Enbridge in JV for Permian gas pipeline, storage assets

Canadian pipeline and energy infrastructure company Enbridge said March 26 it had entered into an agreement with Texas infrastructure company WhiteWater, I Squared Capital and midstream company MPLX to form a joint venture to develop, own and operate natural gas pipeline and storage assets connecting the Permian Basin to Gulf Coast LNG markets.

Enbridge will hold a 19% interest in the joint venture, with WhiteWater and I Squared taking a combined 50.6% stake and MPLX holding the remaining 30.4% interest.

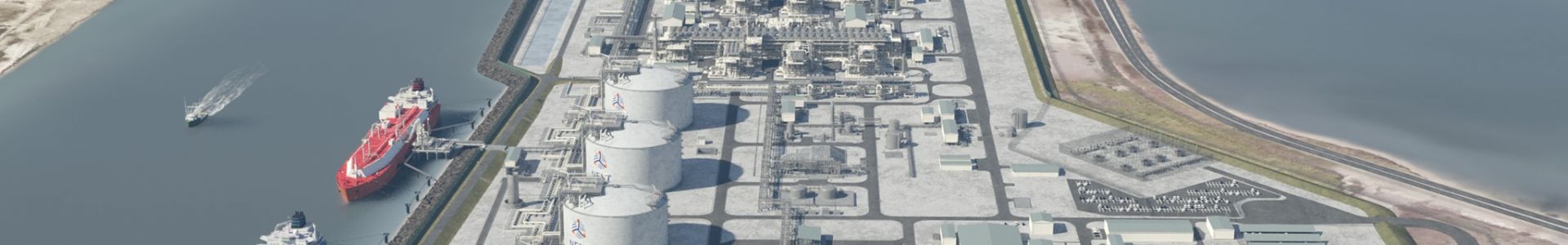

Enbridge will contribute to the joint venture US$350mn in cash and its 100% interest in the Rio Bravo pipeline project that will deliver gas from the Agua Dulce supply area in Texas to NextDecade’s Rio Grande LNG project in Brownsville, Texas.

On closing, Enbridge will retain a 25% economic interest in Rio Bravo, which along with the joint venture’s other assets will be operated by WhiteWater. Enbridge will also fund the first US$150mn of post-close capital expenditures required to complete Rio Bravo.

“Acquiring a meaningful equity interest in an integrated Permian natural gas pipeline and storage network that is directly connected to our existing infrastructure at Agua Dulce through this JV with WhiteWater/I Squared and MPLX is very exciting,” Enbridge executive vice president Cynthia Hansen said. “This is a great way to enhance our super-system approach, bringing energy supply to places where it is needed most and providing last mile connectivity to domestic and export customers.”

WhiteWater and I Squared will contribute their combined 100% interest in the Whistler pipeline, a 450-mile intrastate pipeline moving natural gas from the Waha Header in the Permian Basin to Agua Dulce, near the starting point of the Rio Bravo pipeline.

“This strategic transaction is a win for WhiteWater/I Squared and MPLX,” WhiteWater CEO Christer Rundlof said. “It extends the average contract tenor, brings us closer to an important strategic partner in Enbridge and positions us well for future development opportunities supporting Gulf Coast LNG.”

The joint venture will also own a 70% interest in ADCC pipeline, a 40-mile intrastate pipeline designed to transport 1.7bn ft3/day of natural gas from the terminus of the Whistler pipeline at Agua Dulce to Cheniere Energy’s Corpus Christi LNG terminal on the Texas Gulf Coast. The pipeline is expected to be in-service in Q3 2024 and is expandable to 2.5bn ft3/day.

Finally, the joint venture will have a 50% interest in Waha Gas Storage, a 2bn ft3 cavern storage facility.

The transaction is expected to close in Q2 2024, subject to the receipt of required regulatory approvals and the satisfaction of other customary closing conditions.