Tullow Back in Profit, Gearing up in Ghana

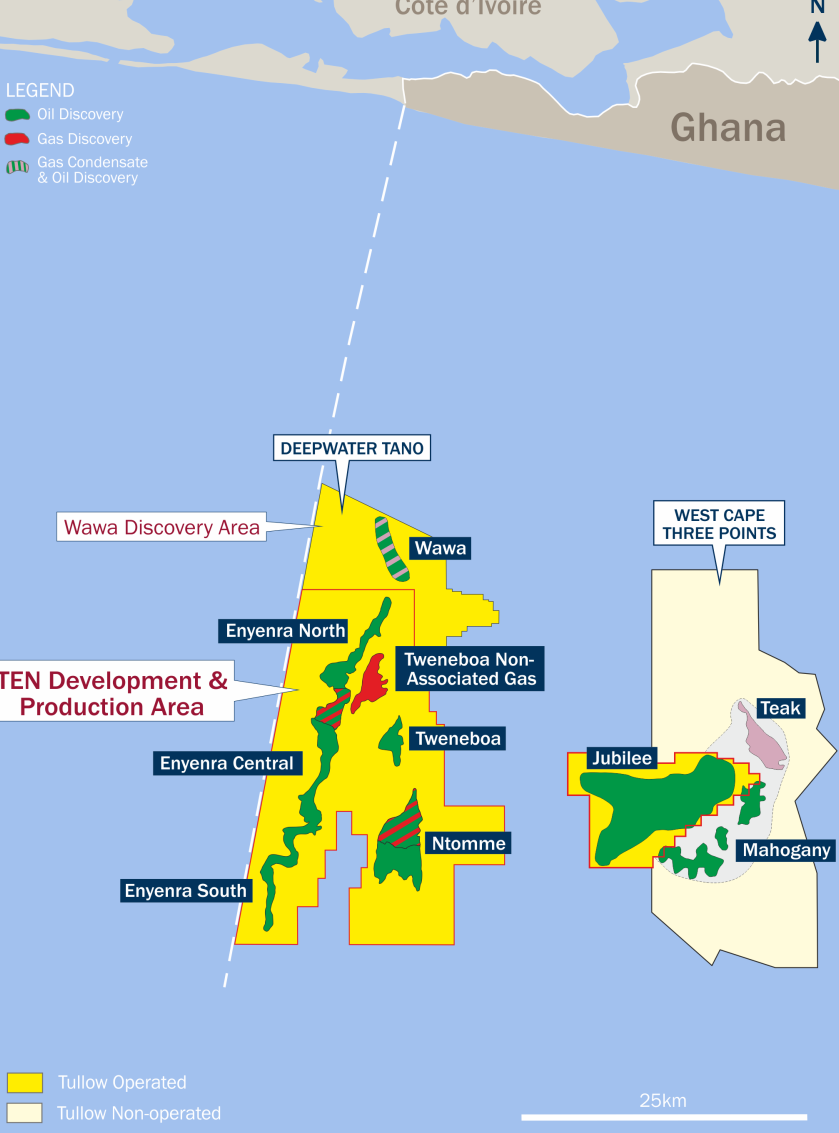

UK-based Tullow Oil said July 27 that its TEN oil and gas development project offshore Ghana remains on budget and on schedule for first oil in August, and that its Kenya oil exploration and reappraisal campaign is to recommence in 4Q 2016. Work to resolve a problem at its Jubilee producing field off Ghana is still pending government approval.

The company made a first-half 2016 profit after tax of $30mn, compared with a loss of $68m in 1H 2015. Operating cash flow before working capital was 50% lower at $256mn. Tullow's overall net production in the period was 50,200 barrels of oil equivalent/day (boe/d), down 25% year-on-year, while its realised gas price was 31.7 pence/therm, down 32%. Its realised oil price was just 14% lower at $60.70/b – in part cushioned by its hedging. The company noted that 38,500 b/d of its oil production for the second half is hedged at an average floor price of $74/barrel.

As announced in June, Tullow and partners at the producing Jubilee oil and gas field offshore Ghana have to resolve an issue with the turret bearing of its producer ship FPSO Kwame Nkrumah. Some work is due for completion by end-2016. A second phase of work, awaiting approval from Ghana's government, will rotate the FPSO to its optimal spread moor heading and is expected to be undertaken in the first half of next year, requiring the FPSO to be shut down and halting Jubilee gas flows to shore for 8-12 weeks in that period. Cost for the two phases is estimated at up to $150mn gross.

Jubilee typically produces 60-80mn ft³/d of gas, supplied to Ghana's market, Tullow said in June. Ghana is heavily reliant on the gas for local power generation. A plan to make up some – though perhaps not all – of that lost Jubilee gas supply during that shut-down with gas production from the TEN field is also pending Ghanaian government approval, Tullow said July 27.

Associated gas produced at TEN will be re-injected into the Ntomme reservoir gas cap until gas export begins, added Tullow: “Gas export was planned to start 12 months after field start-up, with the Tweneboa gas reservoir coming on stream a further 12 months later. However, options to accelerate associated gas export are currently being evaluated as the fabrication of the gas export facilities is ahead of schedule and is expected to be complete in late 2016, some six months early.”

TEN development area offshore Ghana (Map credit: Tullow Oil)

At TEN, it expects gradual ramp-up in oil production towards the FPSO capacity of 80,000 b/d gross by end-2016. At Jubilee, average gross production in 2H2016 is expected to be some 85,000 b/d – compared with its capacity of about 100,000 b/d.

In Kenya, meanwhile, an Early Oil Pilot Scheme transporting oil from its South Lokichar field to Mombasa, using road/rail, is being assessed, such that 2,000 b/d gross might be produced by around mid-2017. It also cited ongoing prospects for exploration in Mauritania, Namibia and Zambia – although its most exciting prospect for now could be its Suriname acreage in South America, close to the significant Liza-1 oil 2015 discovery by Exxon.

In Europe, working interest gas production for the first half of 2016 was above expectations averaging 6,600 boe/d. Full year guidance has been revised to 6-7,000 boe/d.

CEO Aidan Heavey said Tullow benefited from low cost cash flow from its west Africa operations, and from development options in both west and east Africa, with an attractive low-cost exploration programme going forward that works at a low oil price. Tullow might consider some divestments but was in no hurry to do so at current low prices, added Heavey, indicating he'd prefer the oil price should be nearer to $75/bbl before doing so. But the key way to add value for shareholders would be to keep exploring, he told analysts in a conference call.

Tullow's net debt at end-June 2016 was $4.7bn with facility headroom, and free cash of $1bn. Additional headroom of $300m was added through a successful convertible bond issue on July 6, further diversifying sources of debt.

Mark Smedley