Flex LNG Sees Upswing in Shipping Market

Oslo-listed, Bermuda-registered shipowner Flex LNG made a profit in 3Q. It says that all its LNG carriers will be working this quarter, and that it expects the LNG shipping market to improve.

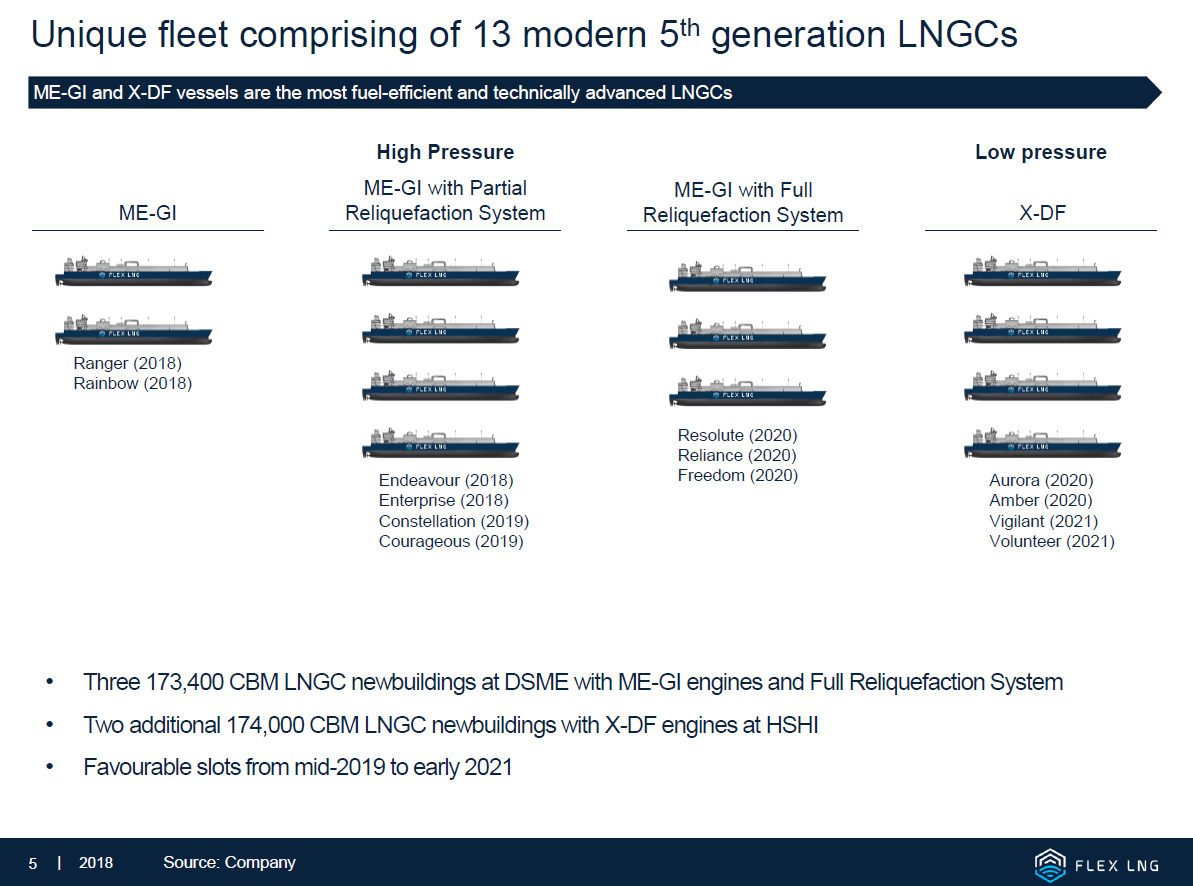

CEO Oystein M Kalleklev said: "Flex LNG has rapidly become the largest owner of modern fifth generation LNG carriers with a fleet expansion from six to 13 vessels since we presented 1Q results" in May. Four are already operating (including Flex Endeavour above, pictured courtesy of the company). The other nine will be ready during 2019-21 (see graphic below).

Last month Flex LNG raised $300mn through a private placement; following this, the largest shareholder Geveran, controlled by shipping magnate John Fredriksen and his family, retains 44.6% of Flex. Five of the newbuild ships being delivered in 2020-21 were acquired from Geveran.

Flex LNG’s net profit for 3Q 2018 was $1.2mn, while during 9M 2018 it lost $3.5mn – considerably up from the year-before losses of $4mn and $11.7mn respectively. Also, because interest for large modern vessels has been very high this winter, Flex already has its carriers booked for all the available days in 4Q and so expects its revenue in the fourth quarter to be around $35mn – approaching double its 3Q revenue of $19mn.

In January, it chartered Flex Endeavour to Uniper for 15 months, with an option of three more. In April, it signed a 12-month time-charter for Flex Enterprise to Italy's Enel to start 2H 2019, with an option of a further 12 months. Also, in July, it entered into a six, plus three month, charter with an unnamed major European company for use of its Flex Rainbow carrier which was delivered that month from South Korea.

"We think the LNG shipping market will remain tight due to a combination of large increase in liquefaction capacity in the near, medium and long-term, limited fleet growth, increased ton/mileage and increased focus on improving air quality favouring the ongoing switch from coal to natural gas," said Kalleklev, who is also Flex’s CFO, as well as CEO. The company's statement said that the worldwide LNG carrier fleet now exceeds 450 vessels and cited shipbrokers who anticipate there could be a "potential shortage" of between 30 and 47 vessels by 2020, even taking into account newbuilds now under construction.