Can sour gas ensure Malaysia’s long-term LNG prospects? [Gas in Transition]

A recent admission from Malaysia’s state-owned energy company that domestic oil and gas production will peak next year and plateau there until the end of this decade will put the spotlight on how Southeast Asia’s biggest LNG producer intends to secure enough feedstock gas supply to ensure it remains a relevant regional player in the years ahead.

Domestic production will reach about 2mn barrels of oil equivalent/day in 2024 and remain at that level until 2030, Mohamed Firouz Asnan, senior vice president of Malaysia Petroleum Management, Upstream Business, at Petronas, said at the Energy Asia conference in late June. Domestic and overseas output at Petronas averaged 2.4mn boe/d last year, according to the Malaysian NOC’s earnings announcement for the fourth quarter of 2022.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

About 60-70% of Petronas’s production is gas and this share will remain unchanged going forward, Adif Zulkifli, executive vice president and upstream chief executive, said at the same event. “We continue to look for more gas portfolio, but of course, there is commitment in Malaysia, I think we need to continue to do some oil exploration to fill up our refineries,” he added.

The hunt for gas comes amid feedstock gas concerns at the LNG export projects operated by the NOC, which carry a nameplate capacity of 32mn tonnes/year and support contracts with predominantly Japanese buyers. Petronas achieved gross LNG sales of 8.9mn t in the first three months of 2023, up by 6% year/year, while sales for all of 2022 climbed by 4.6% to 34.2mn t.

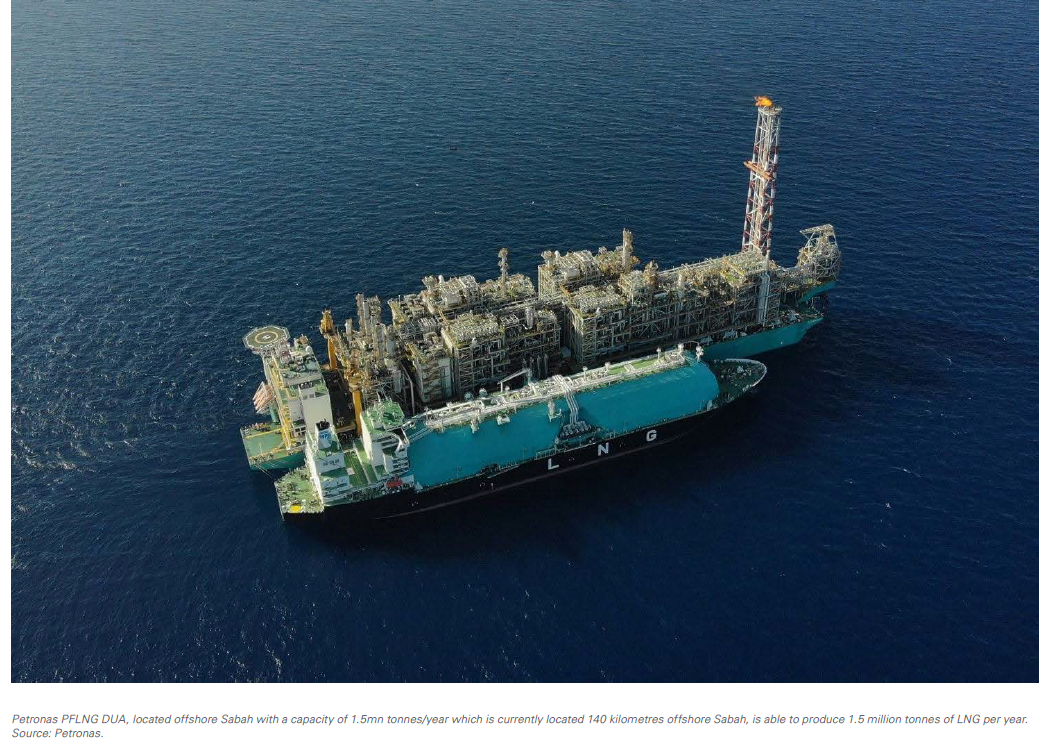

The Petronas LNG complex – also known as Malaysia LNG (MLNG) – is located in Bintulu, within Malaysia’s biggest state of Sarawak. It is the single largest LNG facility in Southeast Asia with nine trains comprising 29.3mn t/yr across four onshore plants – MLNG Satu, MLNG Dua, MLNG Tiga and MLNG Train 9. When including the two floating LNG vessels with combined capacity of 2.7mn t/yr, Malaysia’s total liquefaction capacity of 32.0mn t/yr accounted for half of Southeast Asia’s total at the end of 2022.

Malaysia was the fifth-largest LNG exporter last year at 27.3mn t compared with 24.9mn t in 2021, according to the International Gas Union’s latest World LNG Report released in July. Most of the exports came from MLNG, which began production in 1983. MLNG’s exports have fallen over 2017 to 2020 due to declining feed-gas supply from maturing legacy fields. Although many gas projects are lined up to serve as backfill for the older trains between 2022 and 2025, two out of MLNG’s four plants – MLNG Satu and MLNG Dua – could see feedstock fall by 2030. The plant’s supply outlook now hinges on development of Malaysia’s vast but costly and technically challenging sour gas fields.

MLNG Satu, MLNG Dua and MLNG Tiga were developed to monetise the significant gas reserves offshore Bintulu. These include various gas and associated-gas fields across what are known as the MLNG production sharing contracts. The newer MLNG Train 9 project was developed to liquefy gas from the NC3 and NC8 fields that were discovered in the offshore Block SK316 in 2009.

The commissioning of the Sabah-Sarawak Gas Pipeline (SSGP) in 2014 allowed offshore Sabah gas to be processed at Bintulu and exported as LNG. The 500-km pipeline has a capacity of between 750mn ft³/d (21mn m³/d) and a potential 1.1bn ft³/d. Since it began operations, however, the pipeline has had a multitude of problems – including gas leaks that have affected Bintulu’s LNG production.

A taste for the sour

The biggest potential to sustain Malaysian LNG production lies with Petronas’s ability to monetise its domestic sour gas fields, which contain high levels of CO2 and other impurities such as hydrogen sulphide that are corrosive to pipelines. CO2 also needs to be extracted from the gas as it freezes during the liquefaction process and blocks flow lines. These factors resulted in sour gas resources being previously deemed uneconomical.

The Kasawari field, located in Block SK316 about 200 km offshore Sarawak, was discovered in 2012 and is one of Malaysia’s largest untapped non-associated gas fields. The field holds an estimated 3.2 trillion ft3 of gas but contains between 30% and 40% of CO2. Kasawari’s gas could supply MLNG Train 9, like other fields in the same block.

The Kasawari field, located in Block SK316 about 200 km offshore Sarawak, was discovered in 2012 and is one of Malaysia’s largest untapped non-associated gas fields. The field holds an estimated 3.2 trillion ft3 of gas but contains between 30% and 40% of CO2. Kasawari’s gas could supply MLNG Train 9, like other fields in the same block.

But development of Kasawari has irked China because the field lies in Malaysia’s exclusive economic zone (EEZ) in the South China Sea – most of which is claimed by Beijing via its “nine-dash line.” “Petronas has carried out a major activity in an area that is also claimed by China,” which worried Beijing, Malaysian Prime Minister Anwar Ibrahim said in April after he visited China.

Kasawari is being developed in two phases with the first set to launch this year. The field has a design capacity of 900mn ft3/d of gas that is expected to be reached in 2025. The gas will be processed at an offshore central processing platform that harnesses gas from five subsea wells.

The second phase comprises what Petronas has claimed will be the world’s largest offshore carbon capture and storage (CCS) project when it starts up, capturing 3.7-4mn t/yr of CO2 from Kasawari’s output that will be injected into the depleted M1 gas field. First injection is targeted by the end of 2025 and Petronas has estimated the project could prevent 76mn mt of CO2 from being vented into the atmosphere.

Unlocking other sour fields

The development of Kasawari holds the key to the development of other sour gas fields in Malaysia, including Lang Lebah and the K5 field.

Thailand’s state-owned PTT Exploration and Production Public Company (PTTEP) is looking to develop Lang Lebah – located in Block SK410B – as potential feedstock for MLNG. PTTEP aims to reach a final investment decision on the giant sour gas project this year with first gas slated for the first half of 2026.

The field reportedly holds 2-4 trillion ft³ of gas and appraisals have indicated it could produce up to 1bn ft³/d. The front-end engineering design (FEED) contract for the onshore gas plant – known as Lang Lebah Onshore Gas Plant 2 (OGP2) – was awarded to Technip Energies in October 2022. The plant represents one of the key projects of the Sarawak Integrated Sour Gas Evacuation System Development, which is expected to pave the way for further development of untapped sour gas resources offshore Sarawak.

Separately Malaysia’s K5 field was discovered more than half a century ago in 1970 in the shallow waters of Block SK8 offshore Sarawak. It is estimated to have 4 trillion ft³ of gas and an initial production rate of 250mn ft³/d, but also containing as much as 70% CO2. Gas from the field is earmarked as feed gas for Train 9.

Petronas has been developing in-house technologies over the past decade to commercialise K5 that include CCS, transport, utilisation and storage. The Malaysian NOC is hoping to mature its CO2 management technology and capabilities to reuse them elsewhere and have a competitive advantage in developing numerous high CO2 gas fields in the region.

The East Natuna giant gas field, discovered five decades ago in 1973, remains Southeast Asia’s largest untapped gas resource of potentially 222 trillion ft³ with recoverable gas reserves last estimated at 46 trillion ft³. Located in Indonesian waters of the South China Sea, the closest onshore LNG liquefaction facility to the field is MLNG. Yet, the field is estimated to contain at least 70% CO2.

Progress on the field depends on Malaysia’s progress on harnessing its own gas fields. The current sentiment among industry watchers is that East Natuna will not be approved and commercialised, so it holds little potential for shoring up Malaysia’s LNG outlook.

Historical outages at SSGP

In September 2022, Petronas declared force majeure on supply to MLNG due to a leak at the SSGP. The pipeline has faced several issues over the years and the most recent leak less than a year ago marks the fifth-known incident since 2014.

The largest drop from normal production levels associated with a previous outage was 30%, following an explosion at the SSGP in January 2020. Another disruption in supply occurred in May 2019 when a fire broke out at a segment of the pipeline, lowering production by as much as 17%.

Not all reported leaks had a significant impact on MLNG’s production – a leak at the SSGP in January 2018 had little to no impact on Malaysian production, with Petronas announcing its portfolio LNG deliveries were not affected. But the LNG market was significantly looser in 2018 than in 2022 or in 2023 to date, meaning replacement cargoes could be sourced more easily. The September 2022 outage likely affected buyers in Japan the most as the country’s power market normally tightens in the run-up to winter.

Other events that reduced MLNG’s output in the past have been driven by upstream issues, such as in June 2018 and September 2021. These episodes saw supply falling to similar levels as in previous instances of SSGP outages, but it is unclear whether these upstream issues were related to curbs in gas flow from SSGP.