UK Explorers Provide Morocco Updates

UK-based Chariot Oil & Gas and Sound Energy have provided updates on Moroccan exploration, with Chariot admitting it has still yet to secure approval for Eni to take over as operator of deepwater blocks.

Sound Energy said December 15 it has retrieved sensors from its TE-7 well on its 14,500 km² Tendrara licence onshore eastern Morocco that “confirm that the reservoir pressure correlates with the gas gradient recorded at all previous wells on the structure;” the extended well test there is “ongoing.”

Its next well, TE-8, is now expected to be drilled 12 km northeast of TE-7 in February 2017. It drilled both a shallow and much deeper horizon. Sound currently estimates are that success at TE-8 could mean gas in place at Tendrara of up to 1.5 trillion ft³ (42.5bn m³) gross. Without TE-8, it estimates gas in place at Tendrara of 0.3-0.5 trillion ft³ gross. Sound has 27.5% equity in the Tendrara licence and hopes to produce first gas 1H 2019.

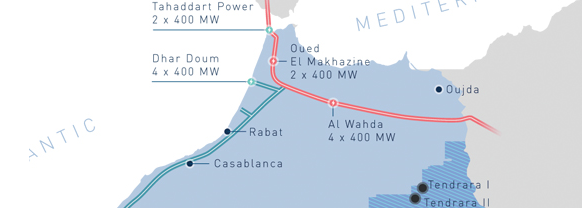

The Maghreb-Europe gas pipeline from Algeria to Spain is not remote from Tendrara (Map credit: Sound Energy)

Chariot said December 15 it has an unaudited cash position at year-end of some $25mn, is debt-free, and has an “inventory of drill-ready prospects with material follow-on potential.” In the Rabat Deep partnership offshore Morocco, where Eni agreed a farm-in in March, it expects the JP-1 prospect to be drilled by the RD-1 well in early 2018, and says JP-1 has audited gross mean prospective resources of 768mn bls. “Licence operatorship will be transferred to Eni on final government approval [of the farm-in] which will trigger the recovery of Chariot's back costs,” it said, without saying why approval is still pending nine months on.

Chariot secured a 75% operating interest in the Mohammedia offshore permits I–III in June – adjacent to Rabat Deep. The JP-2 prospect and others there may have a combined 1bn bbl gross mean prospective resource – but it admits it has yet to acquire 3D seismic, now due to occur in early 2017.

Offshore Namibia, Chariot said it was now interpreting 2,600km² of recent 3D data from its central blocks (2312 and 2412A) and is already seeking partners for its southern blocks (2714A and 2714B) with a data room now open. Partnering on its Brazil licences is expected to begin in 2H 2017.

Mark Smedley