Will a Vaccine Save Oil?

The virus is currently the key determinant of the oil industry’s fate, as free market supply and demand dynamics have been overtaken by the virus. The world was consuming about 100 million barrels per day (bpd) prior to the Covid-19 pandemic, and estimates are that 30 million bpd of demand have since evaporated over the last three months.

Demand could continue to decline, or indeed increase, depending on the direction, speed, and extent of the virus impacts, which of course is subject to counter measures implemented, or omitted, by various governments around the world.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

The recent agreement by oil producers to cut production by 10 million bpd is no match to the current 30 million bpd over-supply and has had no real influence on prices. In fact, last week saw West Texas Intermediate (WTI) crude oil drop to negative figures, for the first time in its history, as investors dumped futures contracts due to expire.

However, there are positive indications that as countries take steps to cautiously re-open economic activities, oil demand will revive and prices strengthen. However, the world is cautious and is yet to know how the virus will fight back with possible resurgences and what scientific wins could be found through a vaccine. The Covid-19 has tested the entire leadership of the world, and turned the world’s energy demand and fundamentals upside down. Only the yet-to-be-found vaccine will overcome the corona virus, a scientific, not a political solution to bring markets back into equilibrium.

The World Health Organization (WHO) says there are 70 vaccines in the making for COVID-19, four of the most promising are already being tested. What should take 10-15 years, the global scientific community hopes to cram into months. The billions being spent now could help return the economies and the oil market back to some normality. However, there is no guarantee that any of the vaccines will work. For now, intermittent lockdowns and flare-ups of coronavirus could be the norm.

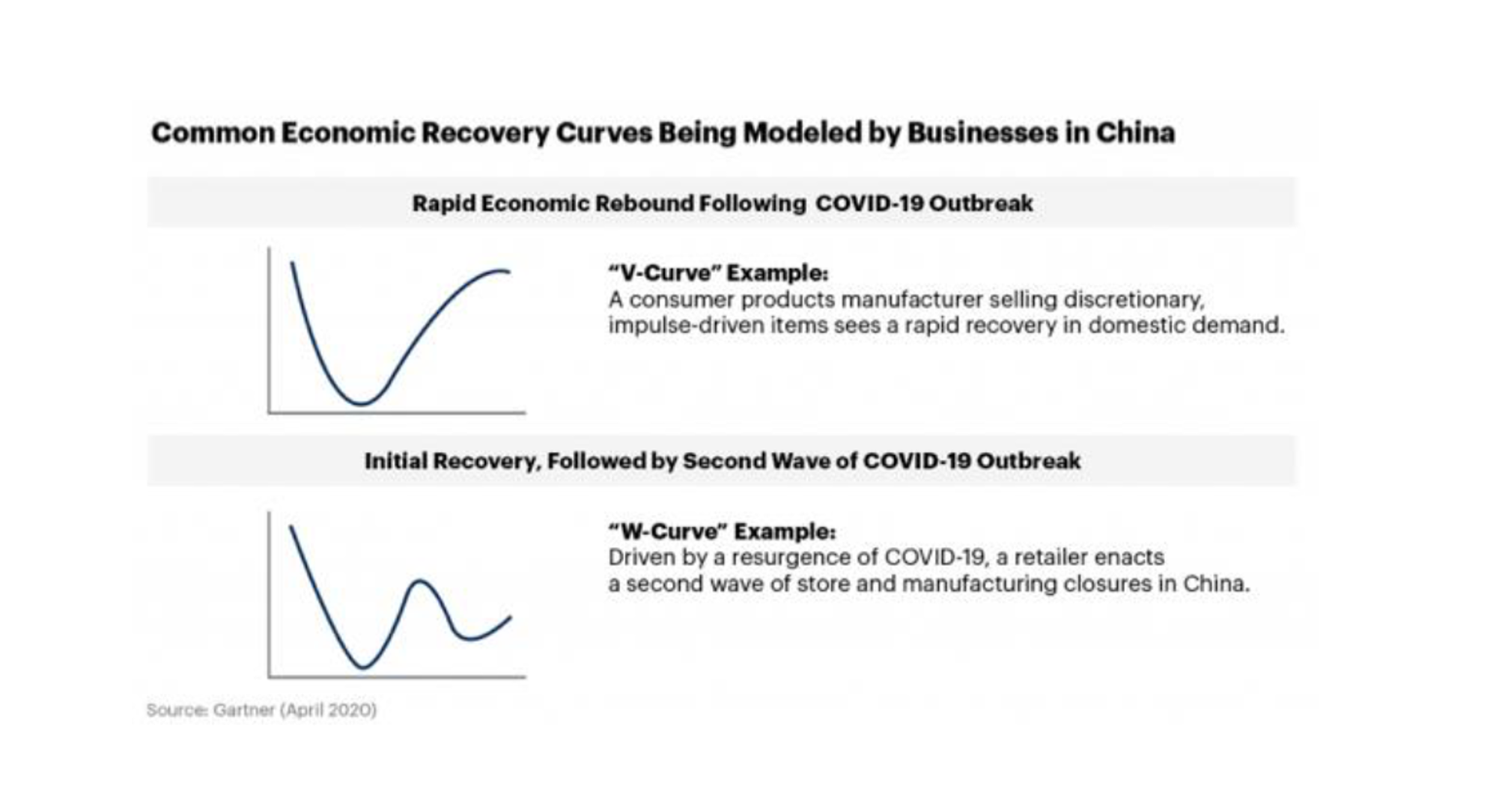

With regard to a timeline, most analyst are expecting a “V-Shape recovery curve” for the economy and in turn, the global energy demand. This scenario assumes that the peak of new COVID-19 cases will come mid-May, and social distancing and other containment measures will remain in place until early July. Energy demand may continue to contract over these intermittent months. The good news is that many sectors may come back to life by July and could see fairly strong rebounds during the summer. The upside to the deeper contractions is that once people resume regular activities, a sharper recovery emerges over the summer.

However, if a vaccine isn’t found before the end of the year, a “W-Shape curve” is likely. A W-shaped recovery means the economy starts looking better and then there’s a second downturn later this year or next. It could be triggered by a second spike in deaths from Covid-19, or hurdles in the vaccine development. Centres for U.S. Disease Control and Prevention Director, Robert Redfield, has stressed that winter 2020 could be “more difficult” if both the Coronavirus and regular flu are “circulating at the same time.”

A Covid-19 vaccine may be the only thing that can bring back "normalcy," said UN Secretary-General Antonio Guterres, and we are hoping for just that before the end of the year. The same can be said for bringing back normality to energy demand and markets. When economies finally begin to recover from Covid-19 restrictions and travel prohibitions, oil markets are likely to normalise expeditiously. However, the vaccine is still the missing piece and the world awaits with bated breath.

Originally published by The Abdullah Bin Hamad Al-Attiyah International Foundation.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.