EU gas production slumps 18% in 2023, outpacing 8% drop in demand [Gas in Transition]

Statistics have been released by the Joint Organisations' Data Initiative (JODI) on EU gas production and consumption. As Poland has not yet provided all its data, we are omitting the country, and focusing only on the EU-25. But this gives a good proxy for the EU as a whole.

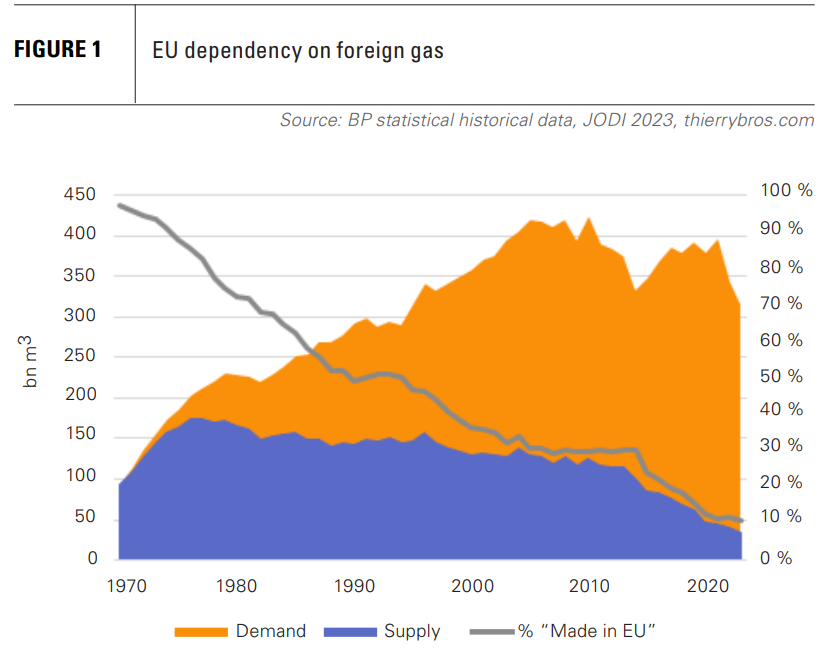

EU-25 gas production was down by a record 18% in 2023, due mostly by the definitive closure of Groningen in the Netherlands (-36% year/year) and years of antipathy to upstream countries in most EU countries. Outside the EU, Turkey saw an impressive growth in its domestic production (+113% yr/yr) and should produce over 1bn m3/yr from 2024.

To help mitigate the drop in Russian pipe exports to Europe and benefit from record prices, neighbours UK and Norwegian increased their production in 2022. But in 2023, even with less Russian gas, as prices were going down, Norway and the UK produced less (-6% and -10% yr/yr respectively).

Overall EU-25 demand was again down by 8% due the weaponisation of gas by Russia that led to both high prices and EU political interventions. Portugal saw the biggest decline in demand of 20%, while on the other end of the scale, Sweden’s demand increased by 11%. After the record drop in demand of 13.5% in 2022, more mild weather, further demand reduction and demand destruction mostly in gas-fired power generation, managed to achieve this EU gas demand decrease. But this cannot be the trend in the coming years; we should expect EU-27 to have reached an undulating plateau of 315bn m3/yr of gas demand. Around the EU, the UK has seen a drop of 11% of its gas demand (compounded by Brexit and economic recession) while markets in Turkey (-5% in 2023 versus 2022) and Switzerland (+5%) proved more resilient than the EU.

The EU’s dependency on foreign natural gas reached a record high of just above 89%. We should expect this percentage to increase further in the coming years. Policymakers in Brussels and member states should be concerned at this and look at ways of boosting indigenous supply, in particular in Romania and Poland, and diversifying supply by incentivising the top three foreign suppliers outside Russia – Norway, the US and Qatar – to invest massively in expanding their exports.

Unfortunately, with the anti-gas narrative still prevalent in Brussels, Norway quietly reduced its production in 2023 to maximise its rent, while, by pausing in January 2024 non-free trade agreement countries (FTA) authorizations for US LNG until after the next election, the Biden administration is delivering a domestic agenda that pleases both greens and voters that want cheap US gas. Ironically, it also revealed the EU’s weak position, from commission to industry. While the bloc publicly states that gas has little future in its energy system, its officials behind closed doors have sought to convince Washington that the US’ sovereign decision should be reversed.

From green to blue

The outgoing EU Commission is in a particularly difficult position after having asked coal, oil and gas-producing countries to phase out output and set over-ambitious green demand “targets” for the end of the decade. With MEP elections looming and given that voters are very unlikely to accept lower living standards to achieve them, those targets are unlikely to be met. After the June 2024 MEP elections, the next Commission should face an EU Parliament that is a lot less green and bluer. It will therefore continue to shift from its 2019 dogmatic green deal idea to more pragmatic solutions. The next European Commission will need to move away from its magic modelling to take into account thermodynamics and voters’ acceptability. This could be achieved with a Commissionaire not only in charge of the usual Energy & Climate but Industry, Energy and Climate to reverse the processes of deindustrialisation and carbon leakage that have taken place over the last decades. Maroš Šefčovič, Commissionaire since 2009, could do the job as he understands that energy affordability remains a key challenge for the EU.

Dr. Thierry Bros

February 21, 2024

Energy Expert & Professor