[NGW Magazine] Batteries and the threat to gas

So far, the intermittency problem has been cited as the obstacle in the way of full-scale renewables, but here too technology is becoming cheaper, and money is flowing into battery research and development.

Has battery storage technology and deployment reached a stage in its development where it can start posing a threat to the use of natural gas in power generation?

Two recent developments may be indicative of what is to come.

In California the Public Utilities Commission (CPUC) approved an order January 11, requiring the state’s biggest utility, PG&E, to change the way it supplies power when demand peaks. Instead of relying on electricity from gas-fired ‘peaker’ plants, the order requires PG&E to use batteries or other non-fossil fuel resources. One of the reasons behind this was the large natural gas leak near Los Angeles at the end of 2015, which threatened conventional energy suppliers and power deliveries in 2016 and even 2017. Part of the identified solution was large-scale battery storage.

In the meanwhile, last November Elon Musk’s Tesla supplied a 100 MW lithium-ion battery to South Australia, the biggest battery ever, which is already performing exceptionally well. No sooner had this record been achieved, than it is about to be broken. Hyundai Electric & Energy Systems Co is planning to install a 150-MW lithium-ion battery in February in Ulsan, Korea.

These developments may be bringing forward the day when energy storage starts to address renewables’ main limitation – intermittency. But do these developments mark a step change in this process? What do they mean in terms of the complementarity of gas to renewables in power generation?

The California decision

California, one of the ‘greenest’ states in the US, aims to get half of its power from renewables and cut petroleum use by half by 2030, as well as reduce emissions by 40% over the same period, in comparison with 1990.

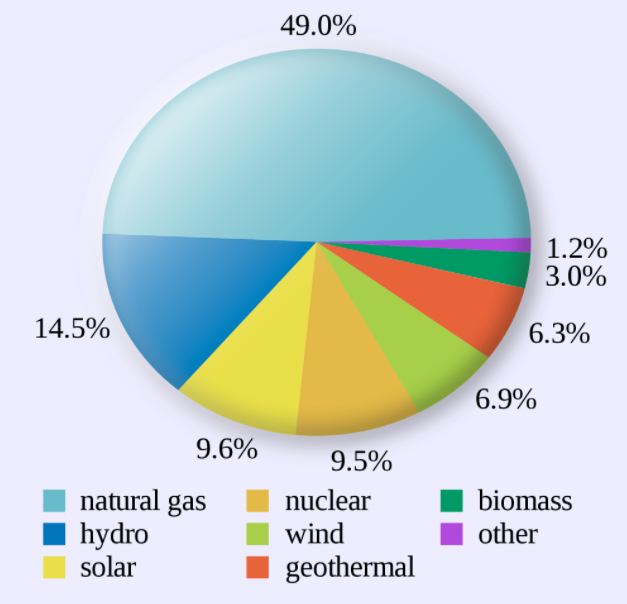

When compared to the current energy mix (Figure 1), it is clear that the strongest impact of achieving these targets will be to reduce natural gas consumption. And with the gas industry in the US as a whole being responsible for more emissions than coal in 2016, for the first time according to Bloomberg, California’s shift away from fossil fuels is gaining traction.

Figure 1: California’s electricity generation in 2016

Source: California Energy Commission

California’s utilities are being transformed, driven by an ever-increasing penetration of renewables, solar and wind, in power generation. And it is about to add large-scale energy storage, using batteries, to address intermittency and to support this transformation.

More renewable energy means that gas plants are sitting idle for much of the year. This is causing problems for gas companies whose plants end-up generating power only during peak demand periods. Now, as a result of CPUC’s decision batteries are on the way-in to provide this role, making such gas ‘peaker’ plants redundant.

Michael Ferguson, director of energy infrastructure at S&P Global Ratings in New York, said: “California is going to create a blueprint for the coming years…. Renewables proliferated where there was supportive regulation, and that caused the costs to decline. I would expect to see the same thing to happen with battery storage.”

However, others are not so sure about this. Kit Konolige, an analyst with Bloomberg Intelligence, said that California still needs gas plants to back up the grid when it is under pressure from volatile solar power.

But, according to Bloomberg the shift away from gas to renewables and batteries is already happening. In 2017, regulators moved to reject a permit for a proposed gas plant in southern California, noting that clean energy resources including batteries could be used to fill the need.

The Los Angeles Department of Water and Power has also put on hold gas plant projects to explore alternatives. In addition, California has requested utilities to install at least 1.3 GW of storage by 2020. And it seems that this shift has been extending to other states, Figure 2. The development of bigger and more efficient batteries is making this shift easier, especially with California being the state behind some of these developments through Tesla.

Figure 2: Operating and planned utility-scale batteries in the US

Source: Energy Information Administration (EIA)

Battery evolution

The growing contribution of green energy, wind and solar, to power grids brings with it the problem of managing the unpredictability and intermittency of such supplies.

Battery storage is developing quickly with the setting up of battery parks aimed at smoothing such electricity supplies to the grid and supplementing the grid when solar and wind are not available. At least for now, in terms of technologies, the lithium-ion battery is the storage technology to beat.

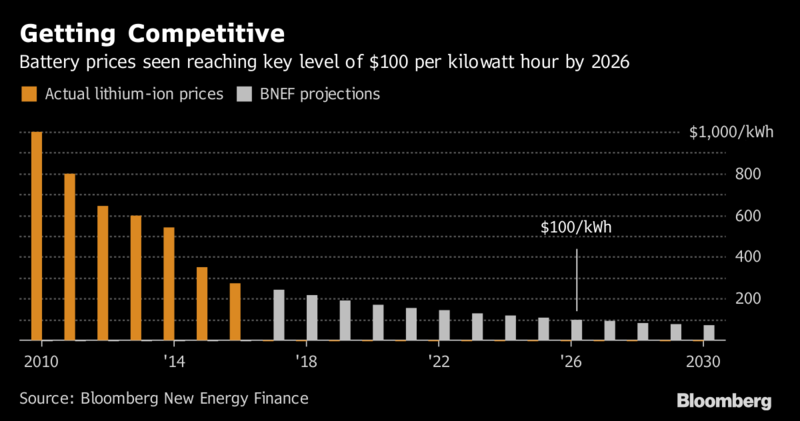

Bloomberg New Energy Finance (BNEF) data show that since 2010 the price of lithium-ion battery packs has fallen by 79%, (Figure 3). But it needs to fall further – battery prices are still too high. BNEF projects that by 2026 it will fall down to $100/kWh, making batteries commercially more attractive.

Figure 3: Lithium-ion battery prices

Source: BNEF

Tesla claims it will be producing batteries below $100/kWh as early as 2020. Batteries are evolving in terms of lower cost and higher energy density at a fast rate.

The cost of renewables is also going down rapidly, but it varies from country to country (Figure 4). The 'tipping point', ie when wind and solar become cheaper than other fuels, for Japan is at about 2025 when solar power becomes cheaper than coal. For India the tipping point for wind power is at about 2030 (Figure 4).

Figure 4: Comparison of wind, solar, coal and gas power unit costs

Source: BNEF

These tipping points are almost here, or coming over the next decade, everywhere in the world, at about the same time as battery costs are expected to become commercially more attractive. The combination of the two will then make providing back-up power and services, such as balancing electrical grids, dealing with outages and peak demand, more cost-competitive.

However, a major switch from gas and coal to solar and wind still needs to address intermittency over long periods. This will need a breakthrough in battery technology, if batteries are to be able to provide the required level of storage capacity at competitive costs. If achieved, storing considerable amounts of electricity for future use has the potential to significantly alter the economics of the power sector.

BNEF expects global energy storage capacity using batteries to increase by a factor of 15 by 2024 (Figure 5). But even by then this could represent only about 2.5% of the 1750 GW of forecast global solar and wind power generation capacity, which is not enough to make a significant impact on dealing with intermittency at large scale.

Figure 5: Global energy storage capacity forecast

Source: BNEF

Referring into the uptake of battery storage, Logan Goldie-Scot, head of storage at BNEF, said: “Policies rather than economics alone will determine the rate of uptake. Energy storage remains poorly understood by many within the energy sector and by policy-makers.” This may delay the process. He added: “This matters hugely since investing in alternatives such as natural gas power plants with a 25-plus year lifetime will either create a long lock-in period that would limit opportunities for other flexible resources such as storage, or result in stranded assets further down the line.”

Looking into the future and the need for a breakthrough in battery technology, the focus of the industry is moving from lithium-ion batteries using liquid electrolytes to solid-state ones, which may be able to address the need for safer and more powerful energy storage. Toyota Motor Corp. has said it is working to commercialise such technology by 2022, and Dyson Ltd. says it will build an electric car using solid-state batteries in three years. With improved technology and lower costs, storage systems are becoming more viable for utilities and may pose a challenge to natural gas.

Bill Powers, an engineer and consumer advocate based in San Diego said “California is a harbinger because we have the most aggressive targets for green power, but the real story in the background is the price for solar continues to drop to levels that people just couldn’t believe we would reach at this point in time.

Battery storage is following the same trend,” adding that, as a result, “natural gas dominance is no sure thing.”

South Australia’s experiment

In South Australia Elon Musk’s bet to install 100 MW of battery storage in 100 days, or give it to the state for free, paid off. ’ came on-line in November 2017 and it is three times bigger than other, existing, electricity storage facilities.

It is capable of storing 129,000 kWh of power, and is working exceptionally well. Its rapid response to unexpected power outages has been better than expected.

Tesla Powerpack (Credit: Tesla)

The previous record was the 30-MW lithium-ion battery for the Escondido project, which begun operations in February 2017 in San Diego California. But its reign did not last long. The rapid growth in battery storage capacity is astonishing (Table 1).

Table 1: Growth in battery storage capacity

* expected

This period may turn out to be the tipping point for battery storage - the point at which the capacity to store a lot of solar and wind energy cheaply and efficiently becomes achievable.

Australian critics though say that because of its capacity, Tesla’s Powerpack can only supply electricity to 30,000 homes for just over 1 hour. Another criticism is that because it is difficult to recover the cost of the battery, it may lead to increases in energy bills.

Tony Wood, energy program director at the Grattan Institute, said “Over time, storage can help put downward pressure on prices because it can flatten out peak demand… It's a very useful step in the right direction ... but it doesn't solve South Australia's problem, even at that scale.”

However, this ignores its many benefits, including that it is designed to help keep the lights on during outages and blackouts. But it is also more likely to be called into action to even out electricity supplies at less critical times.

The Australian Energy Market Operator said that for December, “the battery was dispatched for energy on over 380 separate five-minute dispatch intervals, and enabled on over 4,600 separate dispatch intervals”, providing back-up at a lower cost than before.

The battery is also useful in taking up excessive supply should demand suddenly drop, supporting grid resilience and security. Previously such excess power was disposed of as heat. Its success may usher in a revolution in how electricity is produced and stored.

This success prompted the Australian state of Victoria to sign a deal for a 20-MW battery, again using Tesla, to come on-line mid-2019.

By February an even bigger, 150-MW, lithium-ion battery is expected to come on-line in Ulsan in Korea. It is being built by Hyundai Electric & Energy Systems Co. A number of other companies – such as AES Corp, AltaGas, Next Era Energy and E.ON – are also on the way to produce large, grid-scale, battery packs that are cost-competitive.

Ali Ashgar, a BNEF senior associate, said: “Musk has set a benchmark on how quickly you can install and commission a battery of this size… Falling costs are making them a compelling mainstream option for energy-storage applications in many areas around the world, and projects even bigger than Tesla’s are now under construction.”

These developments are on the way to make energy storage a commercially viable solution to the intermittency challenge of renewables. Such successes are likely to lead to wider use of this new generation of power-packs, with potentially major implications on gas, especially as prices keep falling. The energy industry may be in for disruption – but when?

A threat to natural gas?

The successful combination of renewables and large-scale battery storage (Figure 6), used to complement intermittent solar and wind power, may spell trouble for coal and natural gas in power generation. And with coal in decline and gas on the ascendancy, at least in Europe and the US, increasingly this threat will be against gas. There are also those who say: “we got rid of coal so let’s now skip over gas.”

In addition, these technological developments threaten to create a very different market dynamic. It is one thing to operate in a growing and confident gas market and another to have to do so in a declining market, where oversupply means more competition to secure a share and long-term low prices. This is what the industry has been experiencing over the last few years – low prices may now become permanent.

Figure 6: Combination of renewables and large-scale battery storage

Source: Tesla

With the cost of renewables dropping, batteries coming of age, and policymakers pushing for increasingly ambitious green energy targets, the threat to gas and coal in power generation is becoming real. For example, on 17 January the European Parliament upped the 2030 renewables target from 27% to 35% and energy efficiency from 30% to 35%, even though the European Commission proposed targets of 27% and 30% respectively in December.

The place where this threat may evolve is California, where solar energy is plentiful and Tesla develops its batteries. The combination of California and Tesla may be what is needed to change the mindset of adding batteries to electrical grids becoming standard, ushering in an even wider and faster use of renewables.

The growing size and energy density of batteries and forecast expansion in global energy storage capacity may be sufficient to contribute to grid resilience, stability and reliability and displace gas ‘peaker’ plants within the next decade.

But it is questionable that, without a step-change breakthrough in battery technology and capacity, the combination of renewables and batteries can displace gas and coal from power generation significantly in the foreseeable future.

Without a breakthrough, evolution of battery technology may not come at a pace that can effectively eliminate the intermittency limitation of renewables over long periods and change the reality that fossil fuels store a great deal more energy in a smaller space at a low cost.

But the fact that the gas turbine giants GE and Siemens announced late last year large worker layoffs and scaling down of their core gas and power units is worrying. This has been caused by the downturn in business resulting from the combination of renewable energy and batteries challenging the market for gas ‘peaker’ plants and gas turbines.

The traditional model of the power industry has changed. Siemens CEO Joe Kaesar said: “Nothing has ever become better by ignoring reality.” This ‘new reality’ is becoming a challenge – battery storage applied at utility scale.

Despite the drive to lower emissions, the price of energy, which depends on costs across the complete spectrum from construction to operation of plants, matters. Provided gas and coal remain cost-competitive and they deal more effectively with their emissions, including methane, they will still have a major role to play over the foreseeable future, as most future outlooks and forecasts show.

However, battery storage, whether applied for backup, peak-shaving or to complement renewables in power generation, it is emerging as a key component in the global clean energy transformation.

But, even though the long-term future of energy may be shifting to renewable sources, they are not there yet and abundant supplies of natural gas will help foster the transition, provided gas prices remain competitive.

Charles Ellinas