Spanish Generators Shun Gas as Iberdrola Profits Rise

Iberdrola, the largest Spanish-owned power group, said July 20 it increased 1H 2016 profits year-on-year by 14% to €1.43bn, although earnings from its Spanish liberalised gas business were €73mn lower, as the country’s power demand in 1H 2016 was predominantly met by CO2-free sources.

Data on July 19 from Spanish gas grid operator Enagas showed a 1.3% decline in 1H gas demand, because of a further slump in gas use by power generators from an already low base.

Spanish power grid operator REE said June 30 that mainland Spain’s power demand was flat in 1H 2016 at 123.7 terawatt-hours (TWh), just 0.1% higher than the same period in 2015.

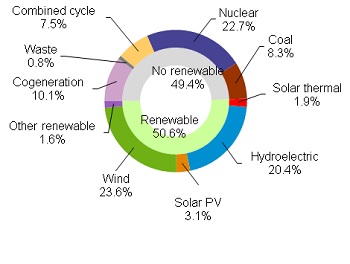

But the share of gas-fired combined cycle plants (CCGTs) in Spain’s overall 1H 2016 generation mix fell to 7.5% (from 8.5% in the same 2015 period) – whereas renewables topped 50.6% (from 42.1%).

Ample water supply meant that hydroelectricity provided 20.4% of Spain’s 1H 2016 power mix, only just lagging wind with 23.6%, and nuclear on 22.7%. Non-renewable nuclear meant that 73.3% of electricity generation in 1H 2016 was obtained using technologies which produce zero CO2 emissions.

Mainland Spanish power generation mix, January-June 2016 (Graphic source: REE)

REE figures for June 2016 showed that CCGTs provided 9.6% of Spain’s power (year-ago 9%), and that coal shrank to 10.6% (from 25.9%). However the three largest sources of power supply were nuclear 25.1%, wind 16.8% and hydro 15.1% (the latter well above its 12% share in June 2015). CCGTs tend to be used more in summer than the rest of the year in Spain, because of high temperatures and the demand for air-cooling. Renewables contributed 42.3% of electricity generation in June 2016, while 67.4% was obtained with technologies producing zero CO2.

Iberdrola's business is diversified across all types of Spanish power generation, and particularly strong in renewables, and has wide international exposure in places like Latin America and the UK. Indeed, while many generators in Spain burned less gas, Iberdrola said production from its CCGTs increased by 44% to 1.1 TWh in 1H 2016 -- but that's still tiny, and less than 1% of all power consumed in Spain for that period. Like other firms, Iberdrola sources its gas for Spain both by pipe and as LNG.

In its July 20 results, Iberdrola said that 75% of its £6.4bn UK capital expenditure plan in 2016-20 “has no currency risk” as a result of Britain's referendum vote in favour of leaving the EU. That's because it is either in sterling or hedged; the other 25% is mostly on new UK offshore wind farms.

Mark Smedley