Turkey’s gas importers facing Russian take or pay showdown [NGW Magazine]

Industry sources close to the issue have told NGW that the problem has become so acute that Botas has begun buying gas from the seven private importers in order to reduce the overhang.

However there are limits to what Botas can do over the next three months and sources confirm that the seven face paying between $50mn and $250mn by year's end for gas they cannot import. As all seven conduct only import and marketing operations, they have little by way of physical assets and some if not all may face bankruptcy as a result.

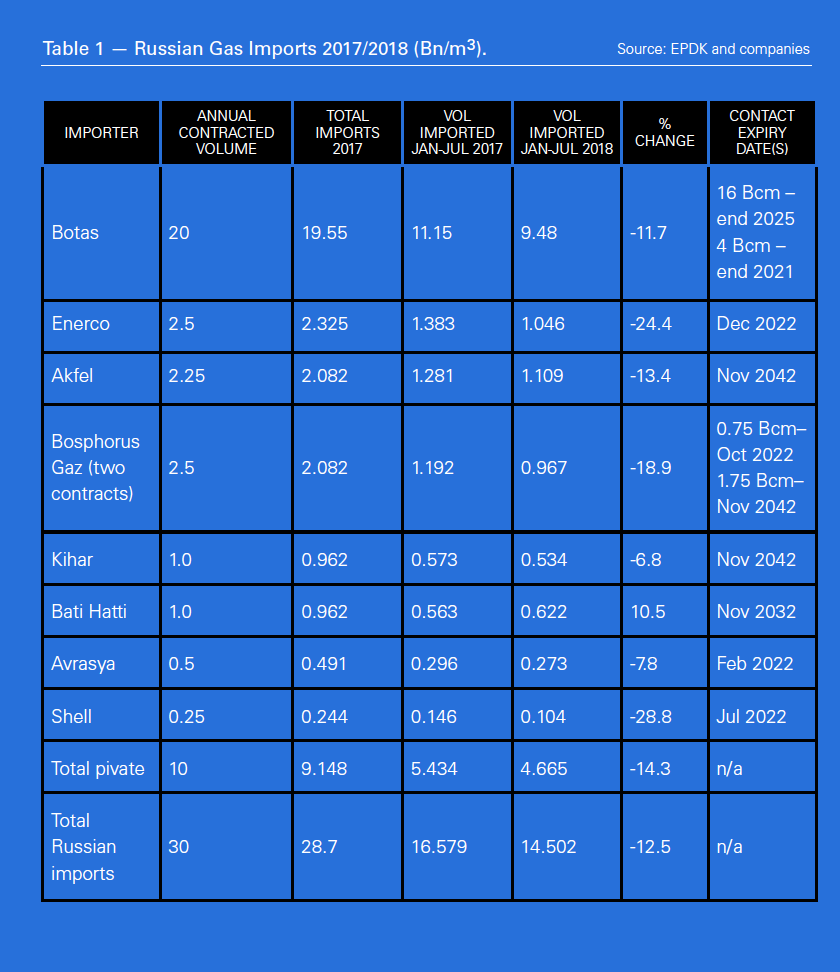

The seven importers themselves have not commented publicly, although one told NGW that publicly available data published by Turkey's energy regulator demonstrates the scale of the problem. EPDK data, which has been published to July shows that Turkey's overall gas imports fell by 7.5% over the first seven months of this year compared to last year, with imports of Russian down 12.5% and four of the seven recording imports down between 13.4% - 28.8%.

Exact take-or-pay import commitments vary according to individual contracts although a source close to the issue suggested that companies are obliged to import around 85% of the annual contracted volume. There are however far stricter limits on seasonal daily volumes which mean that with several of the seven having failed to record any imports during some months, they now face problems meeting their annual minimum commitments even with continued sales to Botas.

How Botas will manage its own take or pay commitments is similarly unclear. As a state company it has the financial muscle, and treasury backing to pay for gas it cannot use; but with imports from Iran and Azerbaijan also down on the year, it may also require political support to alleviate an expensive problem.

It is believed that the issue was discussed in a recent meeting between the Russian president Vladimir Putin; and Turkey’s president Tayyip Erdogan although neither side has commented publicly either to acknowledge the problem or confirm an agreement of a solution.

Moscow however does have a vested interest in finding a solution that suits both parties.

All of the 10bn m³/yr imported by the seven private companies and 4bn m³/yr of the 20bn m³/yr Botas imports arrives through the TransBalkan pipeline through Ukraine, Romania and Bulgaria.

As such it is all scheduled to be switched to the first phase of Gazprom's TurkStream pipeline when it is commissioned, scheduled for the end of 2019, with the additional 1.75bn m³/yr of capacity available for further imports.

Four of the eight contracts held by the seven private importers would not revert to Botas in the event of the company's bankruptcy, and there is no guarantee that Gazprom would be able to find new buyers to take on the pipeline capacity.

Equally Ankara may look less favourably on Moscow's plans to expand the line to allow an additional 15.75bn m³/yr to be exported via Turkey to Europe.

So it seems likely that Moscow and Ankara will reach a compromise, albeit, as always with Moscow, with some additional cost.

Causes

A deal with Russia may solve the immediate take-or-pay issue but won't address the root cause, which can be summarised as "politics".

Faced with an overheating economy, a falling lira and elections in June, Ankara held down retail gas and power prices by having Botas sell gas to power generators and gas distributors below cost.

Undercut by their state competitor, and selling through portfolios of long term, short term contracts and the daily market, six of the private importers lost market share and imported less.

Only Bati Hati succeeded in increasing its imports over the first seven months of the year although it is unclear whether this was due to the nature of its sales portfolio or whether it opted to also sell gas at a loss.

With the election over the government chose to hike the price Botas charges power plants for gas by 49.5% while raising retail gas and power prices by only 14.5%. The move was intended to cut the gas burn, in the process helping reduce Turkey's soaring current account deficit and boosting the long-stated policy of reducing dependence on imported gas for power.

However the hike simply aggravated the existing difficulties faced by gas-fired turbine operators in competing with other power generators.

At least one major plant has been taken offline since summer and several are believed to be offering their plant for sale, in an effort to cut their losses and leave the sector.

The resulting reduction in gas sales further affected the importers while the entire saga, threatened to undermine the start of gas trading on Turkey's Epias energy market in September.

A long-stated aim of Turkish energy policy, Epias gas market has been touted as having the potential to operate as a trading centre for southeast Europe.

That potential may be difficult to realise if Ankara continues to be not only the dominant player – through Botas – but also to manipulate gas and power markets for short-term political gain.

Qatar

That political gain might not be confined to within Turkey. The first seven months of the year saw Turkey's pipeline gas imports from Russia fall by 12.5%; from Iran by 17.7% and from Azerbaijan by 2.9% while LNG imports rose by 13.2%.

In part this can be explained by seasonal demand variations and pipeline bottlenecks which have left Turkey dependent on LNG imports to meet peak midwinter demand, coupled with take-or-pay commitments on Botas' two, long-term LNG import contracts with Algeria (4.4bn m³) and Nigeria (1.3bn m³).

However, they do not explain the 2.059bn m³ of LNG imported from Qatar, a 326% rise over the first seven months of last year.

The imports result from a contract signed last year for 1.5mn mt (2.03bn m³/yr) of LNG, for three years.

Botas has never confirmed details of the contract and the company does not hold a licence issued by Turkish energy regulator EPDK, to import LNG from Qatar on a long-term basis, meaning the imports must be on a "spot" basis. As such, Botas should have the right to decide when and on what terms it imports the gas.

Yet, while 68% of the 2.059bn m³ was imported in the first quarter when gas demand was high, the remaining 32% (0.653bn m³) was imported during April-July, when the take or pay issue with Russian gas imports became apparent, and the private importers were reducing their imports.

Why Botas – which was responsible for at least all but one of the cargoes imported – should have opted to continue to import Qatari LNG up to and beyond its annual contract, during a period of low demand, while other importers were facing problems is unclear.

It could be that the price was extremely low, and Botas used the gas to fill its underground storage.

But the price would have to be extremely low to offset the problems the company now faces, with its own take or pay commitments and those of the seven private importers, raising the question as to whether this too is "political".

It may be further evidence of a close relationship, which in the past two years has seen Turkey establish a permanent military presence in Qatar and supply the emirate with food, when it faced an embargo by its gulf neighbours.

This support was apparently recently repaid by the gift of a luxury Boeing 747-8, by the ruler of Qatar, Tamim bin Hamad Al-Thani, to Erdogan.

Gazprom quits Turkish retail

Russian gas exporter Gazprom has sold its 71% stake in Bosphorus Gaz to the local Sen Group, which is already owns the other 29%, the Turkish gas distributor announced October 1.

Neither company explained the reason for the sale but Gazprom's deputy chairman, Alexander Medvedev has that the company was losing interest as Turkish lira was weakening: it has lost 37% of its value against the US dollar this year.

Gazprom is not alone: OMV completed the sale of its Turkish power plant a month ago, while Germany's EWE has signalled it would like to sell gas distribution assets in two key Turkish cities.

Quoting energy industry sources, Reuters reported that state-run Botas has raised natural gas prices by 9% for residential users and 18.5% for industrial users, the third hike in as many months, as the value of the lira slipped. Botas had already raised prices by 9% for households and 14% for the industrial sector in August and September. Part of the price hike is due to rising oil prices on world markets as well.