CNOOC Replaces Woodside in West Africa Block

China National Offshore Oil Corp (Cnooc) has farmed in, with a 65% interest, to the ‘AGC Profond’ production sharing contract in Senegal/Guinea Bissau offshore joint development zone, acquiring the interest from privately-owned UK-South African independent Impact Oil & Gas.

Impact previously agreed the farm-out to Woodside for AGC Profond but it was never completed and the agreement was terminated February 9.

The transaction with Cnooc was completed a few months later on March 23, said Impact, noting that, as a result, Cnooc is now operator of AGC Profond with 65%, partnered by Impact 20%, and Entreprise AGC, a Senegal and Guinea-Bissau joint venture, 15%.

“We are very excited about the potential of the block given its location and proximity to a number of recent discoveries by Cairn and Kosmos and are confident that Cnooc Group’s technical and financial strength and the knowledge that it has in the conjugate basins of the Atlantic Margins will bring substantial value to the partnership,” said Impact’s executive chairman Mike Doherty.

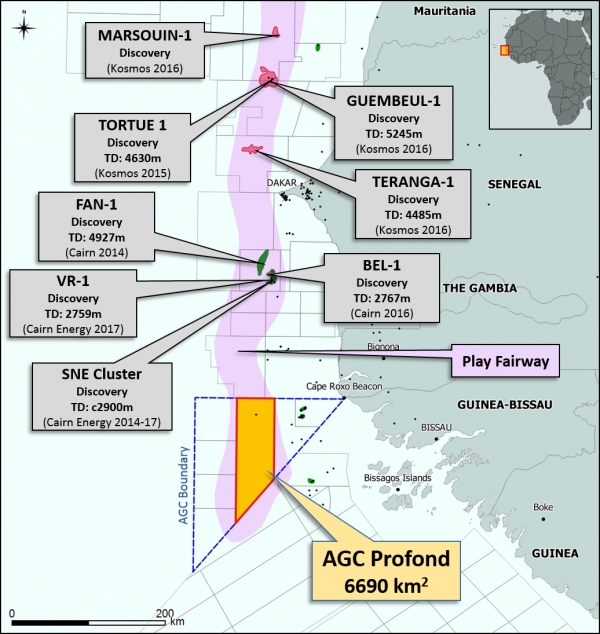

AGC Profond covers 6,690km², in water depths of 1,400 to 3,700 metres, and is to the south of the recent Fan-1 and SNE-1 and 2 oil and gas discoveries made by Cairn and partners.

AGC Profond, into which CNOOC has farmed, is shown in orange (Map credit: Impact Oil & Gas)

The entry of Woodside into Cairn-operated interests offshore Senegal has been contested by FAR, Cairn's junior Australian partner there. FAR this week announced it was expanding and had agreed to farm into acreage offshore Gambia located between Cairn's SNE cluster and the AGC Profond block.

Not all of West Africa’s prospects, however, have yielded results. In annual results March 29, Canadian Overseas Petroleum CEO Arthur Millholland talked again about a dry hole drilled last December by its partner ExxonMobil offshore Liberia, the country’s first spud for many years.

"Whilst we were disappointed with the initial drill results from the Mesurado-1 well [on block LB-13], we have been re-evaluating alternative leads as we believe there remains upside potential,” he said. The Toronto-listed company lost $6.3mn last year, slightly less than its $6.5mn loss in 2015, but “remains confident” of drilling an appraisal well on Nigeria offshore block OPL 226 by late 2017.

Mark Smedley