Vaca Muerta: An opportunity to respond to the global energy crisis

The long-term shift to low-carbon energy systems continues to gain momentum. Over the past two years, we’ve seen an acceleration of societal, policy, and investor pressures on industry players to shift away from fossil fuel–based energy and toward a zero-carbon economy. For instance, at the start of 2020, only a few oil and gas companies had announced net-zero emissions targets by 2050. Today, dozens of companies have set increasingly ambitious targets, including several with timelines of 2040 or before. The bar continues to rise, especially as shareholders demand broader and faster emissions reductions from the highest-emitting sectors.

More recently, geopolitical tensions triggered by the invasion of Ukraine, and the massive impact on the lives and livelihoods of people in the region, are causing turmoil in energy markets in Europe and beyond. Even before the conflict in Ukraine, the rebound in energy demand triggered supply constraints and price spikes for multiple commodities. Now, there is an urgent need for an increased supply of secure, reliable, and affordable energy for global markets in the short to medium term. In previous times of high prices, the oil and gas industry responded by sanctioning multibillion-dollar megaprojects with decades of production life and associated emissions. In contrast, the current lower-carbon imperative requires not only hydrocarbon resources with reduced emissions but also fast cycle times to market—the latter of which is a core characteristic of unconventional oil.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

In the oil and gas industry, the term “unconventional” refers to hydrocarbons that are obtained through methods other than traditional vertical wells. Although most unconventional oil and gas development has been concentrated in North America, alternative sources are being developed in many locations around the world, such as China, Saudi Arabia, and—most notably—Argentina.

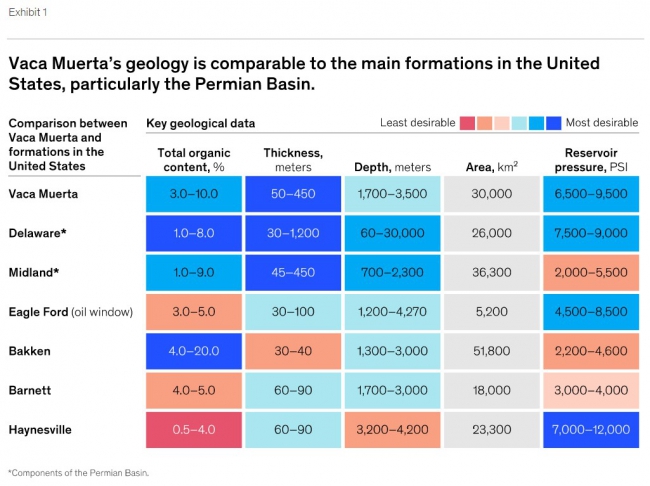

Argentina’s Vaca Muerta—Spanish for “dead cow”—formation shows potential for increasing global supply. In 2019, our research concluded that Vaca Muerta’s geological properties were comparable to the main formations in the United States, and that it was a promising site for development. Today, after years of productivity improvements, including importing best practices, the average technical well breakeven for Vaca Muerta is in line with the main unconventional fields in the United States.

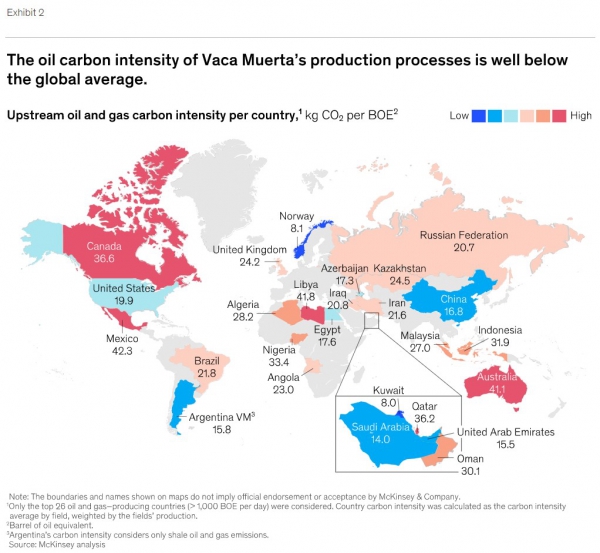

Increased export production from Vaca Muerta ... could help reduce the intensity of global greenhouse-gas emissions and increase the supply of affordable and reliable oil.

Perhaps more important, Vaca Muerta’s oil carbon intensity falls well below the global average. This means increased export production from Vaca Muerta and similar sites around the world could help reduce the intensity of global greenhouse-gas emissions and increase the supply of affordable and reliable oil as the industry transitions.

Vaca Muerta: An overview

According to McKinsey’s 2022 Global Energy Perspective, fossil fuels still have critical roles to play in the years to come, despite increased levels of electrification.1 Toward 2035, demand for natural gas is expected to increase 10 to 20 percent compared with today; it’s expected to account for a relevant part of total primary energy demand by 2050. This means that across scenarios, fossil-based fuels will continue to fill gaps in the energy mix as the world transitions to alternative energy sources.

In the context of heightened volatility due to recent geopolitical events and technological disruptions, shale oil extraction presents an element of certainty given the modularity of its capital expenditures as well as the shorter lead time between drilling and production relative to conventional oil projects. For these reasons, shale oil can respond to sudden supply disruptions and oil price movements with flexibility.

Argentina has the second-most abundant unconventional gas resources and the fourth-most abundant unconventional oil resources in the world, most of which can be found in Vaca Muerta,2 located primarily in the Neuquen province. In addition, Vaca Muerta’s geology is comparable to the main formations in the United States, particularly the Permian Basin and its component parts, such as the Delaware and Midland Basins (Exhibit 1).

Shale wells typically reach their maximum productivity at the start of their lifetime and then quickly decline. With this in mind, Vaca Muerta’s geological characteristics offer comparatively high productivity rates, which are often associated with higher expected ultimate recovery (EUR). In fact, our research shows that Vaca Muerta’s 2021 wells achieved peak production of 82,000 barrels of oil during the first 90 days of production versus 76,000 barrels of oil in Delaware. In addition, wells from Vaca Muerta’s past three annual campaigns have consistently achieved at least 23 percent higher accumulated output than Delaware’s.

In terms of economics, our research shows Vaca Muerta’s technical break-even price for oil is $36.00 per barrel (BBL) and for gas wells is $1.60 per million British thermal units (MMBtu), both of which are in line with most US unconventional fields at $34.00 to $51.00 per BBL and $1.30 to $1.80 per MMBtu. Higher local drilling costs are mostly offset by higher well productivity, which is the result of higher initial production peaks and longer, sustained production levels.

In addition, shale oil from Vaca Muerta is within the lighter range of oils and has low sulfur content (less than 0.5 percent, compared with the typical 1.0 to 3.0 percent). This makes it easier to refine and convert into gasoline and therefore requires less complex refinery technologies. Exports of US light crude to Europe (primarily France, Italy, and the United Kingdom) and East Asia (primarily China, Korea, and Singapore) have also recently increased.3 Thus, it stands to reason that Vaca Muerta’s oil could also be placed in these markets, given its similarity to US light crude.

In addition, shale oil from Vaca Muerta is within the lighter range of oils and has low sulfur content (less than 0.5 percent, compared with the typical 1.0 to 3.0 percent). This makes it easier to refine and convert into gasoline and therefore requires less complex refinery technologies. Exports of US light crude to Europe (primarily France, Italy, and the United Kingdom) and East Asia (primarily China, Korea, and Singapore) have also recently increased.3 Thus, it stands to reason that Vaca Muerta’s oil could also be placed in these markets, given its similarity to US light crude.

Finally, Vaca Muerta’s production processes have an oil carbon intensity of 15.8 kilograms (kg) of CO₂ per barrel of oil equivalent BOE, which is among the lowest carbon intensities for oil and gas operations worldwide—and well below the global average of 23.0 kg CO₂ per BOE (Exhibit 2).

Production potential and exporting opportunity

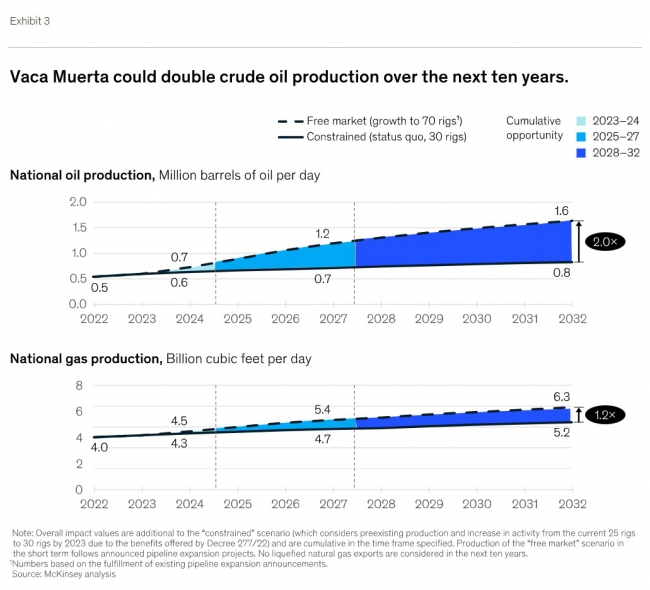

Today, Argentinean crude oil production falls somewhere between 0.5 million and 0.6 million BBL per day. Provided Vaca Muerta grows toward its potential, this could be doubled in the next five years (by 2027) and tripled in the next ten years (by 2032), potentially placing Argentina in the top 20 oil exporting countries. In addition, our analysis shows that natural gas production could increase from about 4.0 billion cubic feet per day to 5.4 billion cubic feet in the next five years and 6.3 billion cubic feet in the next ten years, balancing out Argentina’s dependence on imports.4

These estimates are based on ramping up Vaca Muerta’s activity from about 30 rigs in 2022 to 70 rigs over the next four to five years (Exhibit 3). Doing so would give Vaca Muerta a rig count by acre similar to Texas’s Eagle Ford’s rig count.

Building up the activity of Vaca Muerta will likely require at least $45 billion in investments over the next ten years—which could also help to overcome infrastructure bottlenecks—and could be encouraged by a reduction in the aboveground risk profile.5

Over the long term, the imports of equipment and supplies needed to ramp up oil and gas activity could be fully funded by revenues from increased oil exports and savings from reduced gas imports. Our estimates show that such funding could also generate positive net inflows of approximately $50 billion in the next ten years. Within the same time frame, Vaca Muerta’s increased development could offer as much as $58 billion to $70 billion in federal and provincial revenues.

Furthermore, this increased level of activity would intensify the participation of the oil and gas industry throughout Argentina, effectively raising industry participation in the country’s GDP from its current level of 1.4 percent to 8.4 percent by 2032 and potentially creating up to 20,000 direct jobs and 260,000 indirect and induced jobs.

Vaca Muerta represents an opportunity to tap into an additional energy source that’s economical, easy to access, and consistently available. Shale oil is currently not developed at scale outside the United States, and Vaca Muerta offers the first readily available opportunity to do so.

As the world increasingly moves away from carbon-intensive energy sources, Vaca Muerta can help on two fronts. In the short term, it can provide the world with a much-needed affordable, reliable, and secure energy supply. And in the longer term, it can constitute the bedrock for Argentina to untap additional decarbonization pathways, such as blue or green hydrogen.

Times are uncertain. Global economies are continuing to rebound after COVID-19, the situation in Ukraine is ongoing, and the energy mix is rapidly changing to reflect increasingly ambitious climate targets. The demand for oil, however, will not disappear in the immediate future.

Originally published by McKinsey.

About the authors

Julen Baztarrica Gobantes is a partner in McKinsey’s Madrid office; Giorgio Bresciani is a senior partner in the London office, where Christopher Handscomb is a partner; and Martin Maestu is a senior partner in the Buenos Aires office, where Hernan Negri is an associate partner and Sol Puente is a consultant.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.