Pluto Expansion Could Start 2021: Woodside

“Woodside is well positioned to capitalise on an expected increase in demand from emerging Asian markets,” its CEO Peter Coleman told the company’s annual investor briefing day May 23, disclosing plans to expand its Pluto LNG complex in 2021.

“Our portfolio offers exciting prospects for growing shareholder value that will coincide with rising global demand for gas and an anticipated supply shortfall,” he said, adding that a possible Pluto LNG expansion and Senegal oil development could generate significant cash in 2022-26.

Despite a current global LNG supply glut, the company thinks uncontracted demand will grow steeply in the 2020s driven by the Asia-Pacific with nearby suppliers such as Woodside at an advantage. Out to 2018, 80%-90% of Woodside’s expected LNG output would be under oil-linked contracts.

Wheatstone LNG remains on target for first production in mid-2017, said Coleman; Woodside has a 13% stake in the Chevron-run 8.9mn mt/yr project.

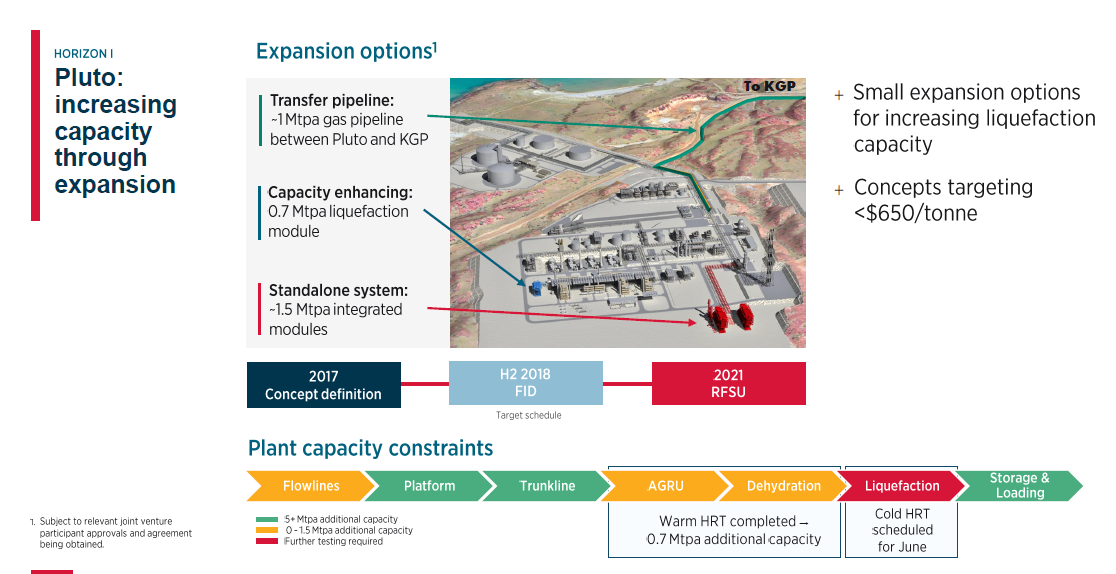

On Pluto LNG expansion, Woodside as operator said a concept is being defined this year which, subject to a final investment decision (FID) in 2H2018, could see 0.7-1.5mn mt/yr extra liquefaction capacity ready for start-up 2021 at costs lower than $650 per metric ton installed.

In February 2017, Woodside first said it was mulling a Pluto LNG expansion; the unit produced 5mn mt in 2016, 16% more than its nominal 4.3mn mt/yr capacity; the single-train onshore unit started up 2012 but more recently the firm has found additional gas offshore.

Pluto LNG’s 2016 production cost was $3.30/barrel of oil equivalent, while Northwest Shelf’s was $3.60/boe. Like Wheatstone they are both offshore Australia – as are offshore Woodside gas resources where as yet no LNG project is under development: Browse, and Exxon-operated Scarborough.

Pluto expansion timeline (Graphic credit: Woodside's 23 May 2017 Investor Day slidepack)

A scalable expansion of the brownfield Pluto LNG plant may be more attractive than a large-scale greenfield LNG project such as Browse. Costs since 2010 have ballooned at new Australian LNG projects, with the Chevron-operated 15.6mn mt/yr Gorgon ending up costing US$54bn. Shell has declined to disclose the cost of its smaller Prelude floating LNG development, start-up of which was recently rolled into 2018.

Woodside also said that the SNE oil field, operated by Cairn offshore Senegal, may produce first oil through a floating production ship in 2021-23, subject to front-end engineering and design next year and an FID in 2019.

The company also said 50% of its 2017 appraisal drilling offshore Myanmar at its 1.5 trillion ft³ Thalin gasfield is now complete, with a development concept to be selected early in 2018.

Mark Smedley