World Hydrogen Fuels Summit brings out rivalry between “blue” and “green” [GasTransitions]

Luc Graré, VP Sales and Marketing at NEL Hydrogen Electrolyser, was one of the many speakers in Amsterdam who discussed the “cost roadmaps” of green and blue hydrogen. NEL, based in Oslo, is dedicated solely to the production of green hydrogen through electrolysis. In fact, it has been making electrolysers since 1927!

In 1940, NEL built the first large-scale electrolyser based on hydropower, i.e. presumably the first “green hydrogen” plant in the world. In 2003 the company opened the world’s first publicly available hydrogen fueling station in Reykjavik, Iceland and in 2016 it started construction of the world’s largest manufacturing plant for hydrogen fueling stations, with a capacity of 300 units per year.

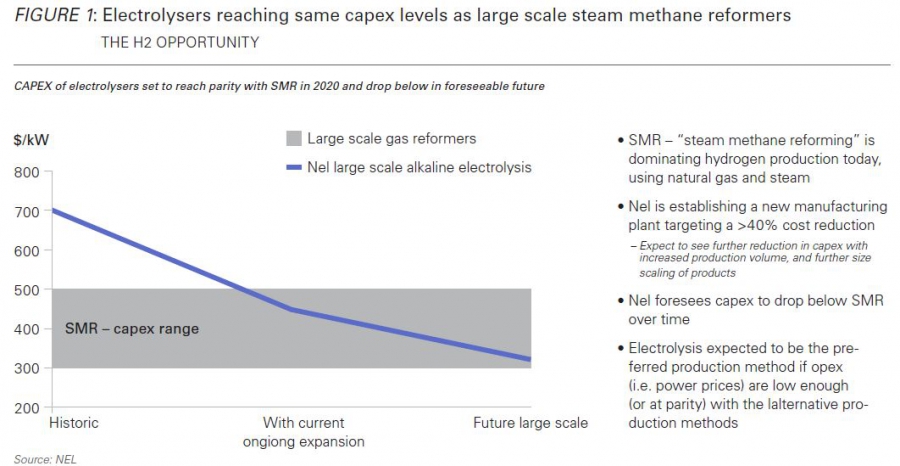

Today of course steam methane reforming (SMR) of natural gas still dominates hydrogen production, but according to Graré, the CAPEX of electrolysis will drop below that of SMR at a certain point if the current expansion continues. (Figure 1)

If the cost of renewable power becomes low enough compared to natural gas prices, electrolysis will be cheaper than SMR, Graré said. He did not attempt to predict when that would be. To decarbonise blue hydrogen requires carbon capture and storage (CCS) of course, which adds to the cost.

Graré further told the conference that NEL is building a second manufacturing plant for alkaline electrolysers in Norway with a capacity of more than 1 GW/year. The company is also involved in a pilot project for fossil-free steel production in Sweden, called HYBRIT, a joint-venture between SSAB, LKAB and Vattenfall. The target of HYBRIT is to reach full-scale implementation of green hydrogen-based steel production by 2035.

Djewels

Florent Baudu, Commercial Director at McPhy, a French manufacturer of electrolysers, presented the Djewels project, which involves construction of the first 20 MW unit dedicated to renewable methanol production in Europe. This will be built by a consortium of six partners (McPhy, Nouryon, Gasunie, BioMCN, Hinicio and De Nora) in the port town of Delfzijl in the northern Netherlands. McPhy earlier built the 6 MW green hydrogen production unit for car company Audi in Wertle, Germany, which started operations in 2013.

The Djewels project, which was awarded a €11-million EU grant by the Fuel Cell and Hydrogen Joint Undertaking (FCH 2 JU) earlier this year, will develop and demonstrate a novel, high pressure, high performance alkaline electrolyser that will help decarbonise the production of methanol in Delfzijl. The production capacity of the plant will be 3,000 tons per year. It is a modest first step of course: current production of “grey” hydrogen in the Netherlands is around 1,460,000 tons per year, according to consultancy DNV GL.

Dead-end street

The rivalry between “blue” and “green” hydrogen was one of the threads running through the debates at the conference. Christian Weinberger, Hydrogen Coordinator at the European Commission, bluntly stated that blue hydrogen is “a dead-end street”, saying it represents a “temporary solution”. Weinberger said that electrolyser manufacturers had told him they can bring the costs of green hydrogen production down to less than $1 per kg, compared to “grey” hydrogen production costs of around $1.50 per kg today.

He also cited a January 2020 report from the Hydrogen Council showing that the cost of hydrogen solutions will fall sharply within the next decade, “sooner than previously expected”. According to this report, “cost is projected to decrease by up to 50% by 2030 for a wide range of applications, making hydrogen competitive with other low-carbon alternatives and, in some cases, even conventional options.”

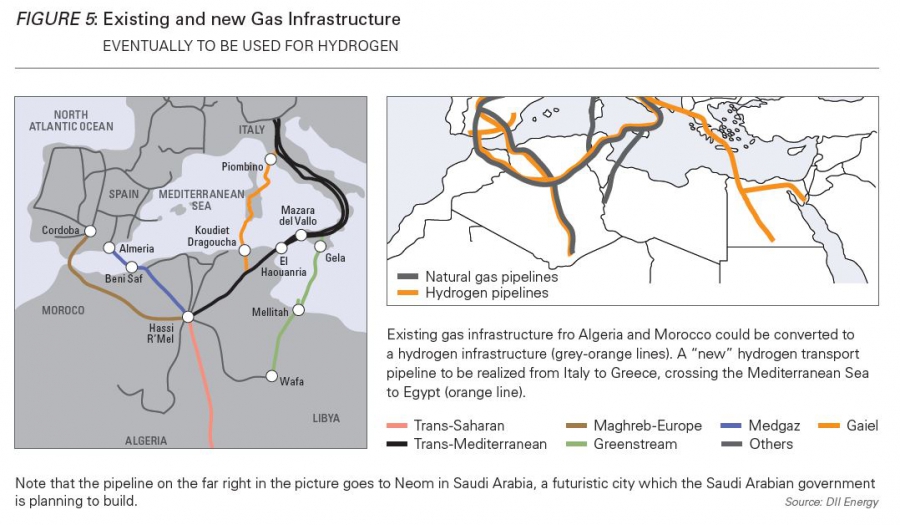

Weinberger, who cited 11 hydrogen projects currently being undertaken in the EU in which €65 billion has been invested, further said that “blending hydrogen in the gas grid is a waste of money” and that he believed transporting hydrogen in pipelines from North Africa would be more feasible than transporting it by ship from Australia or the Middle East. He noted that China has stopped its financial support of battery production and is planning to spend $200 billion on hydrogen.

Solution

Is Weinberger right that blue hydrogen is a dead-end street? The Hydrogen Council report he cited actually includes both green and blue hydrogen and compares their production costs to non-hydrogen alternatives. It doesn’t express a preference for green hydrogen.

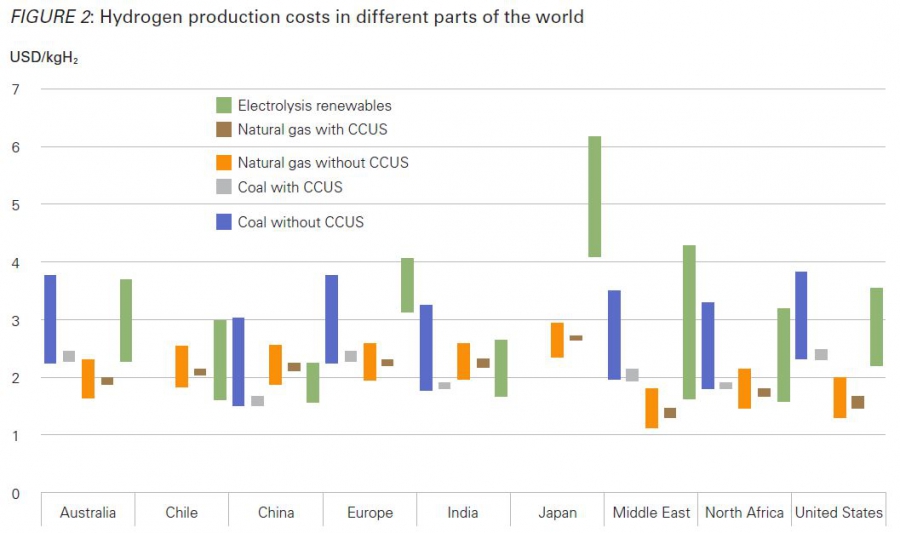

According to the IEA’s authoritative Future of Hydrogen report, published in June 2019, at the present time green hydrogen production costs around $2 to $6 per kg, depending on the geographical location. Blue hydrogen is still cheaper in most places. (Figure 2)

The IEA sees a clear role for blue hydrogen and CCS in the period to 2050.

Think thank Bloomberg New Energy Finance (BNEF) published a report in January 2020 in which they indicated that green hydrogen can become cheaper than grey hydrogen (without CCS) by 2050, if CO2-prices rise to $55 per ton and natural gas prices to at least $6.50 per Btu. Again, however, the target date is 2050, rather far into the future.

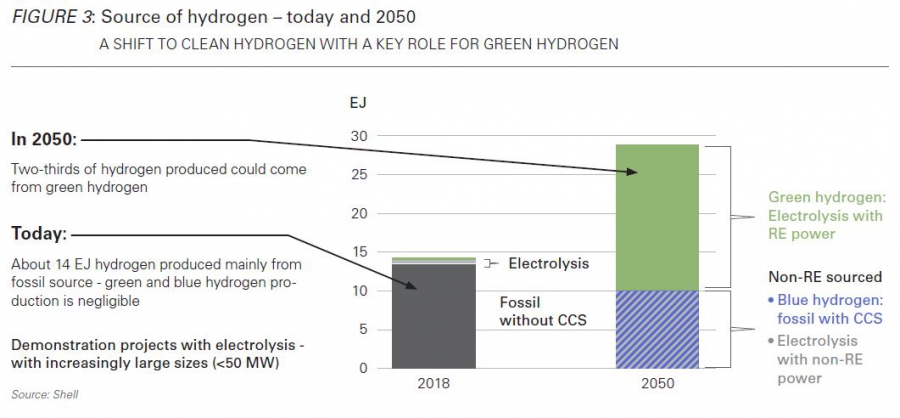

Emanuele Taibi, head of Power Sector Transformation Strategies at the International Renewable Energy Agency, showed a chart at the conference which makes it clear that for IRENA too blue hydrogen is part of the solution. (Figure 3)

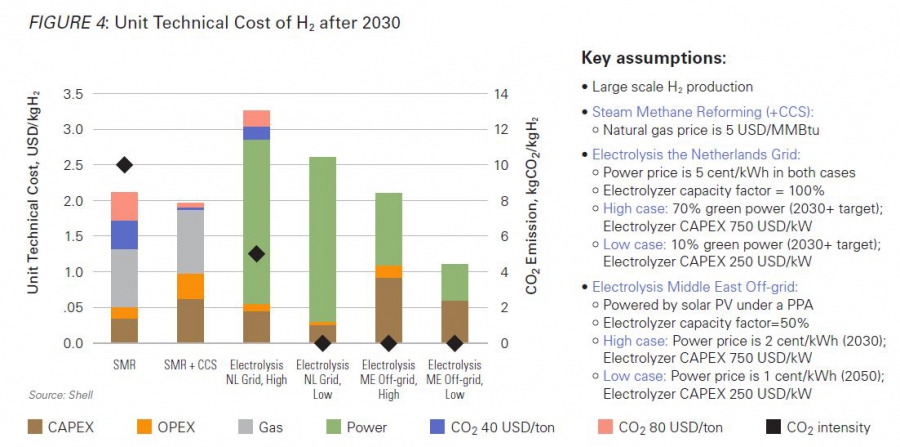

Mattijs Slee, Hydrogen Commercial Europe at Shell New Energies (who filled in for his boss Oliver Bishop, General Manager Shell Hydrogen), presented Shell’s view on the likely cost of blue and green hydrogen “after 2030”, based on a report by McKinsey (figure 4).

This chart shows that green hydrogen produced off-grid in the Middle East will be significantly cheaper than blue hydrogen with CCS. However, in most other circumstances blue hydrogen will remain competitive. Interestingly, the chart shows that grey hydrogen will become more expensive than blue if the CO2 price is set at $80 per ton.

Sunny parts

But there were other speakers who expressed a firm belief that green hydrogen would in time become the only type that would be used, making the use of natural gas superfluous. Frank Wouters, Director of the EU GCC Clean Energy Network, and former Deputy Director-General of the International Renewable Energy Agency (IRENA), sent in a presentation noting that green hydrogen production costs in the Middle East can be expected to become very low. In the Gulf region they will be less than $2/kg as solar power prices are dropping to as little as 3$ct/kWh, said Wouters. At Neom in Saudi Arabia, where the Saudi government is planning a futuristic mega city, green hydrogen would cost just $1.50/kg to produce, according to Wouters.

Paul van Son, Director of DII Energy, also expressed the view that in the sunny parts of the world, in particular Northern Africa and the Middle East, production costs of green hydrogen will become highly competitive.

DII Energy, better known by its old name Desertec Industrial Initiative, founded in 2008 to explore the potential of renewables in the MENA region, used to have great plans to transport solar power through high-transmission power lines from the Sahara Desert to Europe. Lately, though, it has embraced the possibilities of “green molecules”, Van Son explained.

In fact, the option of turning solar power in the desert into molecules, such as hydrogen, or synthetic fuels, is now seen by DII as much more feasible than exporting it directly as electricity through high-voltage transmission networks. Transmission of electricity across large distances is vulnerable to interruptions and involves large energy losses. By contrast, transport of molecules by pipeline or ship is safer, more flexible and more energy efficient.

Ammonia

Van Son zoomed in particularly on Morocco which he said will have 55 to 126 GW of electrolyser capacity installed in 2030 and 260-2685 GW (not a typo) in 2050. These are stupendous numbers of course, yet this type of scale will be needed to create an energy system in which green hydrogen plays a significant role. For all of Europe’s green hydrogen ambitions, there is no way in which Europe could produce sufficient quantities of renewable energy to meet its future projected hydrogen needs.

Part of the green hydrogen to be produced in Morocco and other countries is likely to be turned into ammonia, which is used for the production of fertilisers, said Van Son.

Connecting the green molecules to be produced in MENA can be done with the existing gas infrastructure, Van Son argued. (Figure 5)

Clearly, although at this moment the largest green hydrogen project being undertaken in Morocco is a modest 5 MW green ammonia pilot plant, Van Son agrees with Weinberger of the European Commission that in the end we won’t need blue hydrogen. This is not merely because it might become uncompetitive, but simply because it is not needed. The Sahara, said Van Son, has “quasi-unlimited resources for competitive green-power-to-X, in particular hydrogen and ammonia”.

|

Innovations in transport and storage of hydrogen At the World Hydrogen Fuels Summit, several presentations were held presenting innovative ways to transport and store hydrogen. Siying Huang, Senior Business Development Manager at Hydrogenious LOHC Technologies in Erlangen, Germany, informed attendants of progress on the Hystoc project, which is developing Liquid Organic Hydrogen Carrier (LOHC) technology to enable safe and efficient storage and transport of hydrogen. The low density and explosive nature of hydrogen make it risky and expensive to transport. As explained on the website of Hydrogen Europe, LOHC is the transportation of hydrogen in “an easy-to-handle oil, eliminating the need for pressurized tanks for storage and transport.” The HySTOC project “will demonstrate LOHC-based distribution of high purity hydrogen to a commercially operated hydrogen refueling station (HRS) in Voikoski, Finland, in an unprecedented field test. Dibenzyltoluene, the LOHC material used within HySTOC is not classified as a dangerous good, is hardly flammable and offers a five-fold increase in storage capacity compared with standard high pressure technology, leading to a transport cost reduction of up to 80%.” In the long term, the hope is that “the LOHC technology developed within HySTOC will allow integration of renewable energy by making it available to hydrogen mobility in an easy-to-handle form and will thus help decarbonize the world.” Setsuo Luchi, Senior Vice President of the Chiyoda Corporation in Japan, presented a different transportation technology. Under the brand name SPERA Hydrogen, Chiyoda and its partners have established a hydrogen storage and transport system based on methylcyclohexane (MCH), a carrier that remains liquid under normal temperature and pressure. According to Luchi, the AHEAD consortium (Advanced Hydrogen Energy chain Association for technology Development), is now operating “the world’s first global hydrogen supply chain” in Japan. In 2020 it will involve production, transport and use of 210 tons of hydrogen with the help of the MCH carrier. |

|

European Commission sets up Clean Hydrogen Alliance On the first day of the conference, 10 March, the European Commission happened to present a new Industrial Strategy, which gives a prominent place to hydrogen. The strategy – called “Making Europe's businesses future-ready: A new Industrial Strategy for a globally competitive, green and digital Europe” – includes the formation of a Clean Hydrogen Alliance. Similar to the European Battery Alliance which was launched in 2017, the Clean Hydrogen Alliance will bring investors together with governmental, institutional and industrial partners. It will be officially launched later this year. The EU has so far never succeeded in setting up an EU-wide industrial policy, due to conflicts of interest between member states. Its new approach to industrial policy “aims to break the impasse by considering an entire product value chain – from raw materials extraction to manufacturing – in a few strategic sectors,” explains the Brussels-based news medium Euractiv. In this way it hopes to promote the emergence of “European champions in strategic sectors and help them compete on the global stage.” The “arsenal” the EU will use includes “regulations, competition rules, standards, intellectual property rights, EU funds, and screening of foreign direct investments.” One key new instrument in the EU’s “toolbox” are so-called Important Projects of Common European Interest (IPCEI). Normal EU state aid rules won’t apply to these projects, the Commission confirmed in a statement, saying Brussels will “allow member states to fund large-scale innovation projects across borders which could otherwise not be funded because of market failure”. |