BASF Profits are Stable, as Wintershall's Dive

German chemicals giant BASF's results, released February 24, included annual net income of €4.06bn ($4.3bn) in 2016, up 2%, with 4Q 2016 profit of €689mn, up 103% year on year.

Its oil and gas division, Wintershall, reported operating earnings (Ebitda) of €1.6bn in 2016, down 38% reflecting its sale of gas supply and storage assets, but up 44% in 4Q 2016 at €495mn.

BASF completed its asset swap with Russia's Gazprom on September 30 2015 which meant gas traders Wingas, WIEH, WIEE and storage firm Astora became wholly Gazprom-owned; these contributed €260mn to BASF’s 2015 earnings before special items. Low oil prices impacted 2016 earnings too.

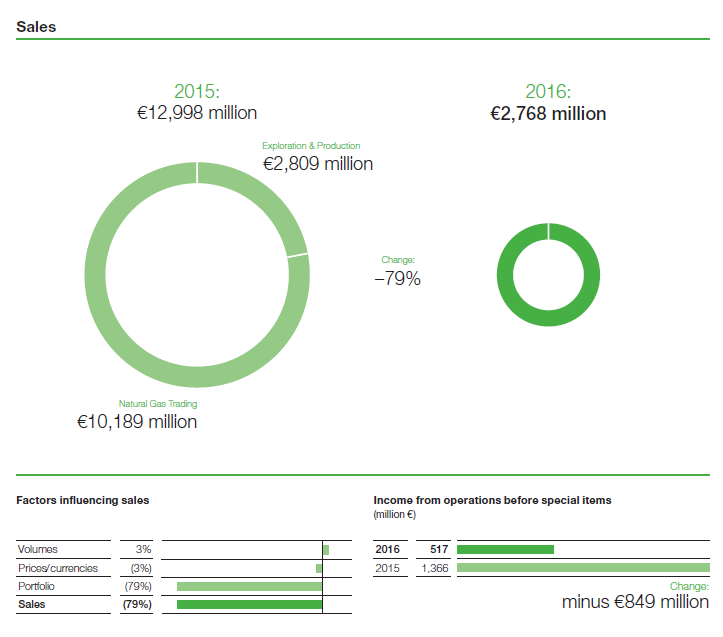

Oil and gas sales for full year 2016 were 79% lower at €2.8bn largely because of the Gazprom asset swap; joint venture gas trading and storage had contributed some €10.1bn to sales in 2015.

Joint venture gas trading and storage had contributed some €10.1bn to BASF-Wintershall sales in 2015, which it no longer had last year (Graphic credit: BASF 2016 annual report)

Wintershall increased production by 8% to 452,000 barrels of oil equivalent/day (boe/d) in full year 2016. Four-fifths of its oil and gas sales were in Europe/Russia, and one-third in South America/Middle East. Globally, it drilled 14 exploration and appraisal wells, of which 9 were successful. Proven reserves fell by 7% to 1.62bn boe and its reserve-to-production ratio fell to 10 years, from 11 in 2015.

Wintershall continued or expanded operations in the North Sea, Norway, Germany, Argentina and UAE. In Russia, the Yuzhno Russkoye gas field in Russia (35% economic interest) has run at plateau since 2009, while it also has a 50% stake in development of Block IA of the Achimov layer of the Urengoy field; gradual development continued with 78 wells producing at end-2016; blocks IV and V of Achimov will be co-developed with Gazprom. In Libya, Wintershall produced 35,000 boe/d from onshore oil block 96 only since mid-September; offshore its stake in the Total-operated al-Jurf oilfield continued operations uninterrupted all through 2016.

BASF-Wintershall continues to hold 15.5% of the existing Nord Stream pipeline, and its Gascade joint venture with Gazprom is promoting the planned Eugal gas pipeline project in eastern Germany with a view to its initial launch by end-2019.

Mark Smedley