC late June. The company's finance chief Massimo Mondazzi said: “Eni is proud to be a member of the GGFR and we have been in the process of reducing gas flaring at of our assets. We are committed to achieving zero process flaring by 2025." World Bank senior director Riccardo Puliti said that Eni was following up its commitments with "action on the ground, working to use flare gas for power projects and other applications that reduce CO2 emissions."

Mark Smedley