US gas flaring hit a record low in September, driven by improvements in the Bakken and Permian

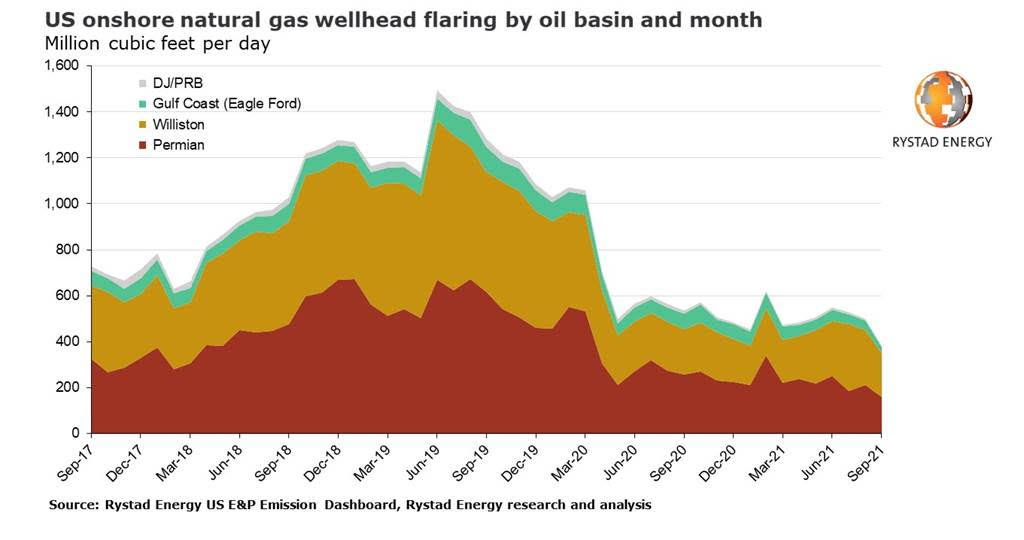

Onshore gas flaring in the US nosedived in the third quarter of 2021, falling to its lowest level since at least 2012*, a Rystad Energy analysis shows. Flaring activity reached 380-390 million cubic feet per day (MMcfd) in September, a roughly 24% fall from the prior month alone. Flaring activity is tumbling as best practices that only major operators had previously adopted spread to smaller, independent players.

The most significant contributors to this steep decline were the Bakken and Permian plays, which saw reduced flaring of around 50 MMcfd each in September. This trend was not unexpected, but the Permian declined rate was more dramatic than anticipated.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

“While the reduction in the Bakken was largely in line with expectations, based on our analysis of satellite data, the rate of change in the Permian is surprising. The decline in flaring activity across the board is a concrete sign that best practices are spreading beyond just large producers to small, privately-owned operators too, and this trend looks likely to continue in the foreseeable future,” says Artem Abramov, head of shale research at Rystad Energy.

The contribution of privately-owned players to gas flaring totals has declined from a record high of 61.5% in April 2021 and sits at 52.3% as of September. However, that rate is significantly greater than the same companies’ contributions to total gas output, which was 24.8% in September.

Declining gas flaring is a trend across the basins. The average flaring intensity across the 50 largest gas producers in the Permian was 1.6% in the third quarter of 2021, compared to 2.5% in the first half of 2021 and 3.2% in 2020.

Breaking down the basins

The Permian’s wellhead flaring intensity hit a multi-year record low of 0.8% on a gas production basis, and 32 cubic feet per barrel on an oil production basis, in September. The basin has demonstrated steady improvements in its flaring intensity since 2019, closely following the reduction in south Texas’ Eagle Ford, with a five-to-six-month lag. Eagle Ford operators flared only 0.4% of gas in September, but their flaring intensity in the first half of 2021 was also close to the 1% mark.

The Bakken region's intensity remains significantly higher than basins in Texas and New Mexico. Still, it has come down from an elevated level of 10% in July 2021 during the gas plant maintenance season. About 6.1% of gross gas was flared in the Bakken as of September, with gas-based flaring intensity levels essentially returning to previous multi-year lows recorded in early 2021. However, as gas production in North Dakota substantially outperformed the oil stream in 2021, flaring intensity on an oil production basis in the state was still at around 164 cubic feet per barrel in September, roughly 15% higher than the level recorded in January 2021.

Honing in on the Permian basin, nearly all major operating areas, or sub-basins, experienced multi-year flared gas volume lows in the third quarter. For instance, the low gas-to-oil ratio Delaware East sub-basin had a flaring intensity of 5.7% in the third quarter of 2019, the equivalent of 131 MMcfd of flared gas in absolute terms. In the third quarter of 2021, flaring intensity levels in the sub-basin declined to 1.1% - still marginally higher than the basinwide average of 1.0% - meaning only 26 MMcfd of gas was flared in the sub-basin. Delaware North (New Mexico) and Delaware West still lead in terms of flaring intensity levels, reaching 0.7% in 2021’s third quarter, down from the peak of 4.9% in the fourth quarter of 2018 for Delaware North and 5.7% in the fourth quarter of 2017 for Delaware West. The Midland North is another major sub-basin that experienced flaring intensity level averages below 1% in the third quarter, coming in at 0.9%. The Midland East and the rest of Permian’s intensity was 1.4% and 1.5%, respectively, for the third quarter.

*US flaring data from the early days of the modern shale era is inconclusive, meaning this record could be the lowest flaring activity since the shale boom of the 2000s.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.