Energean's Challenges In Israel's Upstream

For Greek E&P company Energean, the $148.5mn acquisition of Karish and Tanin from Delek Group, is a big bet and a strategic turning point.

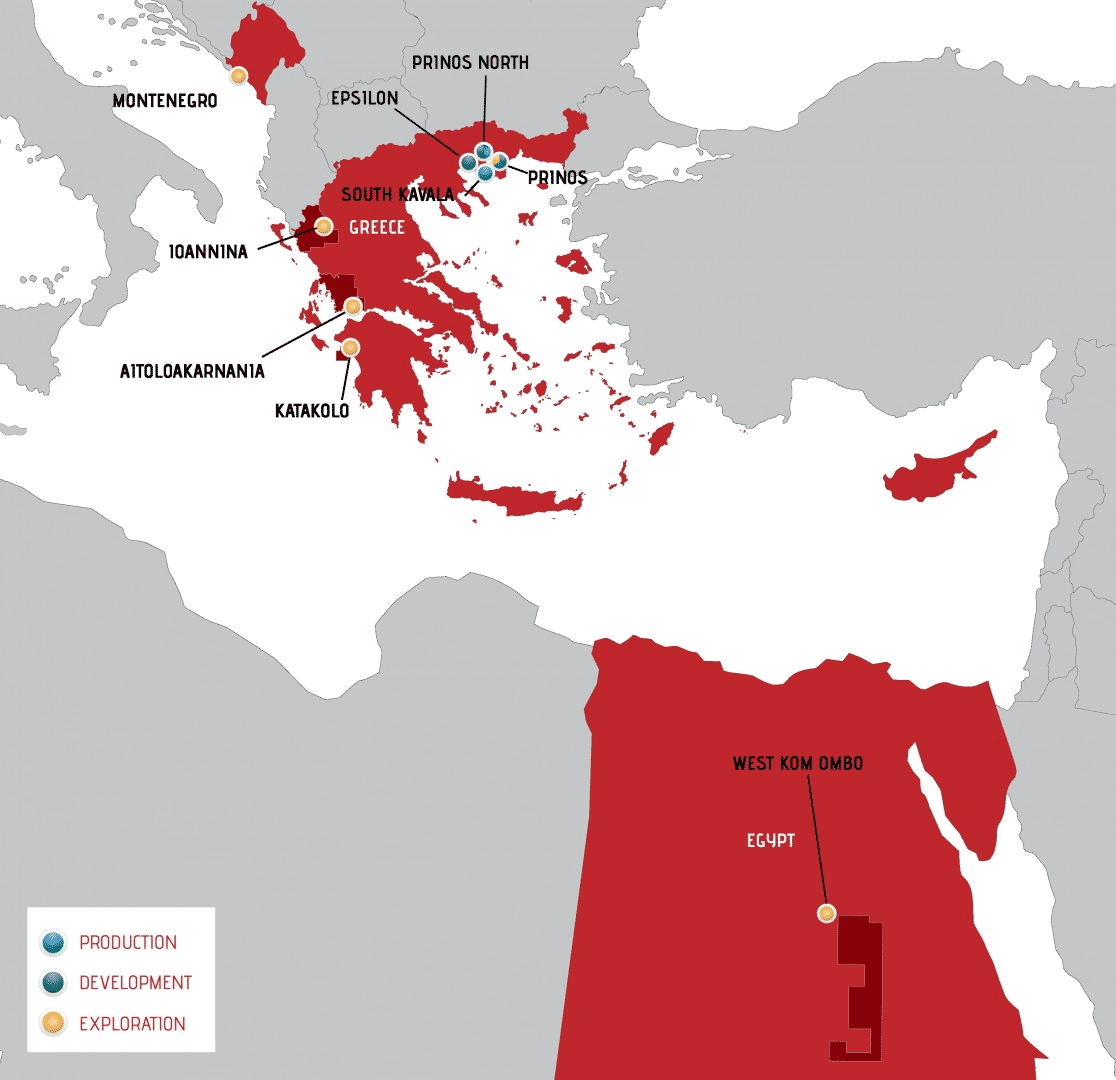

Energean is a small upstream company with operator's capabilities and no ambitions to become a global player in the energy sector. Its efforts are concentrated in Greece, the Balkans, Egypt and now in Israel's Karish and Tanin gas fields, the biggest undertaking in its history. Energean will be allowed to sell its Israeli output only in the Israeli market.The two fields together hold 60 bn m³ which are valued at about $10bn at a price of $5.00/mn Btu.

Energean’s point man and representative in Tel Aviv is Shaul Zemach, formerly the general manager of the energy ministry and famous for heading the Zemach Committee, which set gas export quotas.

With the acquisition of Karish and Tanin, Energean has undertaken its biggest ever challenge: a development of deep water natural gas resources. Energean has never carried out such a technically complicated and challenging project. However, as in any project of this kind the quality of the project is dependent also on the contractors' capabilities and experience. So Energean will have to choose experienced and trusted contractors.

Energean's sphere of operations (Credit: Energean)

Not less of a challenge for Energean will be the operations to raise estimated $800-$900mn in investment needed to develop Karish and Tanin. As it is a private company, it will have to rely mainly on banks loans and institutional investors in order to raise the money or to hope that its deep pocketed shareholder would come to the rescue. Entry of a new partner would also be favourably accepted. Energean will have to submit a development program to the energy ministry within six months of the transaction's closure.

It is expected that apart from drilling the wells and connecting them to the treatment platform, Energean will have to build its own infrastructure, a platform for gas treatment and a pipeline to connect it to the shore. However, the situation is still complicated and fluid, since the Israeli energy ministry has yet to decide upon the incentives that were promised to the small reservoirs' operators and also to set regulations. Energean expects to bring its gas fields online in 2019 on 2020.

Where are the offtakers?

In order to be competitive in the Israeli market Energean will have to offer its gas at a price level of about $4.50/mn Btu. The average gas price is $5.15/mn Btu. However at least 90% of the market is contracted to Tamar Partnership under long term agreements until 2027.

The two new players, Leviathan and Karish-Tanin will struggle to find customers for their gas in the domestic markets. A sharp rise in demand is not forecasted for the next few years and any price Energean would offer, Leviathan, or even Tamar, could undercut because of their scales of operations. So Energean’s success is very much dependent on the regulatory framework when the effective monopoly ends.

In the next few weeks the Israeli energy ministry will examine the deal. It already issued a pre-ruling stating that Energean is suitable to be an operator. And in 45 days, when the deal is approved and sealed and the first $40mn will change hands, the countdown will start.

Ya'acov Zalel