China Building 10% of Sub-Saharan Power Capacity: IEA

Chinese companies have invested substantially in Africa, accounting for 30% of the region’s capacity additions in the last five years, and they continue to develop the power sector particularly in sub-Saharan Africa, according to a study released by the International Energy Agency (IEA) July 5.

The report, Boosting the Power Sector in Sub-Saharan Africa: China’s Involvement, focuses on such investment of around $13bn between 2010 and 2015 from China, primarily financed through public lending. Over half of the projects added are for renewable energy, mainly hydropower.

“African countries have relied heavily on China to support the expansion of their electricity systems, to enable growth and improve living standards,” said IEA Deputy Executive Director Paul Simons.

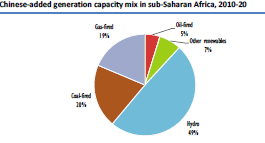

Chinese companies have built, or are contracted to build, 17 GW of generation capacity in sub-Saharan Africa from 2010 to 2020, equivalent to 10% of existing installed capacity in that region, the IEA report says. Of that, 49% is hydro, 20% coal-fired, with gas-firing in third place on 19%, with other renewables (7%) and oil-firing (5%) bringing up the rear.

Graphic credit: the IEA's Boosting the Power Sector in Sub-Saharan Africa: China’s Involvement ; other renewables includes solar, wind, biomass and waste.

In West Africa, most Chinese investment is in gas-fired power plants, especially in Nigeria where Chinese firms have completed three projects totalling 1.5 GW that include use of technology from firms such as GE. “Nonetheless, as local content is a prerequisite for Chinese public funding, foreign suppliers have to manufacture their equipment in China to be eligible for export credits,” the IEA report notes.

In 2010-15, Chinese financing for sub-Saharan Africa power projects was $13bn, or one-fifth of all power investments in the region, chiefly through public lending from China’s Ex-Im Bank. While most Chinese-built projects are financed by sovereign loans guaranteed by African states, a few Chinese companies operate as independent power projects (IPPs) notably the 200 MW Sunon Asogli gas-fired power plant at Tema in Ghana. The report says a second phase, adding 340 MW to reach 540 MW, was planned for completion in 2017, equipped with Dutch turbines and UK generators, but the IEA says that “full load operation will depend on sufficient gas supplies from Nigeria until Ghana has its own supplies.” Those imports from Nigeria have proven in recent months to be unreliable.

Chinese firms are also active in the cross-border transmission lines such as between Ethiopia and Kenya, and in local distribution networks such as in Equatorial Guinea, or ‘off grid’ in rural Angola *.

The IEA notes that 635mn people still live without electricity in sub-Saharan Africa, but commends China for the fact that an estimated half-billion people were provided access to electricity from 1980 to 2000, such electrification in China is now over 99%.

One factor discussed by the IEA is whether Chinese investment in Africa’s power sector might be part of a long-term strategy to develop future markets for its Chinese nuclear reactor exporters. South Africa is the only country in the region with an existing plant, but China has also offered technical support with feasibility studies to Kenya.

The IEA also asks if China might carry off the 5-GW ‘phase three’ of the ‘Giant Inga dam’ in Congo/Zaire. Costs of the phase 3 are put between $5bn and $12bn, but three consortia are interested: one Chinese, one Spanish, and the other Canadian/South Korean.

The IEA’s study is substantial, but its claim that it offers “the first pan-regional overview of the involvement of Chinese companies in the region’s electricity sector” perhaps overlooks work since 2012 by Cape Town-based academic Anton Eberhard and colleagues in a succession of World Bank studies.

Chinese labour flows to Africa

Meanwhile, a July 13 presentation at the Brookings Institution points to how Chinese investment in sub-Saharan Africa has benefited its economy but that Chinese migration has been a “mixed blessing.”

David Dollar, Senior Fellow at Brookings’ John L Thornton China Center, said that an official estimate of Chinese workers in Africa at end-2014 was 259,385 (with most present in Angola 71,542, followed by Algeria 50,231 and Congo 14,483). However he adds that recent unofficial estimates put the Africa-wide figure as high as 1mn.

“Given immigration laws in place, it seems unlikely that all of them are in Africa legally,” Dollar noted in his full report, China’s Engagement with Africa: From Natural Resources to Human Resources, published earlier in July by Brookings.

Half of Africa’s population is under 20 and it needs to create about 20mn jobs per year, the author adds, whereas China’s working age population has peaked and will decline in future decades.

Nonetheless he cited a survey by Pew Global Attitudes in 2015 that reported that 70% of Africans have a favourable view towards China, ahead of 57% in Latin America and also Asia, and only 41% in Europe.

While China’s trade and investment have supported African economic growth, argued Dollar, some resource investments in poor governance environments are not faring well. More data is needed on China-Africa trade relationships and migration, he argues, and also labour flows need to be “managed”.

Mark Smedley

* off-grid systems were the subject of a World Bank-backed conference in May 2016 in Nairobi, recently discussed in this World Bank article here.