Zero-emission vehicles and gas [NGW Magazine]

Battery-powered electric vehicles are all the rage, with consultancies falling over each other to boost projected sales in the longer term. By contrast, hydrogen fuel-cell propulsion has been all but forgotten. However, the future is unlikely to be so cut and dried for road transportation – at least if Asian automotive powerhouses China, Japan and Korea have a say.

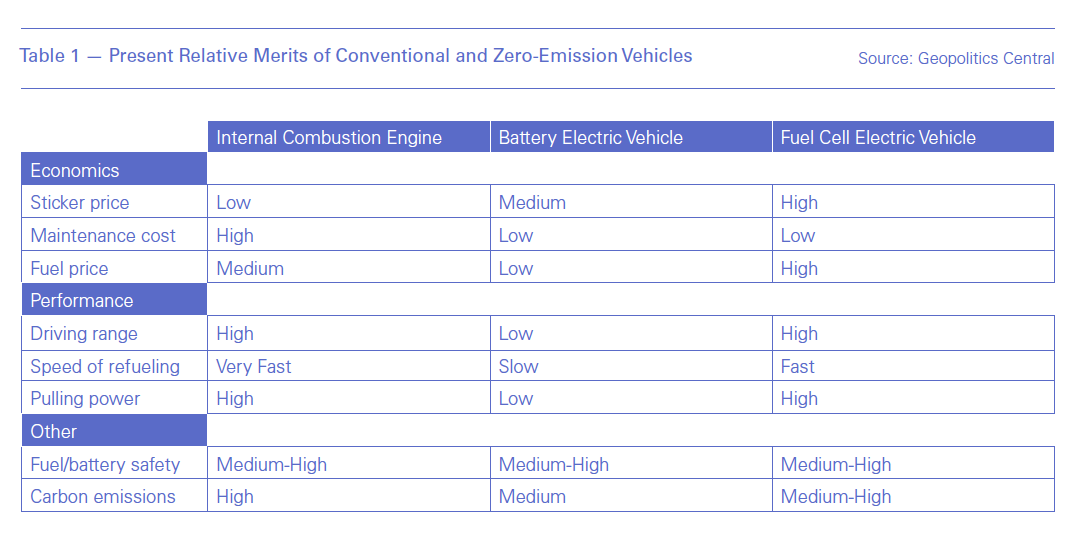

Plug-in batteries have inherent advantages for automobiles, but they also have some deficiencies, while fuel cells have significant potential advantages for long-haul trucking. As a result, the real battlefield for these two technologies could be the bus and short-haul markets.

How the competition plays out between fuel-cell electric vehicles (FCEV) and battery electric vehicles (BEVs) for the zero-emission transportation market will have an impact on gas demand, with the former potentially more supportive in the shorter term, but less so in the longer term.

Asian demand

In July, the former Audi executive, Wan Gang – the ‘father’ of China’s electric vehicle revolution – called on the government to boost its development of FCEVs at a conference in Boao, China. Hydrogen fuel cell technology may continue to have significant hurdles to overcome, especially cost, but Wan argued it is better suited for commercial and long-haul transportation than plug-in battery propulsion. Wan is now China’s science and technology chief and is leading a team to develop his country’s energy vehicle plan for 2021-35.

Japanese and Korean governments and automobile companies are even more enthusiastic, with leaders of both energy-poor and land-constrained countries announcing long-term plans at the beginning of this year for FCEVs to dominate domestically – and not just for commercial and long-haul transportation – to improve energy security and create an important new export industry for each. A majority of their populations live in apartment buildings in densely populated cities, with no room for convenient home chargers for plug-in automobiles.

The Japanese government is planning to showcase its “hydrogen society” during Tokyo’s 2020 Summer Olympics, as a complementary, if not alternative way to achieve a zero-emission transportation future. The host city is planning to use 100 hydrogen fuel cell buses to move people around during the games, as well as 40,000 fuel-cell powered automobiles.

“Hydrogen, as both a primary source, and more importantly, a carrier of energy, must become cheaper and more easily affordable,” the prime minister Shinzo Abe said at Davos in January. “My government is aiming to reduce the production cost of hydrogen by at least 90% by the year 2050, to make it cheaper than natural gas,” he said.

Plug-in cars

Plug-in battery technology dominates global sales of zero-emission passenger automobiles, a trend that is likely to continue for at least the next decade. Automotive giants such as Volkswagen are investing heavily in battery technologies, joining established players like China’s BYD and America’s Tesla.

BEVs are ideal for urban commuters who have dedicated home parking spaces for an electric car charger and travel relatively short distances each day, and they also have a substantial energy efficiency advantage over FCEVs.

In a paper published in the Air Quality and Climate Change Journal in October 2018, “Where are we heading with electric vehicles?”, the authors found well-to-wheel energy losses of BEVs to be roughly half those of FCEVs, which were almost as high as automobiles powered by gasoline, diesel, liquid petroleum gas, and compressed natural gas (CNG) at around 80%. The reason is the direct use of electricity in BEVs, compared with the many steps required to harness hydrogen for transport, with each step incurring an energy penalty.

On the other hand, there are presently only three models of fuel-cell electric passenger cars available, and these only on a relatively limited basis given their extremely high cost and a lack of hydrogen fuelling stations. Honda has been making its FCX Clarity available on a lease basis since 2008; Toyota has been selling its Mirai in markets with at least limited hydrogen fuelling infrastructure such as Australia, California, Europe and Japan since 2014; and Hyundai recently began selling its Nexo SUV.

The sticker price of the Nexo SUV is a whopping $60,000, and even at this price it has been reported Hyundai is selling it at a loss given the high cost of fuel cell technology, which presently relies on a substantial amount of platinum, and no economies of scale.

In addition, FCEVs are suffering from the classic chicken and egg conundrum that has stymied CNG vehicles. Consumers are unwilling to purchase these vehicles given a lack of hydrogen fuelling stations, while companies are unwilling to add hydrogen at their fuelling stations given a lack of FCEVs on the road to make it economic to do so. To date, California, Germany and Japan have attempted to encourage hydrogen fuelling stations through subsidies and low-interest loans, but only Japan has added a significant number given their high cost – more than $1mn/station.

Finally, there are ongoing concerns about the safety of hydrogen as a fuel among the general public. Hydrogen is highly flammable and must be stored under high pressure to make it compact enough for road transportation, compounding this apparent safety issue. In fact, hydrogen tests more safely than gasoline because it vents quickly given its low density, whereas gasoline tends to pool and combust. There are about 5mn BEV automobiles on the road and just 11,000 FCEV automobiles.

Buses and Trucks

The two key advantages of hydrogen fuel cell propulsion – speed of refuelling and driving range – tend to be relatively important to profit-maximising companies, but not to individual consumers. And key deterrents such as the lack of hydrogen infrastructure and public misconceptions about safety are more easily overcome or simply not relevant.

Buses and short-haul commercial trucks – including FedEx, UPS and Amazon – tend to travel long distances each day and operate out of central depots already set up for refuelling. Installing hydrogen fueling infrastructure at such sites would be a relatively simple, albeit expensive, undertaking. China already has at least a thousand fuel cell buses in service, all refuelled at such depots.

Long-haul trucking would require relatively few hydrogen fuelling stations to service the entire industry, even in a country as large as the US. And fuel-cell powered semi-trucks may become economic sooner than battery powered ones.

Electricity and Hydrogen

The amount of gas consumed by BEVs versus FCEVs is dependent on the amount of electricity required to fuel them, either directly or indirectly, and the share of gas in the fuel mix for power generation. In addition, the amount of gas consumed by FCEVs is dependent upon the method in which the hydrogen is produced.

In the shorter term, a FCEV is bound to consume more gas than an equivalent BEV. As previously mentioned, the well-to-wheel energy loss of hydrogen-powered vehicles is twice that of battery-powered ones. As a result, it takes three times more electricity – think in terms of usable energy, rather than energy loss – to power an FCEV than a BEV.

And roughly 90% of hydrogen is presently produced by steam reforming of gas, boosting global gas consumption in a secondary fashion. Whether BEVs dominate road transportation or FCEVs grab a significant share of the market, there is no reason to believe the share of gas in power generation will differ in the shorter term.

In the longer term, a FCEV may still consume relatively more gas than an equivalent BEV, but the difference will be significantly smaller for three reasons. The well-to-wheel energy loss of hydrogen-powered vehicles is bound to improve significantly more than battery-powered vehicles, if for no other reason than having substantially more room for improvement. And given global efforts to reduce carbon emissions, one should expect a substantial shift in hydrogen production from steam reforming of gas to water electrolysis.

Finally, and partly related to the previous reason, the share of gas in the fuel mix for power generation should be lower in a world where hydrogen becomes a relatively important fuel for road transportation. As the amount of intermittent wind and solar power capacity ramps up around the world, hydrogen will serve as a storage mechanism for excess renewable power during off-peak hours, which in turn should contribute to a virtuous cycle between hydrogen production and renewable development.

In addition, Japan’s long-term vision – which could be adopted by other energy-poor and land-constrained countries – is to produce low cost hydrogen from cheap Australian brown coal, pump the carbon underground in Australia, ship the hydrogen on vast tankers to Japan, and distribute it to a nation-wide network of stations.

Japan lacks significant domestic options to reduce carbon emissions because the country is small, mountainous and densely populated, making it ill-suited for large-scale renewable electricity production, and the people are wary of nuclear power after the 2011 Fukushima meltdown (see separate feature).

To conclude, the type and timing of zero-emission vehicle adoption will have differing impacts on gas demand, with greater FCEV than BEV penetration in the shorter term relatively bullish for demand, but less so in the longer term.