UK Upstream has Bright Near-Term Future

Oil & Gas UK, the upstream industry association, has published an outlook that forecasts higher investment commitments in 2018, but fewer field start-ups and exploration wells drilled.

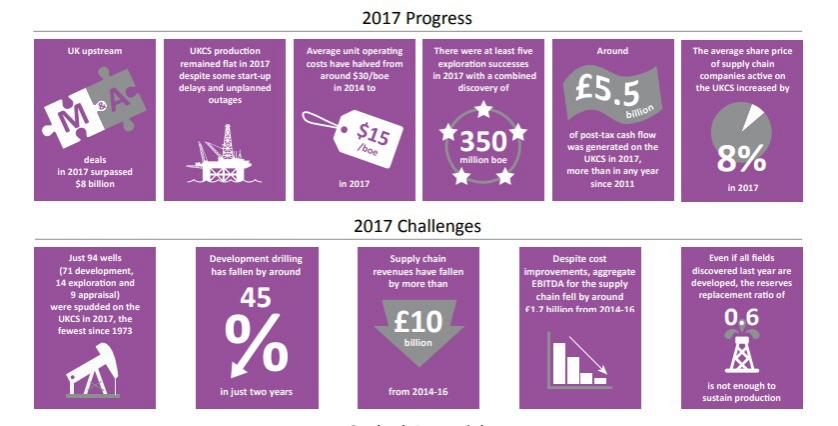

Between 12 and 16 oil and gas developments could get the go-ahead this year – unlocking investment of some £5bn ($7bn), OGUK’s 2018 Business Outlook published March 20 estimates, also yielding more than 450mn barrels of oil equivalent (boe) over time. Those new investment commitments in 2018 are more than in the last three years combined. Supportive factors included the 30% increase (from 2016) in the 2017 average day-ahead NBP gas price to £0.45/th. Brent oil began 2017 over $50/b, topped $70/b in Jan.2018 for the first time in over three years, but has since receded to $65/b.

UK oil and gas production in 2018 is set to increase by 5%, or 20% higher than five years ago. But it will mainly be oil, with Clair Ridge and Mariner oil fields due for start up: “two of the largest in the last decade.”

The report notes that UK gas production increased by 1% in 2014, by 7% in 2015, by 4% in 2016, and increased by 1% last year to 230mn boe, but will likely stay flat at 225-235mn boe in 2018. Start-up of the Cygnus gas field in late 2016 and depleting cushion gas from the Rough storage facility will maintain flat gas output in 2018, it said.

Overall, new start-ups in 2018 will be only 4 to 6 oil and gas fields, down from the 12 fields that started up in 2017 and nine in 2016, the report noted, following a fall of 45% in development drilling in the past two years

The report argued that overall Unit Operating Costs have halved since 2014 and post-tax cashflow is at its highest in seven years – but warns that both, along with revenues, remain a challenge.

More exploration is needed to realise the UK basin’s yet-to-find potential, and to maximise the potential of existing fields is key to sustaining production into 2020s. The report says there are between three and up-to-nine billion boe of yet-to-find oil and gas on the UK continental shelf (UKCS). It forecasts 10-12 exploration wells in 2018, down from 14 in each of the past two years.

“Our sector is leaner, more efficient and more optimistic than it has been in recent years and 2018 looks set to be a better year,” said OGUK chief executive Deirdre Michie: “Our remarkable resilience owes a great deal to the ingenuity and innovation of our people.”

She said that half of companies surveyed expect employee numbers to rise this year, but that some businesses are also reporting difficulties in recruiting people with certain skills and competencies. Over 300,000 people work in the UK upstream sector, or in supporting industries. But the report said that the UK supply chain has faced some of its toughest times with revenue falling more than £10bn from 2014-16 but is expected to stabilise in 2018, thanks to the uptick in UKCS investment. “Many areas of the supply chain are still struggling with the impact of the downturn and have yet to benefit from any upturn in activity,” said Michie.

She added though: “The short-term outlook for our sector is more positive with new projects and new entrants bringing new life to the basin, but there are undoubtedly longer-term challenges.”

The report expects UK M&A activity to remain high, but not match 2017 when deals exceeded $8bn, but says the deal-making “signals confidence in the UK continental shelf.” OGUK said that majors had often been sellers in these deals but are not seeking to exit the UKCS.

Consultancy Deloitte’s senior partner Graham Hollis said that the report’s findings on efficiencies and improvements are encouraging but added: “Some fundamental challenges remain, particularly the need for new, successful, exploration and maximising the potential of existing fields. It is in these areas that all parts of the industry need to embrace transformative change – collaboration, innovation and new technology will all be critical to assuring the long-term future of the UKCS."