Danes Reap $528mn Contract Windfall

Danish producer and utility Dong Energy’s 1H 2016 net profit increased by 129% year-on-year to Dkr 6.39bn ($958mn), helped by a more than half-billion dollar windfall from gas contract renegotiations, it announced August 4.

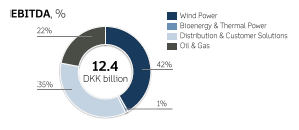

CEO Henrik Poulson described as “satisfactory” a 19% increase year-on-year in group operating profit (Ebitda) in 1H 2016 to Dkr 12.4bn ($1.9bn), noting it was underpinned by strong growth in wind power earnings, partly offset by the impact of lower gas, oil and power prices. Full year 2016 Ebitda is expected to be Dkr 20-23bn ($3bn-$3.5bn), of which half from wind power.

Lump sum payments from the renegotiation of Dong's gas purchase contracts – it declined to confirm which – are expected to contribute Dkr 3.5bn in 2016, most of which were realised in 1H 2016. These swelled Dong's 1H 2016 Ebitda year-on-year by 147% to Dkr 4.6bn ($692mn).

Dong buys contractual gas from the Danish Underground Consortium - a joint venture of Shell, Maersk, Chevron and Denmark's state North Sea Fund -- as well as from US producer Hess and Russia's Gazprom.

In 2013 Dong said it terminated negotiations with Gazprom; the latter's 1Q 2016 results said Dong was among five firms that had referred it to international arbitration (the others were Poland's PGNIG, Turkey's Botas, Dutch GasTerra and Shell Europe). But this spring, Danish newspapers reported that Dong's talks with Gazprom had resumed, indicating that perhaps a settlement had been reached.

Dong says that since 1H 2015 its contractual purchases have now been switched from oil- to gas hub-indexation, noting the 39% fall year-on-year on the average 1H 2016 Dutch TTF hub price to €13/MWh.

Dong's 1H 2016 group operating profit (Ebitda)

Oil and gas production at Dong was up 7% at 116,150 barrels of oil equivalent per day, buoyed by the February 2016 start-up of the UK Laggan-Tormore gas field (Dong’s stake 20%) but upstream's Ebitda fell by 48% year on year to Dkr 2.7bn ($407mn)

Dong’s Dkr 2.3bn ($350mn) sale agreed this May of its gas distribution grid and some oil and gas pipelines to Danish state-run Energinet is expected to realise a gain of Dkr 1.5bn when completed in September. Dong also agreed the $70.2mn sale of non-core interests offshore Norway to UK-listed Faroe Petroleum on July 14 which is expected to conclude by end-2016.

Poulson said the UK's decision to leave the EU was "in our view unlikely to result in any fundamental changes to the UK offshore wind sector."

Mark Smedley