[NGW Magazine] LNG Projects Need Plan B

Final investment decisions for the second wave of US LNG development await resolution of several contract controversies, relating to length, volume and creditworthiness. Keeping costs down, meanwhile, is easier said than done.

In the last couple of years, final investment decisions (FIDs) for new LNG export projects to go into service around 2025 have dried up. This is largely because the old rules governing the structure of the contracts have been torn up and there is no consensus about how to replace them, according to numerous panelists at the 16th Americas Summit of the CWC World LNG & Gas Series in Houston last month.

A senior research associate at Columbia University’s Center on Global Energy Policy, Akos Losz, said FIDs covering only about 10mn metric tons/year (mt/yr) of export capacity were taken in 2016 and 2017, primarily because of a disconnect between buyers who are reluctant to sign long-term contracts and sellers who are unable to sanction new projects without those long-term contracts.

By 2025 there will be a need for about 150mn mt/yr of new export capacity, according to data presented by Patrick Hughes, vice president, corporate strategy and investor relations at NextDecade. But while Losz said more than enough export capacity has been proposed – about 1bn mt/yr – and better than 300mn mt/yr of that could be considered at a pre-FID stage, little of it will actually go to FID without a resolution of the contract stalemate.

“It will be very interesting over the next two years to watch how this impasse will resolve itself,” Losz said. “There are really only a couple of ways it can resolve itself – the question is, who will blink first?”

If buyers blink first, and accept long-term contracts, many major US projects with off-take agreements in place will move quickly to FID. If sellers blink first and accept the ongoing trend to shorter contract terms that has become evident in the last few years, they will need to come up with new business models and creative and unconventional financing arrangements.

The move to shorter contracts has been gaining strength over the last four years, according to Jason Feer, head of business intelligence at ship and energy brokerage Poten & Partners. In 2014, two-thirds – 20 out of 30 – new supply and purchase agreements (SPAs) were for 10 or more years; by 2017, the trend had reversed, with 20 of 30 SPAs for five years or less. "And the number of deals for 20 or more years has plummeted – 10- or 15- year SPAs are now considered to be long-term,” Feer said.

The shorter-term contracts are replacing longer-term legacy contracts that are expiring, he said, and the trend is expected to continue, with 200mn mt/yr of legacy contracts set to expire between now and 2030. Buyers want to replace those long-term, single source contracts with a portfolio of contracts with different terms, lengths and degrees of flexibility, and their old suppliers have found a certain degree of flexibility to meet those new demands, primarily because they’ve paid off the project financing that was supported by the original contracts.

"This represents a fundamental restructuring of the global LNG market,” Feer said, noting that as contract terms shorten, average volumes per deal are falling, to less than 0.70mn mt/yr last year from 0.90mn mt/yr the year before.

These new market realities, he said, are forcing developers and aggregators to sign more contracts – quite possibly with less credit-worthy counterparties – in order to take FID or clear unsold volumes, which just adds to the challenges faced by sponsors and increases the complexity of financing.

In a later session, Carlos Wheelock, head of LNG Americas for global trading house Vitol, said LNG traders can help bridge that contractual gap between sellers and buyers. “The role of the traders will be to facilitate FID for some of these facilities and absorb some of the risks that are required and bridge some of the mismatches between producers, lenders and other stakeholders who require very precise and rigid terms to be able to FID facilities and buyers who demand flexibility and less volume and who perhaps don’t have the required credit,” he said. “That’s what we do for a living – we step between dreams and reality and try to figure it out.”

Indexing options

The first wave of LNG development in the US was financed largely on the strength of global crude oil prices, which were linked to natural gas prices in Asia, and the price of natural gas in North America. Banks were willing to extend project financing to LNG developers based on that spread – which peaked at around $16/mn Btu in 2012.

But when crude prices collapsed in 2014, that spread disappeared, NextDecade’s Hughes said, falling to only about $3 in 2016 and stalling the global LNG market and most of the commercial activity that was associated with LNG projects.

“The spreads are now showing signs of moderate widening and we have witnessed substantially more interest in the US second wave as a result,” Hughes said, pointing to Cheniere Energy’s 15-year SPA with commodities trader Trafigura in January and its 20-plus year SPAs with China National Petroleum Corporation in February as proof that there is global interest in long-term LNG contracts with US developers. “We think Cheniere’s recent success is probably just the beginning of what will be a pivotal year for the US LNG sector.”

What is decidedly less certain, however, is whether global LNG customers will be willing to abandon more traditional LNG pricing links – NBP in Europe or JKM (Japan-Korea Marker) in Asia – for prices linked to the Henry Hub natural gas price in North America. Cheniere’s SPAs with Trafigura and CNPC were based on the Henry Hub price plus a fixed component for liquefaction of just over $3.00/mn Btu in later deals.

Not surprisingly, Cheniere is convinced that Henry Hub is the index of the future for the global LNG industry, largely because few forecasts suggest Henry Hub will increase much beyond its current $3/mn Btu level in the near-to-medium term. Combined with EPC costs for new liquefaction in the US that are falling rapidly towards $500/mt/yr, that Henry Hub price can land US LNG in virtually any market in the world at between $7/mn Btu and $8/mn Btu, Anatol Feygin, Cheniere Energy’s executive vice president and chief commercial officer, told the conference.

“We are in the camp that believes Henry Hub will continue to grow in importance as a pricing index for global LNG trade,” he said. “I believe the first year on the forward strips that Henry Hub is above $3 is 2023, so that is a very nice tailwind for the US export business model.”

Other speakers in Houston were less certain of Henry Hub’s future as a key index for global LNG trade, suggesting the Gulf Coast LNG market still lacks the liquidity to support Henry Hub as a global index and insisting few European buyers have much of an appetite for Henry Hub, even if those in Latin America or Asia are open to the concept.

The CEO of CFEnergia & CFE International (units of Mexico’s state-owned electric utility Comision Federal de Electricidad), Guillermo Turrent said Henry Hub was a natural fit in Mexico, given its pipeline connections to US supply. But Alejandro Alle, executive director of Energia del Pacifico in El Salvador, said power markets in central and south America would likely remain tied to Brent pricing, simply because LNG for power competes directly against fuel oil for dispatch.

Ernesto Parilla, head of LNG trading at Spanish utility Iberdrola, was also sceptical about Henry Hub as an index. “Sellers and traders, I think, are open to it, but I don’t see buyers too interested right now.”

The president of Cnooc Gas & Power Trading & Marketing Ye Yishu was also somewhat sceptical about Henry Hub’s global future, although he did suggest Chinese buyers, while still very tightly tied to oil prices via the NBP index, could accept Henry Hub pricing. “At Cnooc our preference is to have oil indexation, but because of the size of our market we can accommodate Henry Hub if it can provide us some flexibility in contract terms so we can manage demand volatility.”

Vitol’s Wheelock, however, said the question about what index gains prominence is not of burning importance now, compared with the length of contracts – buyers want shorter contracts, sellers want longer contracts. “It’s not necessarily a lack of appetite for Henry Hub, it is a lack of appetite for any long-term contract, regardless of the price indexation.”

Dale Lunan

Costing LNG projects

In today’s competitive landscape with new LNG projects struggling to find buyers and project financing, there is increased focus on being the “low-cost” LNG project. Numerous projects, especially those in the second wave of proposed US LNG export projects, are promising low $/metric ton (mt) engineering, procurement and construction (EPC) costs, with about $500/mt/yr capacity viewed as the magic number to lure buyers.

LNG project developers are promising cheap feed gas, smaller trains, shorter contracts, and just about anything else that might appeal to the new breed of LNG buyers that generally want smaller volumes and shorter contracts. As buyers struggle to evaluate the onslaught of “low-cost” projects out there, it can be hard to evaluate which projects are merely aspirational and which projects might actually go the distance to final investment decision (FID). For this reason, some EPC contractors like Mitsubishi are still focused on LNG projects sponsored by the large integrated energy companies and national oil companies (NOCs) that were instrumental in developing the LNG industry.

On the sidelines of CERAWeek in Houston in March, NGW sat down with Mike Sicker, VP of business development at Mitsubishi Heavy Industries America’s (MHIA) Oil & Gas Division to get his views on the global LNG market overall and where a traditional EPC contractor like Mitsubishi sees opportunities.

Mitsubishi has partnered with ExxonMobil on some of the biggest and most successful LNG projects in the world including Qatar and Papua New Guinea. Not surprising, Sicker indicated that Mitsubishi is focused on several planned expansion projects and sees these projects as having the best likelihood of moving forward in this competitive environment.

While plant expansions are usually the lowest cost of incremental supply, the consensus view seems to be that by the mid-2020s, new greenfield LNG projects will be needed to meet growing demand. Since these projects will need to be sanctioned soon to avoid a supply shortfall, there is increased focus on costs with the view that the recent high capital expenditure and schedule trends cannot be the norm for the next wave of new LNG projects. At a recent panel on LNG technology at CWC’s LNG Americas event, a group of industry experts discussed the various technological and cost issues facing the LNG industry and even challenged the conventional wisdom on $/mt as a measure. According to Christopher Caswell, director of global LNG and FLNG technology and development for engineering giant KBR, it is often misleading to use $/mt as a means to judge past LNG projects as well as the feasibility of future LNG projects since the site-specific elements of every project are the biggest drivers of project capex and schedule. Projects at their earliest stage of development are not likely to know their site-specific impacts to capex and schedule, which makes the estimate of $/mt merely an estimate.

CWC's LNG & Gas Americas Summit panel 'Driving LNG Use through Infrastructure and Technological Innovation: How are New Technologies Impacting the LNG Business?' From L to R: Susan Sakmar, author and attorney; Christopher Caswell of KBR; Mona Setoodeh of CH-IV; Robert M Shivers of LoneStar – LNG; Martin Rosetta of Chiyoda International (Photo credit: Susan Sakmar)

It is often very difficult to determine what exactly is included or excluded in reported costs and at the end of the day, there is very little certainty that what was previously included as reported costs at the time of sanction actually reflects the owner’s final cost when EPC is completed. This leads to a wide range of $/mt for completed projects.

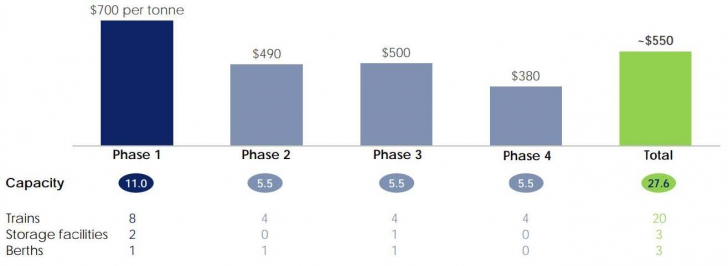

Nevertheless, projects seeking investors, offtakers, or project financing typically use $/mt as a way to benchmark their project against all others. For example, Tellurian has characterised its proposed Driftwood LNG project as one of the lowest cost projects in the world at an estimated $550/mt EPC costs, with equity stakes being sold at $1,500/mt/yr output.

At the CWC event, a potential LNG buyer from China expressed some frustration at the range of costs and asked how buyers should evaluate the various claims being made. While no specific feedback was given at the event, it is evident that the devil is in the details with LNG projects and buyers would be well advised to do extensive due diligence to determine whether there is enough data to make the estimate reliable. This task is made difficult since the $/mt cost metric only captures capital expenditure and the LNG production rate and does not take into account the scope and site-specific differences in each project.

Key terms of EPC agreements with Bechtel

Source:Tellurian Corporate Presentation, March 2018, www.tellurianinc.com

Driftwood vs. competitors – cost per tonne

Source: Tellurian Corporate Presentation, March 2018, www.tellurianinc.com

Note: (1) The World Bank bases the Logistics Performance Index (LPI) on surveys of operators to measure logistics “friendliness” in respective countries which is supplemented by quantitative data on the performance of components of the logistics chain.

These include the size of facility (large or small); whether or not it is modular; the size of the trains; and the availability of manpower. In recent years, rising costs for raw material, equipment and skilled labour have all contributed to rising LNG project costs. In the end, it will likely be the bankers that help sort out the aspirational projects from the ones grounded in reality as project financiers have continued to insist they still require long-term contracts with creditworthy offtakers. Project lenders also typically require proven technology with a track record of success.

Unless the bankers relax their standards and accept more risk, existing LNG projects and projects backed by large integrated energy companies or NOCs will continue to have an advantage.

Susan Sakmar