U.S. Shale Gas Meets European Climate Change Policy

Economists are suckers for a good paradox. Few things are more intellectually appealing to the practicing economist than a result which runs counter to his or her immediate intuition. Indeed, some of the most enduring ideas in history of economic thought have surprising implications at the heart of their allure; from the paradox of thrift to Ricardo's law of comparative advantage.[*] For their part, the specialized fields of energy and environmental economics are not immune to the charms of counter-intuitive theories either. This includes textbook favourites like the green paradox and the rebound effect.

Beyond the intellectual appeal, it is clearly sensible to be mindful of such factors when designing policy. However, our inherent affinity for paradoxes is also problematic in that it can cause people to overstate their role in real world situations. To illustrate using the aforementioned rebound effect, Nature recently published a comprehensive literature survey on the subject by Gillingham et al. (2013). The authors show that the rebound effect’s significance is much overplayed, being typically only in the region of 10% (with an upper bound of about 30%). Hardly a compelling objection to improved efficiency standards then.

I would suggest that understanding the appeal and potential pitfalls of counter-intuitive ideas provides a useful framework for thinking about natural gas and the environment. In my upcoming series of posts I’ll aim to explore this issue in more depth by touching on such factors as fugitive methane emissions, cost-effectiveness and barriers to entry, water pollution and so forth. However, for today’s post I’ll focus on a specific (paradoxical) effect that the U.S. gas glut appears to be having on European emissions.

Gas forces U.S. coal abroad

There is widespread agreement that shale gas played a major role in bringing U.S. carbon emissions to a historic twenty-year low in 2012. This should not come as a surprise given that gas-fired power plants emit about half the CO2 per MWh compared to their coal-based cousins. However, some commentators have warned about surging U.S. coal exports, as cheap gas forces American coal companies to seek foreign shores. The obvious concern from a climate perspective is that the global emissions will not be substantially altered as a result; the reduction in U.S. coal consumption at home will simply be offset by increased burning of U.S coal abroad. European emission trends certainly appear poised to be adversely affected.

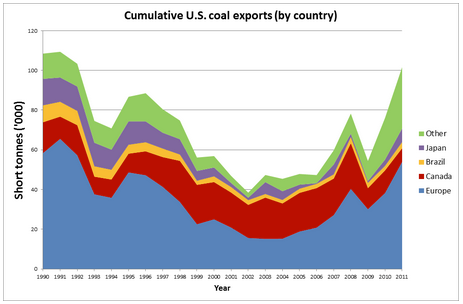

Empirical support for this idea can be found in the International Energy Agency (I.E.A.’s) Medium-Term Coal Market Report 2012, which indicates that U.S. coal exports to Europe rose by 29% last year. Rather than being an entirely new development, it could be suggested that this is actually part of a wider secular trend. As depicted in Fig. 1, U.S. coal exports have been on the rise since the early-mid 2000s, following a steady decline over the previous decade or so. We can also see that Europe is primary driver of this trend. Of course this is still consistent with the shale gas story, with the boom brought on by hydraulic fracturing (“fracking”) now ongoing for roughly the same period.

Fig. 1– U.S. coal exports (Source: EIA)

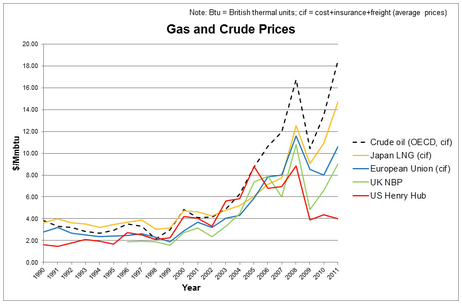

The varying degrees to which the coal and natural gas markets are globally integrated plays a key reinforcing role in all of this. Coal is widely traded across international waters with seaborne cargo accounting for a full 90% of all coal trading volumes (IEA, ibid.). In contrast, gas – particularly of the non-LNG variety – is much harder to store and transport over long distances. This has resulted in regionalized gas markets that have fairly distinct boundaries. The shale glut in the U.S. has only served to underscore this regionalization by precipitating a divergence in international gas prices (Fig. 2).

Fig. 2 – International natural gas prices (Source: BP)

Will this undermine European, or even global, climate goals?

The short answer to this question is “no”. While the recent trends in European imports of U.S. coal may have grabbed the headlines, it is important to realize that this is largely a short-term phenomenon. The IEA itself forecasts that the coal-for-gas reversion in Europe will probably peak this year, and that the continent’s coal demand will steadily drop afterwards due to “increasing renewable generation and decommissioning of old coal plants”. My own feeling is that the much-maligned EU ETS acts as a natural break on this sort of thing anyway, since any sustained increase in coal imports should see a resurgence in the carbon price.[**] Indeed, as I have written elsewhere, cheap U.S. shale gas may ultimately help to make unilateral climate action by Europe more meaningful. In essence, we should think of the EU ETS as placing a tariff on incoming dirty energy. To the extent that rising U.S. coal exports are a form of carbon leakage then, European climate policy will be able to “capture” these leaks through its cap-and-trade system.

The take home message is that the perverse impact of U.S. shale gas on European emissions is likely to be short-lived. Again, it is important to be mindful of the paradoxical effects that stand to impact our energy and climate policies, but not overstate their significance.

This article by Grant McDermott was originally posted on The Energy Collective.

Rebuplished with the kind permission of The Energy Collective Fellows.

___

[*]A famous tale has it that Paul Samuelson, whom many consider to be the pre-eminent economist of the latter 20th century, was once challenged by the mathematician Stanislaw Ulam to name “one proposition in all of the social sciences which is both true and non-trivial”. Samuelson ultimately responded with the theory of comparative advantage: “That it is logically true need not be argued before a mathematician; that it is not trivial is attested by the thousands of important and intelligent men who have never been able to grasp the doctrine for themselves or to believe it after it was explained to them.”

[**] The price of EU ETS trading permits has plummeted together with actual emissions in the wake of Europe’s economic woes (in conjunction with an overallocation of initial permits).